2023 – Defying Economic Expectations

Commentary

In the world of Economics, nothing is certain. 2023 started off with the expectations of a possible economic recession with significant downside risks. However, global economic conditions have shown tremendous resilience against numerous headwinds in both 2022 and 2023. Both monetary and fiscal policies were substantially tighter, inflation soared, and persistent geopolitical turmoil continued to inject significant uncertainties regarding the economic outlook. Financial markets remained in flux for much of the year, with record high interest rates, which created volatility in both the bond and stock markets, while a culmination of economic and geopolitical factors continued to affect the commodity market. Towards the end of 2023 however, some of the risks began to fade and the global economy seemed to have defied initial expectations, ending the year on stronger footing. However, beyond 2023, some of the same risks remain and for emerging markets, in particular, economies lag their pre-pandemic performance and are at risk of debt distress. There is also a major concern about China’s lackluster economic recovery and the implications on the rest of the world.

Slower Global Recovery, Gradual Decline in Inflation

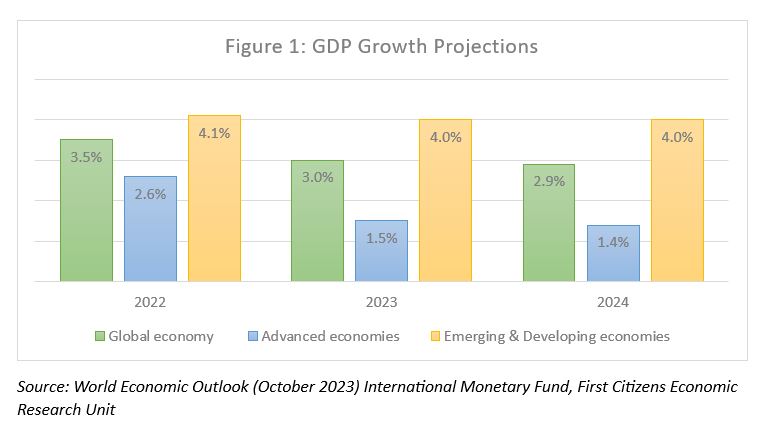

The International Monetary Fund (IMF) is estimating growth of 3% for 2023, from 3.5% recorded in 2022, below the historical average of 3.8% during the period 2000-2019. Expectations are for a marked slowdown in activity in the advanced economies, driven by weaker than expected growth in the Euro area. This is balanced by stronger expansion in the US, which has witnessed the strongest recovery among the major advanced economies. Growth in the euro area continues to be inhibited by the war in Ukraine and the knock-on effects from higher energy import prices. While the advanced economies are expected to expand at a 1.5% pace in 2023 from 2.6% in 2022, the US economy is expected to outperform the average with growth of 2.1%, while the euro area is forecasted to grow by just 0.7%, from a strong 3.3% in 2022. Expectations for 2024 are also subdued with economic expansion projected at 2.9% for the world economy, 1.4% for the advanced economies, 1.5% for the US and 1.2% in the euro area. In Europe, the two hardest hit economies are Germany, expected to contract by 0.5% in 2023 and the United Kingdom, expected to grow by just 0.5% because of the tighter monetary policy stance to curb high inflation as well as the lingering impact of the terms of trade shock caused by higher energy prices.

The Chinese economy is expected to record a 5% expansion in 2023 relative to an estimated 3% in 2022. However, in 2024, this is projected to moderate to around 4.2%, driven by the concerns regarding the real estate market and lower investments. Growth in India on the other hand, is projected to remain strong at 6.3% in both 2023 and 2024, from 7.2% in 2022, reflective of strong domestic consumption. In the Latin America and Caribbean region, economic activity is projected to expand by 2.3%, noticeably down from 4.1% in 2022. This moderation is reflective of a normalization of economic activity, a weaker external environment as well as tighter policies of the past year.

