Market Review: First Quarter of 2025

Commentary

International Market Review

The elevated market volatility seen in late 2024 continued into early 2025, driven by political and policy upheaval following Donald Trump’s inauguration. In a striking start to his term, Trump signed a record number of controversial executive orders, including efforts to end birth right citizenship, roll back electric vehicle mandates, and suspend most federal grants for health, education, and small businesses. Although many of these orders were blocked by federal courts, their broad economic implications stirred investor uncertainty and fuelled further market turbulence.

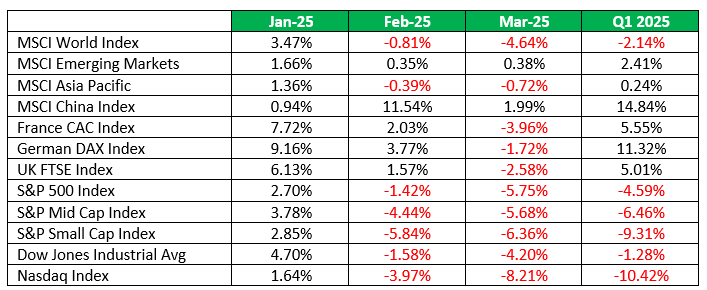

The most pronounced strain on stocks came later in January when the Trump administration announced its intention to impose tariffs on imports from Canada, Mexico, and China. The eventual implementation of these tariffs later in the quarter further destabilized investor confidence. Consequently, the MSCI World Index recorded a loss of 2.14% for Q1 2025, reflecting the cumulative impact of political turbulence and global economic shifts.

U.S. Stocks

U.S. stocks underperformed its international peers in the first quarter of 2025, posting a loss of 4.59%. January was the only positive month, as strong economic data and Trump’s tax cut promises lifted sentiment, pushing the index up 2.70%. However, optimism faded by mid-February when Trump announced a 25% tariff on key trading partners, reigniting trade war fears.

The positive momentum only lasted into mid-February as market volatility intensified, owing to rising inflationary pressures. Consequently, the Federal Reserve adopted a cautious stance and kept interest rates at 4.25% in both its January and March meetings. At the most recent FOMC meeting held in March 2025, Chair Powell affirmed that the Fed is in “no hurry” to cut rates.

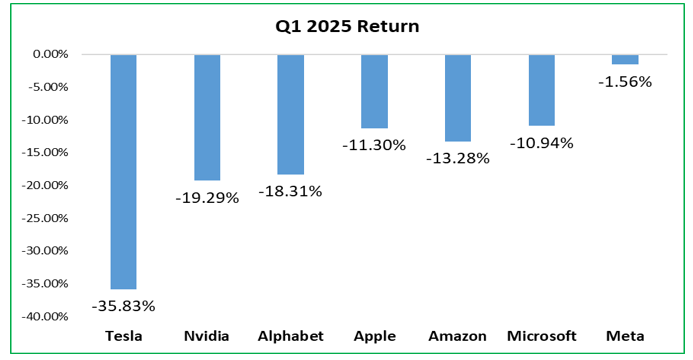

Tech stocks struggled, with the Nasdaq plunging 10.42%, making it the worst-performing major index. The “Magnificent Seven” suffered sharp losses, led by Tesla (-35.83%) and Nvidia (-19.29%). Nvidia’s decline was driven by concerns over competition from China’s DeepSeek AI, while Tesla faced multiple headwinds, including Trump’s rollback of EV mandates, weak deliveries, and auto tariffs squeezing margins.

By quarter’s end, all major U.S. indices had posted losses—S&P 500 (-4.59%), Dow Jones (-1.28%), and Nasdaq (-10.42%)—a stark contrast to their Q4 2024 gains. Small- and mid-cap stocks were hit hardest due to their sensitivity to tariffs, while larger firms with diversified revenue streams proved more resilient, making them a preferred choice for investors.

