Trump’s New Tariffs: The True Economic Impact

Commentary

Tariffs are taxes imposed on imported or exported goods and are among the oldest tools of economic policy. Governments implement tariffs for various reasons: to protect domestic industries, reduce trade deficits, or generate revenue. President Donald Trump has announced plans to implement sweeping new tariffs and pledged to impose significant tariff hikes, including a 60% tariff on goods from China and a 25% tariff on products from Canada and Mexico. While these measures may seem straightforward, their true economic impact is far-reaching and complex. Beyond the immediate cost to importers, tariffs influence consumers, businesses, and the broader economy in multifaceted ways. Understanding the economic ramifications of tariffs requires an exploration of their effects on prices, trade relationships, industries, and long-term economic stability.

How do Tariffs work?

Tariffs are typically calculated as a percentage of the value of the goods being traded. For instance, if a domestic company imports a car valued at $60,000 and a 25% tariff is applied, the company must pay the tariff in addition to the car’s original price. This means the total cost for the company would be $75,000 ($60,000 × 1.25).

Workings of an Import Tariff

Effect on Consumer Prices

When tariffs are imposed, the initial cost falls on the importers, who pay the tax when the goods cross the border. For instance, a 25% tariff on imported machinery increases the cost for importers to purchase these products. Importing companies then face two options: they can either absorb the additional expense, which reduces their profit margins, or transfer the cost to consumers by raising prices. If the cost is passed along, American consumers would face higher prices for goods, ultimately diminishing their purchasing power and straining household budgets.

Furthermore, these effects tend to ripple through the economy. Industries reliant on imported goods as inputs, such as manufacturing or construction, may also experience rising production costs, further driving up prices for finished products and services. Over time, this inflationary pressure can reduce overall economic efficiency and competitiveness, especially in sectors heavily dependent on international trade.

Effect on Consumption Patterns and Supply Chains

Higher consumer prices can significantly influence spending habits as households adjust to rising costs. Consumers may switch to more affordable alternatives where possible—for instance, opting for generic or store-brand products instead of pricier branded ones. Non-essential expenses like entertainment or travel may be reduced, as families prioritize necessities such as food and housing. If no suitable substitutes are available, consumers might purchase smaller quantities of goods to manage their budgets.

When companies cannot pass higher costs on to consumers and must absorb them, they often seek cheaper suppliers to reduce expenses. This shift can disrupt supply chains in several ways. Finding new suppliers may require renegotiating contracts, revising logistics plans, and altering production processes, adding complexity and potential delays. New suppliers located farther away could increase transportation costs and lead times, disrupting the timely flow of goods.

Additionally, cheaper suppliers might rely on lower-quality materials or less precise manufacturing processes, which could result in substandard products, higher defect rates, or increased quality control efforts. In some cases, these suppliers may lack the capacity or infrastructure to handle unexpected surges in demand, leading to missed deadlines or order cancellations, further straining supply chains and production timelines.

In summary, any implementation of tariffs is expected to lead to higher consumer prices, shifts towards domestic products, reduced consumer choices, challenges for small businesses, and increased inflationary pressures. These changes reflect a complex interplay between trade policy and consumer behaviour that could have lasting implications for the U.S. economy.

Effects on Employment

Revitalizing American manufacturing was a central goal of Trump’s tariff policies during his first term. By making foreign goods—such as consumer products, steel, and aluminium—more expensive and less competitive, the tariffs sought to encourage American businesses and consumers to favour domestically produced alternatives. Additionally, the policy aimed to incentivize companies to bring back manufacturing jobs that had been outsourced to lower-cost labour markets. By raising the cost of imported goods, the tariffs were intended to promote reshoring, potentially boosting job creation in U.S. manufacturing and assembly industries.

However, the outcomes of such policies are not always straightforward. Many industries, such as technology, consumer electronics, automotive, and agriculture, rely on imported components and materials. Tariffs increase the cost of these essential inputs, forcing businesses to either absorb the additional expense or pass it on to consumers. Companies that absorb higher costs may reduce production or cut jobs to maintain profitability. If these costs are passed on to consumers, higher prices can suppress demand, especially in price-sensitive sectors, further leading to business contraction and workforce reductions.