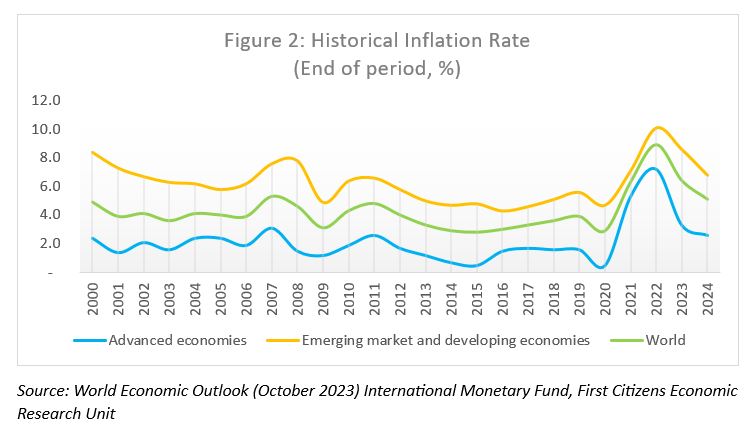

Global inflation was registered at 8.9% in 2022, the highest in decades and well above the 4% average for the period 2000-2021. While price pressures are likely to decline beyond 2022, inflation remains relatively high, with the IMF projecting global end of period inflation at 6.4% in 2023 and 5.1% in 2024. These averages, however, remain well above many countries’ official inflation targets. The pace of disinflation varies between the advanced and emerging economies. The emerging market economies are likely to see sticky inflation as they contend with currency depreciation and the associated impact on domestic prices. The advanced economies according to the IMF benefit from stronger monetary policy frameworks which facilitate disinflation. Generally, beyond 2022, the disinflation trend will be largely reflective of a decline in international commodity prices.

Higher Interest Rates and an Inverted US Yield Curve

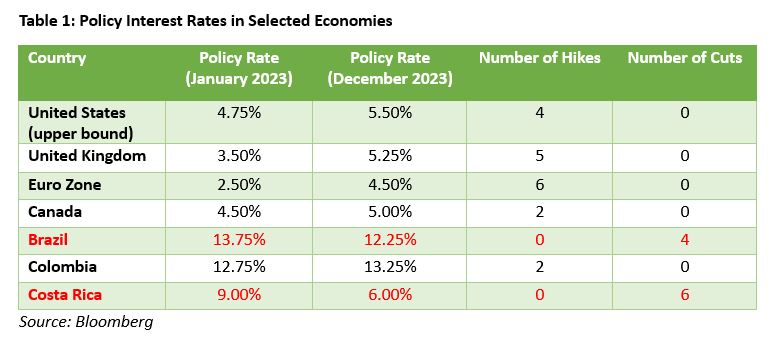

In 2022, many central banks started to aggressively tighten policy in response to record high inflation experienced across the world. There were unprecedented hikes in policy interest rates to record high levels well into 2023 as prices continued to soar above central banks’ targets, more so during the first half of the year.

Moderating inflationary pressures during the second half of the year provided many major central banks the flexibility to reconsider their tightening stance and adopt a more cautious approach particularly to evaluate the impact of the cumulative rate hikes on the economy. For most of the advanced economies, there were no rate cuts as inflation remains well above target ranges. However, in some of the emerging markets, benchmark interest rates were cut as price pressures retreated. In Costa Rica, for example, a situation of deflation has persisted since May 2023, prompting aggressive rate cuts. The decline in prices is largely due to the appreciation of the currency and the price of imported goods. The country’s soaring currency- which has rallied 11% year to date was the sixth best performing currency globally. In Brazil, inflation remains just above the target, and has bounced off its June 2023 low of 3.2% back up to 4.82% in October. This recent uptick is likely to be temporary and all indications are that the central bank will proceed with rate cuts in Q124.

