Understanding Your Risk Appetite

Maritza Ferreira Ramdeen Manager – Investment Research

Insights

Risk is an inherent and unavoidable aspect of investing. In financial terms, risk is the likelihood that an outcome will differ from what was expected. As such, there is chance that an investor can lose some or all funds invested. There is also the risk that the investor would not achieve the expected return. It is for these reasons that knowing, understanding, and managing risks is crucial in making informed investment decisions.

All asset classes carry some degree of risk. For any tradeable investment such as stocks, commodities and bonds, investors can potentially lose money due to price volatility, which is how much and how quickly prices move over a given time period. Higher volatility means that an asset’s price is fluctuating more widely over time, and it implies that the investor has a greater chance of losing money or experiencing large swings in value while lower volatility means that the asset’s price is relatively stable.

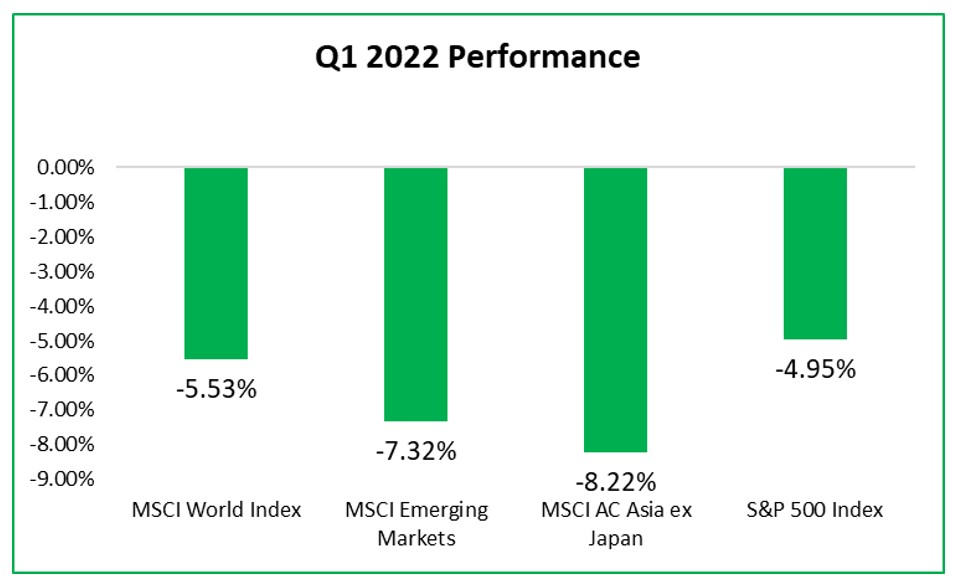

Investors are also exposed to market risk, which is the chance of financial losses occurring due to changes in overall market conditions that are often influenced by economic conditions, geopolitical events and regulatory changes. The emergence of the COVID-19 pandemic in 2020 and the Russia-Ukraine war in early 2022 negatively impacted financial markets around the world and resulted in temporary declines in stock prices. In the quarter ending March 2022, at the onset of Russia’s invasion of Ukraine, investor confidence waned due to the global geopolitical and economy uncertainty associated with the war. Consequently, stock prices plunged during the first quarter of 2022.

Figure 1: Selected International Stock Indices

Source: Bloomberg, FCIS Research & Analytics

Bondholders are also impacted by credit risk, which refers to the possibility that the issuer of a bond may default, or not honour its interest payments or fail to repay the principal amount at maturity. If an investor holds bonds of an issuer that defaults, they may not receive the expected interest payments or may lose the principal amount invested.

Risk Appetite

The term risk appetite is defined as the psychological willingness and financial ability to bear monetary losses to achieve a particular investment goal. An investor’s willingness to accept risk reflects an individual’s attitude towards taking on risk in their investment portfolio, and it can vary greatly among different investors and is influenced by several factors. One such factor is the time horizon, which is the length of time an investor plans to hold their investments. The longer the time horizon, the more willing the investor will be to accept losses in hope of future gains.

Emotional biases also play a major role in determining one’s willingness to withstand financial losses. An investor who is fearful of making any losses may be influenced to avoid taking risks while an investor who is overconfident may be prone to take excessive risks.

Investors who have knowledge and understanding of financial markets and experience in investing will be more comfortable in taking on higher levels of risk when compared to investors who are new to the investing world.

An investor’s financial ability to tolerate risk refers to their capacity to withstand and bear potential investment losses without compromising their financial stability. This ability is influenced by one’s personal circumstances such as current financial situation and responsibilities. An investor who has sizeable savings, permanently employed and who is single may be able to take on more risk as they are more financially stable and have less responsibilities than those who do not have adequate savings, do not have a stable job, and have dependents. Age also plays a major role in determining one’s ability. A younger investor may have a greater capacity to absorb investment losses as they have the time to recoup such losses than an investor who is close to retirement.

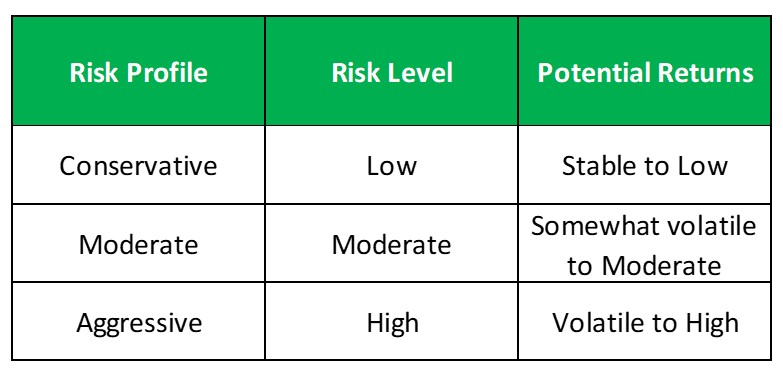

Risk Profiles

The risk appetite for investors is normally classified into three (3) risk profiles – Aggressive, Moderate and Conservative. An aggressive investor has the ability and willingness to take on high levels of risk is willing to endure market fluctuations for the potential of long-term gains. Such investors may be more inclined to investing in assets with higher volatility, such as stocks, commodities, or alternative investments, which offer the possibility of higher returns but also carry higher risks.

Investors who do not have the tolerance for any fluctuation in investment value and are unable to absorb losses are profiled as Conservative. Such investors tend to play it safe with their capital and favour capital preservation over potential gains. They may prefer to invest in lower-risk assets, such as bonds, fixed deposits, or cash, with the aim of protecting their investment and generating stable, albeit modest returns.

The Moderate risk profile is the balance between conservative and aggressive. Such investors are willing to take on some degree of risk in their investment portfolio, but also prioritize capital preservation. They may invest in a mix of higher-risk and lower-risk assets, such as a diversified portfolio of stocks, bonds, and real estate, aiming for a balance between potential returns and risk mitigation.

Table 1: Risk Profiles, Risk Level and Potential Returns

Source: FCIS Research & Analytics

All investments carry some level of risk and the potential for losing money is integral in investing. Investors should seek to diligently assess and understand the risks associated with each investment as different types of investments have varying degrees of risk. It should be noted that circumstances and environmental conditions are never static – income levels, investment objectives, family structure and economic conditions usually change with time. Thus, it is important for investors to re-evaluate their risk appetite periodically to ensure that it remains in line with their changing financial situation and investment objectives.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.