Market Review: Third Quarter of 2024

Advisory

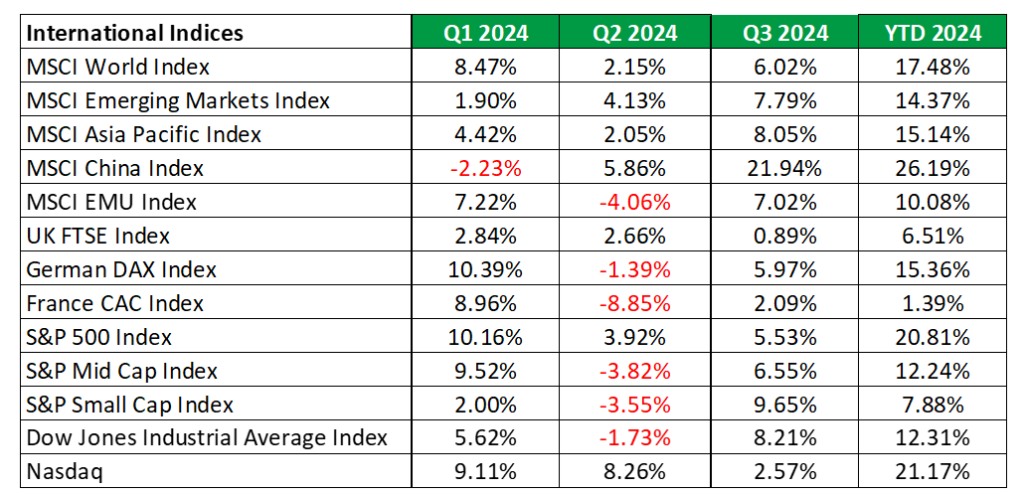

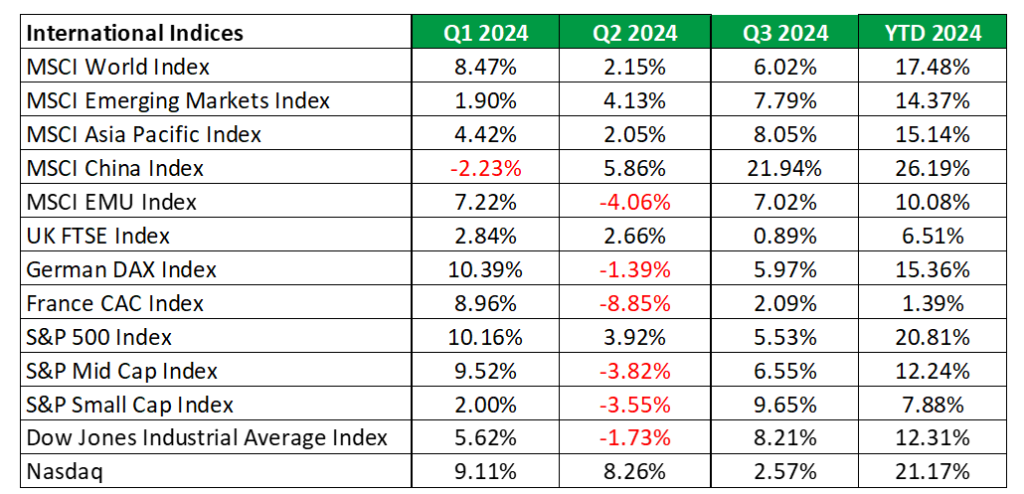

International Market Review

During the quarter, global stocks continued its climb, with the MSCI World Index gaining 6.02%, pushing the year-to-date growth to 17.48%. Emerging markets outpaced developed markets, led by strong returns in Asian equities, as investor confidence was lifted by China’s aggressive stimulus measures.

US Stocks

After a slowdown in Q2 2024, U.S. stocks regained momentum in Q3, with the S&P 500 Index posting a quarterly gain of 5.53%, up from 3.92% in the previous quarter, bringing its year-to-date growth to 20.81%. The Dow Jones Industrial Average also rebounded strongly, rising 8.21% in Q3 after a 1.73% decline in Q2. Meanwhile, the Nasdaq lagged behind with a modest 2.57% gain, as investors shifted away from high-valued tech stocks to other sectors.

The stock market was buoyed by improved investor sentiment following the Federal Reserve’s 0.50% rate cut, which marked the start of a new easing cycle. This decision was aimed at supporting economic growth amid easing inflation pressures.

In Q3 2024, small and mid-cap stocks rallied significantly, with gains of 9.65% and 6.55% respectively, after posting losses in the previous quarter. Both outperformed their larger counterparts. Smaller companies, which often rely more on financing for growth, are expected to benefit from lower borrowing costs, driving increased demand for their stocks and boosting investor optimism.

Europe and the United Kingdom

European equity markets saw a strong recovery in Q3 2024, with the MSCI EMU Index rising by 7.02%, rebounding from a 4.06% loss in the previous quarter. This recovery was supported by positive economic data and the European Central Bank’s (ECB) decision to cut interest rates in June, with signals of further potential easing to counter slow economic growth and inflation. The ECB’s accommodative stance boosted investor confidence, helping drive stock prices upward.

France’s stock market also experienced a notable rebound. The CAC Index gained 2.09% in Q3 2024, bouncing back from an 8.85% loss in Q2. The quarter began with political uncertainty after the French President called for elections following losses in the European parliamentary elections. Initially, fears of a far-right victory caused a sell-off in French stocks. However, the election resulted in a fragmented parliament, calming fears of major policy shifts. While a far-left coalition won the most seats, it did not secure a majority, reducing concerns about drastic legislative changes.