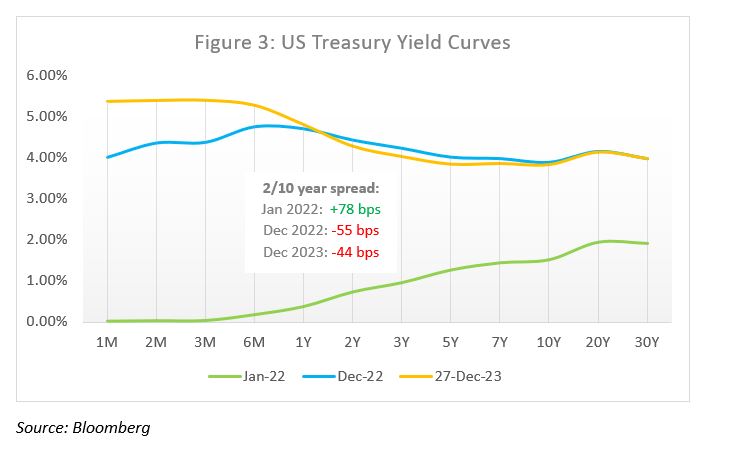

The US Fed has paused its tightening cycle to assess the impact of the cuts on the economy and expectations are for lower rates in Q124 but this reversal in policy will largely be data dependent. The impact of the rate hikes on the US Treasury yield has been quite notable. Since June 2022, the spread between the two- and 10-year treasury turned negative, indicating an inverted yield curve. Year to date, this spread has averaged -64.8 basis points compared to an average of -0.31 basis points in 2022. Simply, this means that the yield on a two-year note has on average been approximately 65 bps higher than the yield on the 10-year bond. US short term rates are highly sensitive to changes in the US Fed Funds rate. The slope of the US Treasury yield curve has important predictive power for the US economy, based on empirical evidence from the National Bureau of Economic Research which shows that the yield curve slope turns negative before each economic recession since the 1970s. According to a Bloomberg survey as of 27 December 2023, the probability of a US recession stood at 50%.

Caribbean Economies Rebound – But Risks Remain

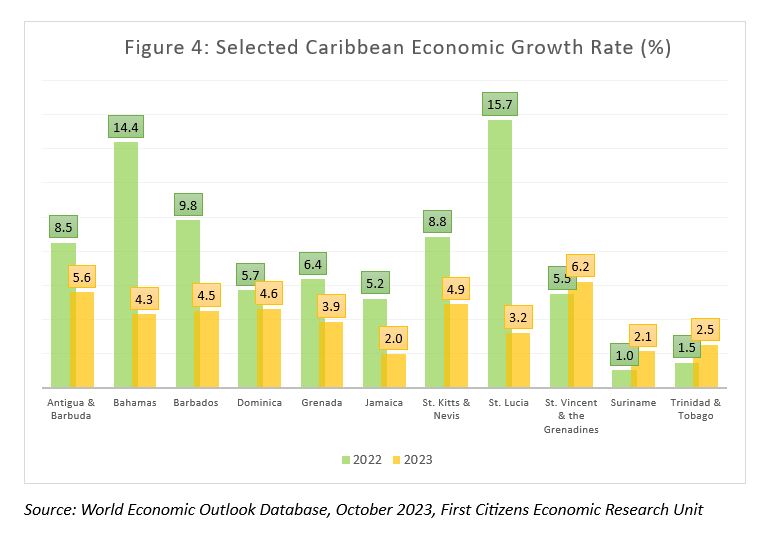

The Caribbean experienced relatively strong economic growth in 2022, driven by modest performances in both the tourism-dependent and commodity-exporting economies. The IMF estimates that the region (excluding Guyana) expanded at a 4.2% pace in 2022. The region’s commodity exporters benefitted from the higher energy prices which positively impacted economic growth, while tourism demand continued to pick up in the post-pandemic period. In 2023 however, economic activity is expected to have weakened due largely to external factors and is estimated to average 1.9% (excluding Guyana). The moderation in GDP growth this year was impacted by slowing global growth, particularly in the major tourism source markets, softer labour market conditions, a strong US dollar and still high inflation both in the advanced economies and domestically. In 2023, Guyana will again emerge as the regional outperformer, with estimated growth of 38.4%, following 62.3%, the highest rate globally in 2022. In some economies, economic activity is expected to continue to be supported by construction activity, both from public and private sector investment projects. In 2023, most of the tourism-dependent economies (excluding Jamaica, Grenada, and St Lucia) are expected to perform above the regional average[1] of 4%, while the commodity exporters are expected to post growth below this average.

