Second Quarter of 2023 Review

Maritza Ferreira Ramdeen Manager – Investment Research, Research & Analytics

Commentary

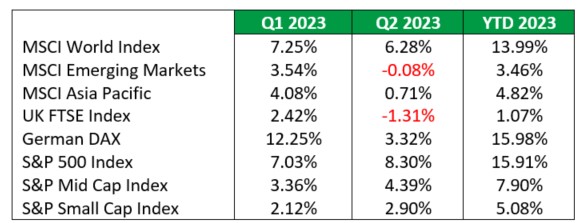

In Q2 2023, global equities exhibited a robust performance following the collapse of US regional banks in the prior quarter. Notably, the US market stood out with strong returns, while European and emerging market stocks struggled to keep pace. Moderating inflation, the temporary halt in the US Federal Reserve’s interest rate hike drive, along with the resolution of the US debt ceiling instilled investor confidence and added stability to markets, bolstering the overall positive trajectory of equities.

US

Notwithstanding the US stock market emerging as the top performer in the quarter, particularly showcasing significant gains in June, investors faced a series of challenges during the three-month period. The lingering repercussions of the collapse of two US regional banks, namely Silicon Valley Bank and Signature Bank in March, continued to have lasting effects. In May, concerns surrounding the solvency of First Republic Bank began to surface, eventually escalating when the bank failed on May 1st and the Federal Deposit Insurance Corporation (FDIC) was appointed as the receiver. However, later on that same day, JPMorgan announced its acquisition of the bank from the FDIC. This announcement helped alleviate investors’ anxieties regarding potential risks of financial contagion, offering a sense of reassurance within the market.

Market volatility remained high however due to an extended impasse among lawmakers concerning the increase of the US debt limit. The debt limit represents the maximum borrowing capacity of the US government. In January 2023, the US debt ceiling reached its threshold, prompting the implementation of extraordinary measures to ensure the government could fulfil its financial obligations. However, these measures could only sustain the government’s payment responsibilities until June 1st. As the deadline approached, the lack of progress in reaching an agreement raised concerns that the US might default on its debt obligations. Fortunately, on May 28th 2023, just days before the government would have faced a funding shortfall, the two parties finally reached an agreement to extend the debt ceiling by two years.

US investor sentiment was also bolstered by encouraging macroeconomic data, showcasing the economy’s resilience even in the face of a higher interest rate environment. Notably, the Gross Domestic Product (GDP) growth rate for Q1 2023 experienced an upward revision from the initial estimate of 1.3% (annualized) to a solid 2%, exceeding expectations and highlighting a robust economic performance. Furthermore, the US witnessed a decline in consumer prices, primarily driven by reduced energy costs. This downward trajectory resulted in the consumer price index reaching its lowest level since April 2021, with a year-on-year decrease to 4% in May.

The moderation of inflationary pressures, coupled with a robust economy, prompted the US Federal Reserve to maintain the fed funds rate unchanged in May, ranging from 5% to 5.25%. This decision marked a pause in the series of consecutive rate increases that had been implemented for over a year. Investors warmly welcomed the halt in interest rate hikes, which fuelled a broad rally in stocks. Particularly in June, the S&P 500 index reached its highest level since April 2022, contributing to the overall positive market momentum.

Europe

In Europe however, the economic landscape presented a less optimistic outlook. Inflation remained sticky as consumer prices held steady for the second month in May at 8.7% in the UK, while the Euro Area core CPI climbed to 5.4% in June from 5.3% in May.

Europe encountered some macroeconomic challenges, as the Eurozone grappled with a mild recession marked by a decline in GDP during both Q4 2022 and Q1 2023. In the face of elevated consumer prices, both the Bank of England (BOE) and the European Central Bank (ECB) opted to maintain their interest rate hike strategies, resulting in two benchmark rate increases over the course of the quarter. Consequently, UK equities concluded the quarter with a decline of 1.31% quarter-on-quarter (QOQ), while stocks in the Euro Zone managed to achieve a modest quarterly gain of 3.32%.

Emerging Markets

During the second quarter, emerging market equities experienced a decline, primarily driven by China, Malaysia, and Thailand. Sentiment towards emerging market equities was dampened by sluggish growth in China, as the initial economic rebound following the relaxation of COVID-19 restrictions gradually lost momentum. Weak consumer spending and subdued export demand added further strain to China’s industrial output.