Tariffs can also provoke retaliation from affected countries, which may impose their own tariffs on U.S. exports. This can harm U.S. exporters, reducing their sales and resulting in job losses in export-dependent industries. Furthermore, while tariffs may protect specific sectors like steel, they can inadvertently harm industries that rely on those materials. For example, higher steel prices can increase costs for manufacturers of machinery and construction equipment, leading to reduced production and layoffs in those sectors.

Effect on the trade deficit

The trade deficit—the gap between a nation’s imports and exports in a given year—is a key measure of economic balance. In 2016, before Trump took office, the U.S. trade deficit for goods and services was USD480 billion, representing about 2.5% of GDP. By 2020, despite the introduction of tariffs, it had grown to USD653 billion, or roughly 3% of GDP. Economists suggest that one reason for this increase was the unintended impact of tariffs on the U.S. dollar. By raising the dollar’s relative value, tariffs made American goods more expensive and less competitive internationally, reducing demand for U.S. exports.

Globalization also played a role in undermining the effectiveness of tariffs. For example, after the Trump administration imposed a 30% tariff on solar panels from China in 2018, Chinese manufacturers shifted production to countries like Malaysia, Thailand, Cambodia, and Vietnam. These solar panels were then exported to the U.S., effectively bypassing the tariffs.

While Trump’s tariffs aimed to reduce the trade deficit, the outcome has been more complicated. A mix of reduced imports, retaliatory tariffs that limited U.S. exports, and global shifts in production has shaped the trade balance. The success of such policies hinges on the ability of the U.S. to strengthen domestic manufacturing, improve export competitiveness, and navigate the risks of trade wars and inflation.

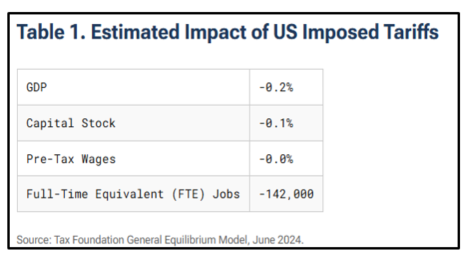

Effect on Gross Domestic Product (GDP)

The Trump administration’s tariffs imposed in 2018 had a profoundly negative impact on both the U.S. economy and the global economy, according to the Tax Foundation. These tariffs, along with the additional implemented by the Biden administration in May 2024, are projected to reduce U.S. long-term GDP by 0.20%, decrease the capital stock by 0.10%, and eliminate about 142,000 jobs. This downturn is largely due to higher costs for businesses, reduced consumer spending power, and decreased competitiveness of U.S. exports resulting from retaliatory tariffs.

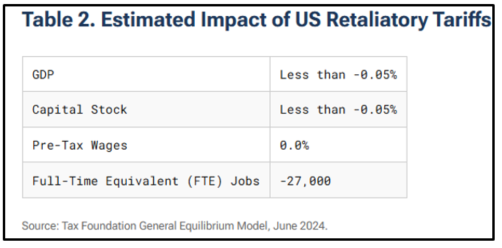

Moreover, the U.S. economy will face additional challenges from retaliatory measures by its trading partners. These retaliatory tariffs are expected to further reduce U.S. GDP and capital stock by less than 0.05% and cut an additional 27,000 full-time jobs.

Estimated Impact of U.S Imposed Tariffs

The true economic impact of tariffs extends far beyond their initial cost, influencing consumers, businesses, and international trade relations. While tariffs can offer short-term protection for domestic industries and address trade imbalances, their broader consequences often include higher consumer prices, strained trade relationships, and potential economic inefficiencies. Policymakers must carefully weigh these trade-offs when implementing tariff policies, considering both their immediate goals and long-term implications for economic stability and global cooperation. By understanding the multifaceted effects of tariffs, nations can navigate their trade policies with greater foresight and balance.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.