The region has perennially been affected by high indebtedness, which has also inhibited growth potential. For decades, many countries earmarked significant government revenue for debt servicing to the point where debt restructuring exercises had to be undertaken to reduce this onerous burden. Several countries have made significant progress in narrowing fiscal imbalances and curtailing the rise in public sector debt. During the pre-COVID 20-year period, the region’s[2] fiscal balance averaged -2.9% of GDP, with variances among countries in the size of the shortfall, but none recording an average surplus. During the period 2020-2023, this average rose to -4.3% of GDP, with greater amount of variability among the countries- St Kitts and Nevis recorded an average surplus of 1% of GDP, while both Grenada and Jamaica recorded small deficits of -0.3% and -0.4% of GDP respectively. The largest fiscal deficit in the post-COVID period was seen in the Bahamas -7.5% of GDP, with St Vincent & the Grenadines in second with -7.3%. Notably, the countries which are operating within a fiscal responsibility framework have been able to rebound much quicker and were able to post surpluses in 2021 and 2022 – both Grenada and Jamaica. Trinidad and Tobago benefitted from higher energy prices, which resulted in an overall surplus of 0.3% of GDP in 2022. The IMF forecasts that the fiscal balance will average around -1.7% of GDP in 2024, slightly down from the 2023 average of -2.1%, with only three countries projected to post surpluses – Grenada, Jamaica and St Kitts and Nevis. As a result of persistent fiscal shortfalls over the years, the region’s debt remains excessively high averaging close to 75% of GDP since 2010 and rising further to 88% during 2020 – 2022. As countries revert to normal activity and fiscal targets back on track, indebtedness in several countries have started to decline, with Guyana, Grenada, Trinidad and Tobago and St Kitts and Nevis expected to end 2024 under 60% of GDP.

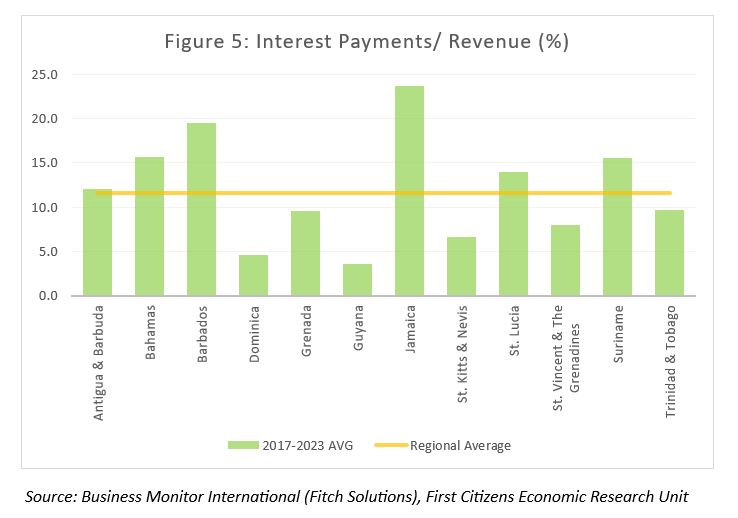

The countries depicted in figure 5 have averaged around 12% of government revenue expended on general government interest payments. However, there are significant divergences amongst countries. For example, Jamaica’s interest payments to revenue ratio averages 23.7% – the highest in the selected Caribbean countries, with Barbados experiencing the second highest at 19.5%. Dominica and Guyana are on the lower end of the spectrum. However, six of the countries are above the regional average. This relatively high debt servicing burden hinders economic development in the region, as it diverts already scare government revenue away from more productive uses.

A Glance Into 2024…

Many of the world’s economies would have been able to avert a recession in 2023 showing tremendous resilience in the face of notable headwinds. However, even as inflation is expected to moderate and policy tightening cycles have ended, and in some cases, reversed, there are significant risks associated with the global economy into 2024. The lagged impact of significantly tighter monetary and fiscal policies will have a dampening effect on economic activity. Labour market conditions are also softening which can adversely impact upon consumer spending – the backbone of many economies. The US Federal Reserve is forecasting that the US economy will grow at a 1.4% pace in 2024, from 2.6% in 2023, while the unemployment rate is projected to rise to 4.1% from 3.8% in 2023. Furthermore, in the US, the continual inverted US treasury yield curve continues to flash warning signs of an impending US recession. In Europe, the UK is forecasted by the IMF to eke out growth of just 0.6% in 2024. Most of Europe is expected to remain relatively weak due to the lingering impact of record high inflation as well as the ongoing conflict in Eastern Europe.

The ever-present threat of geopolitical tensions will also cloud the outlook. These events can impact commodity prices, which can stoke inflationary pressures, and result in interest rates remaining higher for a longer period and ultimately higher bond yields and tighter financial conditions – a risk more acute for already highly indebted emerging markets. There are also several important elections taking place in 2024, with 50 countries expected to head to the polls, including the US, India, Indonesia, Mexico, and South Africa. Elections for the European Parliament will also take place in June 2024. Developments in China will also impact the overall outlook for the global economy. Chinese growth has remained fragile even after three years of its strict zero-COVID policies and going forward the challenges within the country’s large property sector will weigh on economic prospects, which may result in further stimulus measures to shore up activity.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.