In contrast, UK stocks saw modest gains in Q3 2024, with the FTSE Index rising by 0.89%, down from a 2.66% gain in Q2. This performance was shaped by macroeconomic factors and the Bank of England’s (BoE) cautious approach to monetary policy. The BoE cut interest rates for the first time in four years, reducing the rate from 5.25% to 5% in August 2024. However, the bank chose not to lower rates further, citing continued inflation concerns and economic conditions.

Emerging Markets

Emerging markets continued to grow in the third quarter of 2024, with the MSCI Emerging Markets Index gaining 7.79% from July to September. This rally was driven by renewed investor optimism, thanks to the bold actions taken by the People’s Bank of China (PBOC). The PBOC introduced interest rate cuts and fiscal support aimed at reviving the economy after a period of stagnation. These measures included injecting more liquidity in the stock market by refinancing bank loans, enabling firms to buy back their own shares. In addition, institutional investors are allowed to borrow liquidity assets using their stock holdings as collateral. This marked a strong shift in policy and helped boost market confidence.

International Stock Indices Performance (Local Currency Returns)

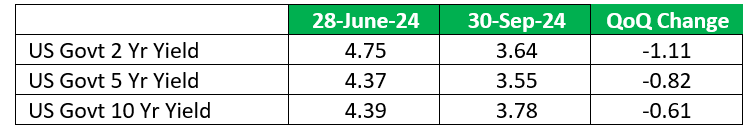

US Treasury Yields

Yields on U.S. Treasury securities dropped significantly during Q3 2024. The yield on the 10-year Treasury note fell from 4.39% at the end of June to 3.78% by the end of September, a decrease of 61 basis points. Similarly, shorter-term bonds saw notable drops, with the 2-year Treasury yield hitting a two-year low of 3.64%, down from 4.75% in June. This decline was mainly driven by the Federal Reserve’s decision to cut interest rates by 0.50% in September.

Notably, the yield curve returned to a positive slope for the first time in over two years. After being inverted (where short-term yields were higher than long-term yields), the curve started to normalize in early September as short-term yields dipped below long-term ones.

US Treasury Yields

US Sector Performance

Utilities emerged as the top-performing sector, with returns of 18.47%. Close behind, the real estate sector saw a robust increase of 16.09%, benefiting from lower interest rates and ongoing demand for residential and commercial properties. The industrial sector also performed well, posting a gain of 11.15%, driven by strong earnings reports and increased infrastructure spending.

Energy stocks struggled, falling by 3.12% due to weaker demand and declining oil prices. During the quarter, crude oil prices dropped significantly by 16.40%, reaching USD68.17 per barrel by the end of September 2024. This decrease was largely due to a global reduction in demand and concerns about oversupply. Technological advancements and favorable conditions allowed the U.S. to boost oil production, peaking at 13.4 million barrels per day in August 2024. Although OPEC+ maintained and extended production cuts of 1.65 million barrels per day through November 2024, these efforts failed to stop the downward pressure on oil prices.

US Sector Performance: Q3 2024

Local Market Review

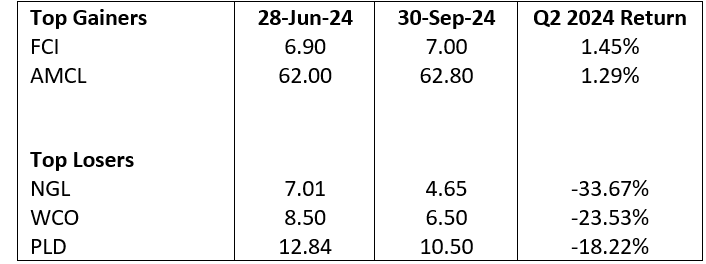

The local stock market maintained its downward trend in the third quarter of 2024, led by losses in the All T&T Index. The All T&T Index declined by 7.27% in Q3 2024 compared to a loss of 4.85% in Q2 2024 and the Cross Listed Index registered a loss of 4.49% versus a loss of 9.27% in the prior quarter.

The stocks with the largest share price gains over the third quarter of 2024 were First Caribbean International Bank Ltd (FCI) and Ansa McAl Ltd (AMCL) as their respective share prices increased by 1.45% and 1.29% respectively. Leading the declines were Trinidad & Tobago NGL Limited (NGL), West Indies Tobacco Company (WCO) and Plipdeco (PLD) as their share prices fell by 33.67%, 23.53% and 18.22% respectively.

Local Stock Indices Performance

Top Gainers and Losers

Equity Markets Outlook

The outlook for global equities in the final quarter of the year is cautiously optimistic. Recent policy measures by China to boost growth, along with supportive global monetary policies, are expected to lift investor confidence. Consumer spending is also projected to help sustain economic activity, particularly as interest rates gradually decline.

However, investors should stay alert to geopolitical events and labor market trends that could affect market performance. Ongoing conflicts, especially in Ukraine, and broader global uncertainties may bring volatility. Additionally, the upcoming U.S. presidential election and its potential impact on trade and fiscal policy could pose challenges for emerging economies. Keeping an eye on economic indicators and policy shifts will be key to understanding market direction. In this shifting environment, maintaining a diversified portfolio will be essential to managing risks and seizing opportunities.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.