The ongoing tensions between the United States and China also casted a shadow over investor confidence. In February, the revelation of a Chinese surveillance balloon hovering over US territory escalated the strained dialogue and communication between the two nations, creating an atmosphere of closure and tension. The delicate nature of the situation became apparent when China declined a bilateral meeting between the defense chiefs of both countries in early June.

US Market Capitalization

By market capitalization, large-cap stocks outperformed small caps. Regional bank concerns and higher interest rate weighed heavily on the medium and small cap stocks as smaller companies are historically more dependent on financing to sustain their operations and fund growth.

International Stock Indices

Source: Bloomberg, FCIS Research & Analytics

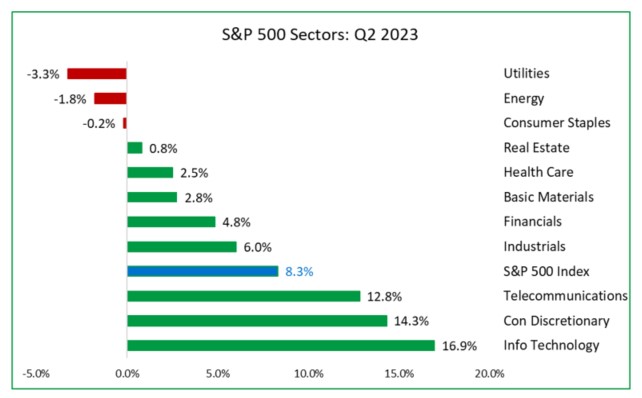

US Sector Performance

From a sector perspective, as expected, Information Technology was the best performing sector, with a quarterly return of 16.9%, followed by Consumer Discretionary (14.30%) and Telecommunications (12.8%). Traditional defensive sectors underperformed in the second quarter, led by Utilities with a quarterly loss of 3.3% and Consumer Staples with 0.20% loss. The energy sector also posted a negative return in Q2 2023 due to lower oil prices.

US Sector Performance

Source: Bloomberg, FCIS Research & Analytics

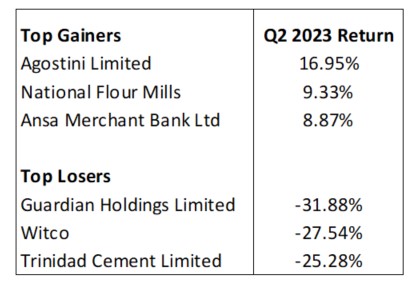

Local Market Review

The local stock indices maintained its downward trend in the second quarter of 2023, led by the Cross-Listed Index that posted a loss of 14.39%, followed by the T&T Composite Index with 7.31% and the T&T Index with 5.30%.

The stocks with the largest share price gains over the three-month period ending June 2023 were Agostini’s Limited (AGL), National Flour Mills (NFM) and Ansa Merchant Bank Ltd (AMBL) with returns of 16.95%, 9.33% and 8.87% respectively. Leading the declines were Guardian Holdings Limited (GHL), West Indies Tobacco Company (WCO) and Trinidad Cement Limited (TCL) with losses of 31.88%, 27.54% and 25.28% respectively.

Local Stock Indices

Source: TTSE, FCIS Research & Analytics

Top Gainers and Losers YTD Basis

Capital Markets Outlook

In the third quarter of 2023, it is anticipated that stocks will continue their expansionary trajectory, primarily driven by the United States. The ongoing decrease in inflation, solid economic growth, and the temporary halt in the Federal Reserve’s interest rate hike are expected to have a positive impact on the stock market. Conversely, European stocks may not experience the same level of buoyancy as their American counterparts due to recessionary pressures and high inflation, which could potentially hinder sales growth and corporate profit margins. Additionally, emerging market stocks may struggle to perform well due to the projected sluggish global growth.

Investors should exercise caution due to the lingering risks present in the global economy and markets. One notable risk is the potential resumption of interest rate hikes by the US Federal Reserve. Chairman Powell has indicated that the strength of the labor market will influence whether the rate hike is merely a pause or a complete halt. If interest rates continue to rise, there is a possibility of reduced consumer spending and a subsequent decline in economic growth.

In the face of continued uncertainty, investors need to stay alert to economic and market risks and carefully manage their portfolio’s risk and return goals. It is crucial to focus on establishing and maintaining a well-balanced portfolio that can effectively endure any unexpected market surprises and fluctuations. By doing so, investors can be better prepared to navigate the uncertainties and potential challenges that lie ahead.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.