Europe and the United Kingdom

European stocks outperformed their U.S. counterparts in the first quarter of 2025, with major indices posting gains amidst challenging global conditions. This rally was supported by rate cuts from the European Central Bank (ECB), which provided a tailwind for equities despite stagnant economic data across the region.

German stocks delivered double-digit returns during Q1, defying political turbulence following the government’s dissolution in December after a no-confidence vote. The February elections aligned closely with pre-election polls, enabling the two major center-right political parties to begin exploratory coalition talks with one of the oldest and largest center-left political parties, fostering stability and investor confidence.

In the United Kingdom, stocks reached new heights, with the FTSE 100 achieving its best monthly performance in two years. This surge was fuelled by higher energy prices, driven by colder-than-expected winter temperatures and the U.S. announcement of stricter restrictions on Russian oil exports. Additionally, investor sentiment improved as the U.K. successfully avoided U.S. tariffs due to its lack of a trade deficit with the U.S.

Emerging Markets

Emerging market stocks outperformed their developed market counterparts in the first quarter of 2025, driven primarily by a strong rally in Chinese equities. The MSCI Emerging Markets Index delivered a modest return of 2.41% for the quarter, with Chinese stocks leading the charge, posting an impressive gain of 14.84%.

Investor confidence in China surged despite the looming threat of U.S. tariffs, thanks to proactive measures by the Chinese government to stimulate economic growth. These included interest rate cuts and increased fiscal spending, which reassured markets and supported growth expectations. Optimism was further bolstered by the launch of DeepSeek’s AI model, which showcased China’s technological prowess and potential for innovation.

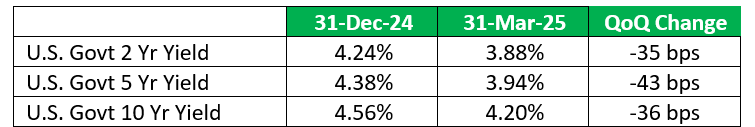

U.S. Treasury Yields

U.S. Treasury yields fell in Q1 2025, led by a risk on risk off strategy among investors. Despite stronger-than-expected economic data, particularly a robust labour market, the period announcement of new tariffs on major trading partners heightened fears of a global trade war which can negatively impact the economy’s growth prospect. Pushing yields down was also the persistent price pressures and the resultant cautious stance taken by the Federal Reserve. This pause, combined with expectations of potential future rate cuts and the economic uncertainty led investors to seek safer assets, driving Treasury yields down.

The yield on the 10-year Treasury note fell from 4.56% at the end of December 2024 to 4.20% by March 2025, marking a decline of 36 basis points. Shorter-term bonds experienced similar losses, with the 2-year Treasury yield decreasing from 4.24% in December 2024 to 3.88% by March 2025.

U.S. Treasury Yields

US Sector Performance

In the first quarter of 2025, investors shifted their focus towards more stable sectors due to economic and geopolitical uncertainties. The energy sector performed exceptionally well, rising by 9.3%, followed by healthcare (6.1%), consumer staples (4.6%), and utilities (4.1%). These sectors are generally less affected by market downturns, making them attractive during uncertain times.

On the other hand, sectors that typically thrive during economic growth, such as Consumer Discretionary and Information Technology, struggled significantly. The Consumer Discretionary sector, which includes companies like Tesla, experienced the largest decline, dropping by 14%. This sector is substantial, being the fourth-largest in the index.

The Information Technology sector, which accounts for nearly 30% of the S&P index, was the second-worst performer, falling by 12.8%. This decline was particularly impactful, as it pulled the entire index into negative territory.

U.S. Sector Performance: Q1 2025

Magnificent Seven Performance: Q1 2025

Local Market Review

In the first quarter of 2025, the local stock market in Trinidad and Tobago lost its momentum from the prior quarter, driven by local stocks. The All T&T index posted a quarterly loss of 3.18% which dragged the T&T Composite Index to register a loss of 2.17%. The Cross Listed Index is the sole index to maintain its momentum from the prior quarter, posting a return of 1.05% in Q1 2025.

