US 2024 Elections and what is means for the Financial Markets

Commentary

Structure of the US Elections

In the United States (US), presidential elections occur every four years, with candidates needing to secure 270 of the 538 electoral votes to win. The two major political parties, the Democratic and Republican parties, each nominate candidates for the presidency, Senate, and House of Representatives, with occasional candidates from smaller third parties.

The House of Representatives consists of 435 members who serve two-year terms, with all seats contested every two years. These seats are distributed based on state populations, and each representative serves a specific district. The party with the most seats typically controls the House and selects the Speaker of the House. The Senate, on the other hand, has 100 members—two from each state, who serve six-year terms. About one-third of Senate seats are up for election every two years. A party holding a Senate majority can shape major legislative decisions and has influence over confirming federal judicial and executive appointments.

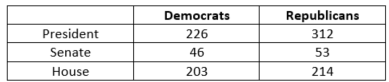

2024 Election Results

US elections were held on November 4, 2024, and the Republicans achieved a significant victory, securing control of the presidency, Senate, and House of Representatives. With unified leadership, there is potential for Republican-led economic policies, such as tax reductions and regulatory easing, to advance more smoothly. This shift may impact market sentiment and shape economic expectations in the near future, as investors and businesses anticipate possible changes in fiscal and regulatory approaches.

The US 2024 Election Results

Impact on the Stock Market

a) Tax Policy

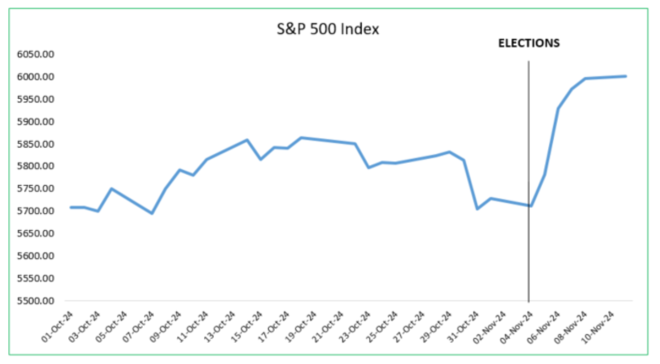

Historically, US presidential elections have had a significant impact on the stock market, often resulting in heightened volatility as investors respond to new policy directions. After the Republican sweep in the November 4 election, the S&P 500 rose by 3.76% in the following two days, driven by optimism around potential tax cuts and deregulation under Republican leadership.

A major policy priority for the Republicans is making the 2017 Tax Cuts and Jobs Act (TCJA) permanent, potentially with further reductions in individual and corporate tax rates. The TCJA, enacted in December 2017, marked a substantial tax overhaul aimed at simplifying the tax code, reducing rates for individuals and businesses, and fostering economic growth. It notably slashed the corporate tax rate from 35% to 21%, enhancing the competitiveness of US companies, boosting their investment capacity, and potentially created more jobs and higher wages. Unless Congress intervenes, many provisions of the TCJA, particularly those impacting individual taxes, will expire after 2025 and revert to the 2017 rules.

When corporate taxes are lowered, companies retain a greater portion of their earnings, providing them with more capital to reinvest in growth, reduce debt, or reward shareholders through dividends and stock buybacks. This increased profitability and financial flexibility tend to attract investors, often driving up stock prices as businesses become more appealing due to their strengthened position and growth potential.

Similarly, reductions in individual taxes increase disposable income, allowing people to invest more in stocks, further boosting demand and potentially raising stock prices. Lower taxes can also stimulate consumer spending, benefiting companies’ revenues and profits, and, in turn, making their stocks more attractive. Together, increased consumer spending and investment create a positive cycle that can support stock market growth.

S&P 500 Index

b) Deregulation

Following Donald Trump’s victory at the US polls, his proposed policies are anticipated to include key deregulatory measures that could positively impact stocks, particularly in the energy and financial sectors. Central to his campaign is a plan to ease environmental regulations, which currently limit activities like oil and gas drilling and coal mining. If these green regulations are reduced, traditional energy companies may see lower production costs and potentially higher profit which influences higher stock values in these sectors due to increased investor optimism about profitability.

In the financial sector, President-elect Trump has pledged to create a supportive regulatory landscape for cryptocurrency, including measures like establishing a “Bitcoin and crypto presidential advisory council” and opposing the introduction of a federal digital currency (CBDC). He aims to prevent government auctions of seized cryptocurrencies, which often lead to price drops, and proposes maintaining the federal holdings of Bitcoin.

Such measures could boost confidence in the cryptocurrency market, drawing more institutional and retail investors into crypto-related stocks, such as companies involved in blockchain technology, exchanges, and mining. The anticipated influx of capital into cryptocurrencies might shift investments away from more traditional stocks and bonds, as some investors may view the relatively unregulated crypto space as a high-growth opportunity. This shift could potentially impact stock prices in sectors less connected to the cryptocurrency market.

c) Trade Policy

Trump’s 2024 campaign placed a strong focus on protectionist trade policies, with key proposals such as a 10% tariff on most imported goods and significantly higher tariffs, potentially over 60%, on imports from China. He has also proposed the introduction of the Trump Reciprocal Trade Act, which would allow the president to set matching tariffs on countries that impose higher tariffs on US exports than the US does on theirs. Additionally, the President-elect has also indicated plans to revoke China’s Most Favoured Nation (MFN) status, which would further escalate tariffs on Chinese goods, possibly provoking reciprocal actions from China.

