Implications of the Global Distribution of SDRs

Insights

While the Covid-19 pandemic and the Credit Crunch are two separate and unique events, they share common effects and consequences. The Global Financial Crisis (GFC) in 2008 materially disrupted the financial system and while the coronavirus’s initial target was the healthcare system, it also brought a halt to worldwide economic activity as countries responded to the health crisis. As a result, unemployment increased, many economies entered into recession and there remains a high level of uncertainty surrounding the timing and the extent of the recovery.

What is an SDR?

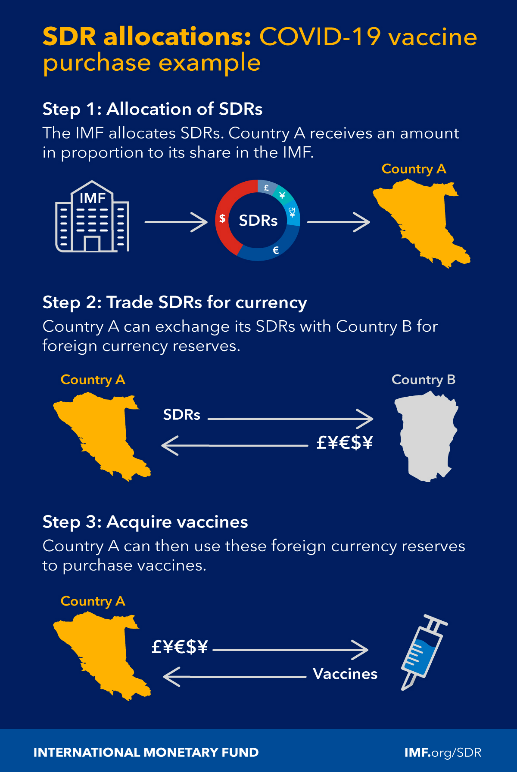

Special Drawing Rights (SDRs) are an international reserve asset created by the International Monetary Fund (IMF) to supplement the official reserves of its member countries. It is not a currency, but a potential claim on the freely usable currencies of IMF members. The value of an SDR is based on a basket of the world’s five leading currencies – the US dollar, Euro, Yuan, Yen and the UK pound. Countries can exchange their SDRs for hard currencies with other IMF members and all transactions involving SDRs must go through the IMF’s SDR Department. This has historically been done on a voluntary basis, with countries in a stronger financial position agreeing to help others when needed.

Uses and Importance of SDRs

Most developing countries rely heavily on imports for basic goods, which they primarily pay in US dollars and Euros. SDRs are a useful tool to bridge fiscal gaps, meet external debt obligations, or address foreign exchange shortages. For example, if Trinidad and Tobago is facing a foreign currency shortage, its Central Bank can voluntarily sell a portion of its SDRs to its British counterpart in exchange for the pound sterling to pay for imported goods. SDRs supplement countries’ reserves, using the collective strength of the Fund’s membership to make all 190 member countries financially stronger. Adding SDRs to a country’s international reserves makes it more resilient financially. In times of crisis, a country can dip into its savings for urgent needs, for example, to pay for the importation of vaccines.

IMF Governors Approve a $650 Billion SDR Allocation

The Board of Governors of the IMF approved a general allocation of Special Drawing Rights equivalent to US$650 billion (about SDR 456 billion) on August 2, 2021, to boost global liquidity as it will serve to supplement countries’ foreign exchange reserves and reduce their reliance on more expensive domestic or external debt.

This is the largest SDR allocation in the history of the IMF. The allocation of SDRs became effective on August 23, 2021. The newly created SDRs were credited to IMF member countries in proportion to their existing quotas in the Fund. Upon joining the IMF, each member country contributes a certain sum of money, called a quota subscription, which is based on the country’s wealth and economic performance. On August 24 2021, Trinidad & Tobago received the equivalent of US$644 million from the global distribution of SDRs by the IMF, boosting the country’s net foreign reserves to over US$7 billion.

An SDR allocation is ‘cost free’. The SDR Department pays interest on SDR holdings to each member and levies charges on SDR allocations of each member at the same rate (the SDR interest rate). Thus, the charges and interest net to zero if the countries do not use their SDR allocations.

However, the use of SDRs is not cost free. When a country trades SDRs for freely usable currencies, their holdings decrease and their foreign exchange reserves increase. This causes the holdings to fall below the allocations. When this happens, the interest payments associated with the two positions do not cancel each other out and the country will pay more interest than it receives. Alternatively, if a country trades freely usable currencies for SDRs, their holdings can increase above their allocations. The country will then receive more interest than it pays out.

The IMF estimates that US$275 billion will be allocated to emerging and developing countries. Of that, low-income countries will receive about US$21 billion, which is equivalent to as much as 6 percent of their GDP in some cases. The IMF estimates over the next five years, low-income countries will need US$450 billion of which US$200 billion would be required just to fight the pandemic and the remaining US$250 billion to return to the path of catching up with advanced economies. The SDR allocation is not nearly sufficient to meet those estimates. The IMF is also discussing creating a Resilience and Sustainability Trust, to lend channelled SDRs to countries alongside plans to combat the pandemic or promote climate resilience. It is important to note that the channelled SDRs will be loans, not grants.

SDR Allocations During the Global Financial Crisis

According to Ted Truman, a former Treasury and Federal Reserve official, by the time the GFC began, most people in positions of authority had never heard of the SDR. Then late in 2008 when policymakers were trying to respond to the GFC’s impact on the international economy, the SDR became a highlight. A general allocation of US$250 billion in SDRs was approved by the IMF Board. Some 20 developing countries used most of these new SDRs within a year to help withstand the economic fallout.

A 2018 IMF Policy Brief states that the SDR allocation increased reserves by about 19% for low-income countries and over 7% for emerging economies (excluding China and fuel exporters). Markets reacted favorably to the allocation. For some countries, the SDR allocation was especially significant. For example, Uganda’s SDR allocation constituted 860% of its international reserves at the time.

Critique of SDR Allocations

SDR allocations are not without criticism. Mark Sobel, a former IMF hand at the U.S. Department of the Treasury, criticized the moral hazard created by an allocation, the idea that the SDR is a long-term tool being used for the short-term problem of COVID-19, and the fact that SDRs impose interest charges. Sobel argued that borrowing from the IMF at a 0% interest rate made it significantly better for low-income countries than SDR allocations, as they need “less debt and more grants.” The IMF acknowledged that SDR allocations have targeting problems as they go to all IMF members regardless of need. Wealthier countries don’t actually need the additional SDRs since they have access to monetary tools and reserve cash.

Outlook

The World Bank estimates that approximately 143 to 163 million people could be forced into extreme poverty worldwide in 2021 and the pandemic could cost the world economy more than US$22 trillion by the year 2025, compared to projected growth pre-pandemic.

To combat the pandemic, G20 countries, an intergovernmental forum comprising 19 countries and the European Union, have kept their economies afloat through stimulus packages worth nearly 19 percent of gross domestic product (GDP), while low-income countries have only been able to spend less than 2 percent of GDP. This has led to a divergence of outcomes and an uneven global recovery.

An SDR allocation is not an all-encompassing solution. It is part of a package of broader international efforts to support global recovery. This package also includes strong support from the IMF, multilateral development banks, and debt relief in some cases, all alongside countries taking necessary reform steps. The IMF has warned that an incomplete global recovery will endanger the entire global financial system. Just as no one is safe until everyone is safe, we can’t move forward unless we all do it together.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are not a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have not acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do not have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.