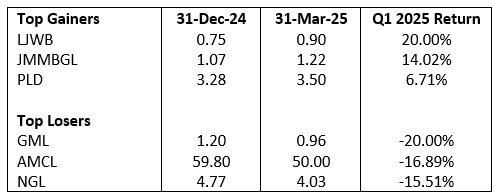

The stocks with the most significant price gains in Q1 2025 were LJ Williams Limited (LJWB), JMMB Group Limited (JMMB), and Point Lisas Industrial Port Development Limited (PLD), with their share prices rising by 20.00%, 14.02%, and 6.71%, respectively. On the other hand, the largest declines were recorded by Guardian Media Limited (GML), Ansa McAl Limited (AMCL), and Trinidad & Tobago NGL Limited (NGL), with their share prices falling by 20.00%, 16.89%, and 15.51%, respectively.

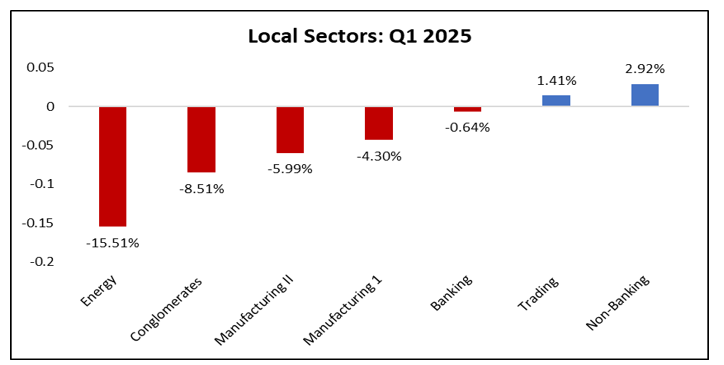

In the first quarter of 2025, only two sectors managed to post gains amidst a challenging market environment. The Non-Banking Finance Sector rose by 2.92%, while the Trading Sector gained 1.41%, driven by robust double-digit growth in the share prices of JMMBGL and LJWB respectively.

The Energy Sector was the worst performer, suffering a sharp decline due to the significant drop in the share price of its sole member, NGL. The Conglomerates Sector followed closely as the second-worst performer, with all its constituent companies experiencing share price declines.

Local Stock Indices Performance

Top Gainers and Losers: Q1 2025

Local Sector Performance: Q1 2025

Equity Markets Outlook

The announcement of sweeping U.S. reciprocal tariffs on April 3, 2025, sent shockwaves through global financial markets, triggering a sharp sell-off. The S&P 500 plunged approximately 5% in a single day on April 4, as investor sentiment soured amid the unexpectedly severe scope of the tariffs. Markets were gripped by fear over the potential economic fallout.

Retaliation came swiftly. On April 7, China announced tit-for-tat tariffs of 34% on U.S. goods, set to take effect on April 10. In response, President Trump escalated tensions further, threatening an additional 50% tariff on Chinese imports starting April 9 unless China withdrew its retaliatory measures. The escalating trade conflict deepened global market turmoil, with stock indices worldwide tumbling as investors grappled with the prospect of severe disruptions to the global economy.

The pervasive and widespread tariff imposition is expected to slow down the global economy and cause disruptions to global supply chains. As such, we expect investors to continue to adopt a risk off strategy and pull back from risky assets such as stocks, and instead continue to seek safe-haven assets such as Treasuries.

Amidst rising global uncertainty and market volatility driven by Trump’s new tariffs, investors should focus on staying diversified, maintaining a long-term perspective, and avoiding emotionally driven decisions. Trade tensions can trigger short-term swings, but overreacting may lead to missed opportunities or increased risk. Emphasizing quality assets, such as companies with strong balance sheets, global revenue streams, and pricing power, can offer resilience in turbulent times. Additionally, exposure to defensive sectors like healthcare or utilities, as well as safe-haven assets such as U.S. Treasuries or gold, can help cushion portfolios.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related t