These protectionist policies are likely to benefit some domestic industries by curbing foreign competition, providing competitive advantage to those sectors focused on domestic production. However, industries heavily reliant on international supply chains, such as automotive, electronics, and retail, could face increased costs due to higher tariffs on imported components and materials, especially from China. This could put pressure on stock prices in these sectors as companies contend with rising production costs, potentially lower sales, and narrower profit margins. Conversely, sectors like agriculture, construction, and local manufacturing, which have fewer global supply dependencies, could see stock prices improve as they gain competitive ground.

In response to tariffs, companies may reconfigure supply chains or import products in advance to manage costs, although these adjustments could cause delays and product shortages. Ultimately, higher costs are likely to be passed unto consumers, raising prices on many goods and possibly reducing consumer demand, which can affect corporate earnings.

Trade restrictions often lead to market uncertainty as businesses struggle to forecast costs and navigate shifting international relations, leading to heightened volatility in the stock market. Investors may shift away from trade-sensitive stocks, with long-term investors potentially favouring more stable sectors like utilities, healthcare, and domestic infrastructure, which are less impacted by trade policies.

Impact on the Bond Market

When the government reduces taxes, it may need to find alternative ways to fund public services and obligations since tax revenue, which usually finances these functions, will decrease. A common approach is for the government to borrow more by issuing Treasury bonds, which are debt securities sold to raise funds. When the supply of Treasury bonds increases, it can drive bond yields up, as yields (interest rates paid to bondholders) often rise to attract more investors willing to lend to the government, especially if there are concerns over increasing national debt.

With proposed tax cuts and trade policies, the Federal Reserve might reconsider its current approach to interest rates due to potential inflationary pressures. Trade policies involving high tariffs can drive inflation by raising the prices of imported products, which then leads companies to increase prices for their own goods, especially if they depend heavily on imports. Inflation is the general increase in prices across the economy, reducing purchasing power, and can lead to higher costs for everyday items.

Additionally, if companies anticipate tariffs, they may start stockpiling (buying extra inventory) in advance to avoid future price hikes. This behaviour can temporarily push up demand, driving prices higher even before tariffs take effect. Likewise, if consumers expect prices to rise, they may start buying goods earlier, further increasing demand and contributing to inflation.

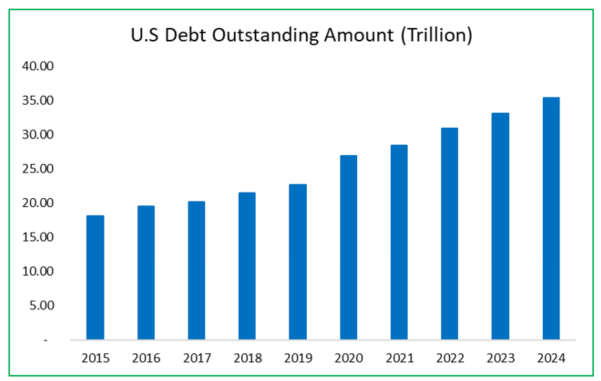

With unified Congressional control, deficit spending is likely to accelerate, compounding the increases seen since the 2017 Tax Cuts and Jobs Act (TCJA), pandemic relief measures, and recent infrastructure investments. Extending the TCJA alone could add approximately USD3.5 trillion to the federal deficit by 2034, which may bolster household balance sheets and support economic growth.

However, this increased spending may not have the anticipated positive effect on markets. Rising debt levels bring higher expectations for economic growth but also amplify policy risk. Market interest rates are likely to climb, which could drive volatility. Fiscal expansion, while a longstanding trend, is becoming increasingly relevant to US debt sustainability. On a global scale, the depth of US capital markets provides stability, reducing the likelihood of a prolonged sell-off in US Treasuries. Yet, structural shifts—such as reduced global reliance on the US dollar or potential policy missteps—could elevate this risk.

Finally, increased protectionist policies like tariffs can increase market uncertainty, prompting a “risk-averse” shift in the bond market. Investors might favour safer assets, like US Treasury bonds, which are seen as more stable, pushing yields down on these bonds. Conversely, corporate bonds, especially those considered riskier, could experience decreased demand and wider credit spreads, resulting in higher borrowing costs for companies facing uncertain economic conditions.

U.S National Debt ($US)

In light of the recent US election result and the sweep of both the Senate and the House, investors should take a proactive strategy by prioritizing sectors likely to benefit from lower taxes, such as energy, finance, and industrials, while being cautious about rising bond yields due to potential inflation and increased national debt. A modest, diversified investment in crypto-related assets may also capture gains from a favourable regulatory environment, though investors should be mindful of the sector’s volatility. High trade barriers are expected to benefit domestically focused companies over those with extensive international supply chains. To navigate risks associated with policy changes, a balanced portfolio that includes both defensive sectors, such as utilities and healthcare, alongside growth-oriented assets, can provide added resilience and stability.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.