The Costs and Benefits of Dollarization

Insights

Currency substitution, also known as dollarization, refers to a country’s use of a foreign currency in parallel to or in place of its own domestic currency. While currency substitution can involve a country using any foreign currency as its main or secondary medium of economic value transfer, the prominence of the US dollar (hereafter USD) in international economic affairs means that most cases of currency substitution involve USD. According to the IMF, USD’s share of global reserves stands at around 59% (the euro is second at 21%), while it is used in roughly 40% of international trade invoicing. As a result, while dollarization is technically a type of currency substitution, the two terms are often used interchangeably.

There are two main forms of dollarization: full (or official) and partial (or unofficial). Full dollarization takes place when a country retires its domestic currency and adopts USD as its sole legal tender. Partial (unofficial) dollarization, in contrast, occurs when a country and its residents choose to hold a significant share of their assets in USD, but does not require the abandonment of the domestic currency. Some countries have opted to fully dollarize after a major currency or economic crisis, for example Ecuador and El Salvador. Others have been fully dollarized for pragmatic and historical reasons, like Panama, which has used the USD since its independence in 1904, though it maintains a local currency (the balboa) in coin form at parity to USD. In the Caribbean, there are several territories that use USD exclusively, including the British Virgin Islands, Turks and Caicos, and the Caribbean Netherlands (Bonaire, Sint Eustatius and Saba).

It is important to note that while any form of dollarization may appear to be a radical leap, many countries in the Caribbean are in practice partially dollarized. Central banks across the region hold reserves predominantly in USD, establishments in almost all Caribbean countries accept USD as a medium of exchange, and many households keep some savings in foreign currencies, while their financial systems make heavy use of USD alongside their own sovereign currencies. Partially dollarized economies in the Caribbean include the Bahamas, whose currency is pegged at parity to the USD, as well as Barbados, whose currency is pegged at BBD 2:1 USD.

Pros and Cons of Dollarization

A key benefit of dollarization is in relation to the value of the currency itself. USD has largely held its value over the long run, and adopting it as an anchor currency would extend this benefit to the dollarizing country. For small countries in particular, a free-floating currency tends to be subject to frequent and unpredictable swings, while a fixed exchange rate regime requires the use of scarce foreign exchange reserves to maintain a rigid dollar peg. This is a major reason why dollarization is so attractive to the world’s smallest economies – there are 37 small economies and territories globally that have fully substituted their currencies.

Moreover, the literature suggests that countries whose currencies are unstable in value or whose value must be frequently supported by central bank intervention, would benefit from dollarization by reducing capital outflows and encouraging foreign direct investment, though dollarization must be accompanied by sensible economic management. According to a paper by the Atlanta Federal Reserve, “elimination of devaluation risk might bring stable capital flows, increase the confidence of foreign investors, and therefore promote investment and growth. However, sovereign or default risk is still present and investors still respond to financial crises—real shocks as well as political and social conditions specific to a country.”

A country’s decision to dollarize, either partially or fully, will have significant consequences for its economic policy regime. The greater the degree of dollarization a country undertakes, the less flexibility it will have in terms of monetary policy, such that its ability to craft responses to macroeconomic challenges (rising inflation, falling employment, recessions, etc.) will be limited. Concretely, a country that is fully dollarized cannot expand the money supply to stimulate the economy in the event of a recession since it does not control issuance of its currency, and cannot use devaluations to try to address a trade or balance of payments crisis, for similar reasons.

This stricture on a country’s economic policy can be seen as an advantage or a disadvantage. From the positive side, the general stability of the USD means that inflation and other key macroeconomic variables are arguably easier to keep under control than for a typical developing country managing its own currency. This benefit is especially relevant in a region such as the Caribbean that has been beset by economic uncertainty and volatility for most of its independent history. According to an IMF paper, “[t]he main attraction of full dollarization is the elimination of the risk of a sudden, sharp devaluation of the country’s exchange rate… Dollarized economies could enjoy a higher level of confidence among international investors, lower interest rate spreads on their international borrowing, reduced fiscal costs, and more investment and growth.”

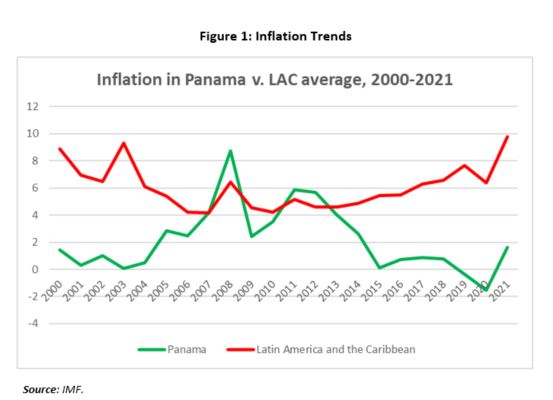

The experience of dollarization in Panama in comparison to the rest of Latin America (see Figure 1) shows that, outside of globally destabilising events such as the 2008 crisis, there may be some advantage to adopting the dollar in terms of price stability.

Figure 1: Inflation Trends

On the other hand, losing effective control over its own monetary policy can be considered a significant diminution of a country’s economic sovereignty, and many countries may be reluctant to relinquish such control despite the potential gains in macroeconomic stability. Furthermore, the cost of dollarization in terms of losing monetary policy autonomy should not be underestimated, especially during global crises. In such times, where the assumption of USD stability can break down, countries may find themselves in a double bind – failing to be buffered by the external currency and powerless to enact counter-cyclical measures against macroeconomic shocks.

According to a 2021 Yale study, “the major benefits of dollarization, increased fiscal discipline and removing domestic political considerations from banking issues… do not occur in international crises.” The study, which looked at Panama’s economic policy response to COVID-19 showed that compared to its Latin American neighbours, the burden of crisis response fell solely on fiscal policy. Without monetary policy helping to lower interest rates, the country will have to make sacrifices to debt service as a result of the fiscal deficits incurred to support the economy during the pandemic.

In addition, while dollarization can lead a country to greater price stability and encourage fiscal responsibility, it by no means guarantees these conditions. The experiences of Ecuador, which dollarized in 2000, and El Salvador, which did so in 2001, show that adopting USD is not a panacea for a country’s macroeconomic ills. Since adopting the USD, Ecuador has defaulted on its debt twice (in 2008 and 2020), while El Salvador defaulted once in 2017, and based on its current sovereign debt ratings it is considered likely to default once again in 2022.

The Caribbean Context

Given the debt and currency-related challenges that the Caribbean economies have persistently experienced, as well as their close linkages with the US economy, dollarization may be seen as a viable option. Former Central Bank of Barbados governor Dr. Delisle Worrell is a proponent of dollarization in the context of the Caribbean, and in a 2021 paper he stated that the current regimes, in which most Caribbean territories maintain their own sovereign currencies, are wasteful and inefficient. Worrell suggests three reasons that these regimes have been unsuccessful for the region’s economic development.

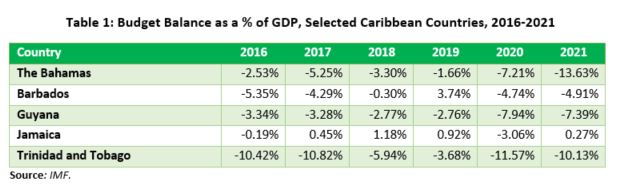

First, he argues that each of the Caribbean currencies have little utility outside of settling domestic transactions, and cannot even be used for trade within the region. Next, the currencies are a poor vehicle for savings, since they tend to lose value over the long run. Finally, they run the risk of devaluation when governments run persistent fiscal deficits – a situation frequently observed in the Caribbean. Indeed, he suggests that having a local currency has not only allowed but in fact has encouraged public sector profligacy (see Table 1), since Caribbean governments can issue local currency debt with relative ease.

As a result, Dr. Worrell suggests the retirement of all Caribbean currencies, and adoption of USD across the region. The arguments put forward for such a step are that cutting off domestically-issued credit would impose market discipline on governments, which “would be obliged to maintain a good international credit rating”; exclusive USD use would relieve Caribbean banks of the struggle to maintain correspondent banking relationships; and that the resulting improvements in investor confidence and ease of doing business would portend well for economic growth. The IMF has mostly warned countries against excessive dollarization, and in some papers, have argued instead for the benefits of monetary policy flexibility and the option of currency devaluation in response to fiscal and balance of payments crises. In the Caribbean context, however, devaluations have often failed to deliver the desired results.

The critical benefit that dollarization can bring to Caribbean economies is stability. As stated above, adopting the USD can help these countries avoid the damaging swings in value that imperil their economic development. Once other fundamentals are maintained, this currency stability can bring order to Caribbean countries’ capital positions by reassuring domestic and foreign investors. Lower inflation and lower borrowing costs are potential benefits that could be derived from this currency stability. On the other hand, this stability comes at the cost of losing control over monetary policy, which can severely inhibit countries’ responses to economic crises, and dollarization could be politically challenging to implement in the Caribbean. Nevertheless, in a region searching for innovative solutions to its historical macroeconomic difficulties, dollarization is a provocative but pragmatic option which should engage the minds of policymakers.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.