Emerging Markets Under Pressure

By Vangie Bhagoo-Ramrattan – Head, Economic Research Unit, First Citizens

Insights

The global economy continues to undergo a period of significant volatility and uncertainty even though the worst of COVID-19 seems to be behind us. More than three years after the initial wave of restrictions, the recovery from the unprecedented decline in economic activity globally in 2020 has been uneven and inundated with challenges. The economic adjustment in many countries has been severe as policymakers are faced with a situation of persistent core inflationary pressures, weakened economic activity and anemic job growth, higher indebtedness due to increased borrowing to finance expenditure during the pandemic years as well as increased pressure on external liquidity. Many central banks have adopted an aggressive approach to monetary policy to tame inflation, which has tightened global financial conditions, a major concern for emerging markets and developing economies (EMDEs). Over the past few months, investor sentiment has been mixed and highly dependent on the actions of the US Federal Reserve as well as other major central banks globally.

Slowing Global Growth Prospects

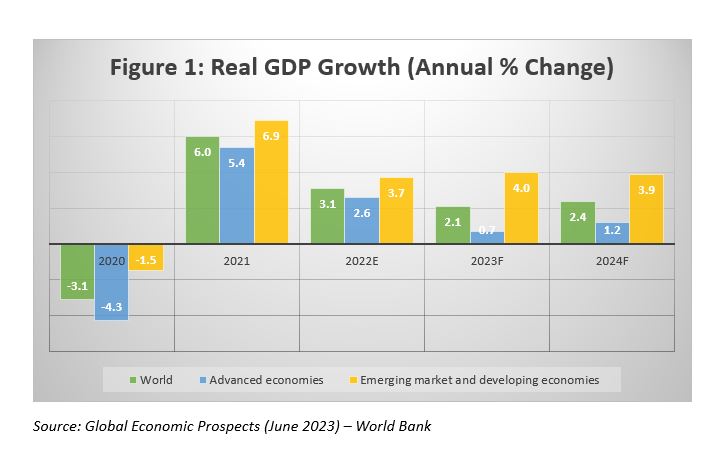

Investors widely expect that the global economy will slow markedly in 2023 with this trend likely to continue into 2024 due to the lingering impact of monetary policy tightening. In its Global Economic Prospects report released in June 2023, the World Bank projected that global growth would decelerate from 3.1% in 2022 to 2.1% in 2023 and up slightly to 2.4% in 2024. The 2023 forecast represents one of the weakest growth rates in the last five decades, according to the World Bank, and underscores the heightened risks associated with both higher interest rates and the elevated financial stress especially in the EMDEs.

The most pronounced deceleration is expected for the advanced economies, where economic growth is projected at a mere 0.7% in 2023, increasing moderately to 1.2% in 2024. This compares to an average growth of 4% in 2021 and 2022. The US economy is expected to grow by 1.1% in 2023 and to further slow to 0.8% in 2024 largely because of the lingering impact of the sharp increase in interest rates over the past year. The prospects in the Euro area are even weaker as the region is expected to grow by a meagre 0.4% in 2023, significantly down from 3.5% in 2022. The forecasted deceleration is also supported by the lagged impact of tighter policy measures as well as elevated energy prices.

In the EMDEs, growth in China is expected to outpace the regional average, with real GDP expected to expand at a 5.6% in 2023, higher than the 3% estimated for 2022. Up to 2025, the Chinese economy is projected to average economic growth of 4.9%. Excluding China, EMDEs are expected to grow by 2.9% in 2023 from 4.1% in 2022. The moderation in commodity prices expected beyond 2022 is expected to negatively impact upon the commodity-exporting EMDEs, where growth is expected to slow to 1.9% in 2023 and 2.8% in 2024, compared to growth of 5% and 4.4% for the commodity-importing EMDEs in the same period.

Sticky Core Inflation, Higher Interest and Tighter Global Financial Conditions

Despite the weaker economic growth prospects globally, the persistently high and rising inflation prompted central bankers globally to aggressively tighten monetary policy as inflation remains outside official targets. While the moderation in commodity prices has tempered recent price pressures, underlying inflation, as measured by core inflation remains relatively sticky, largely because of strong job and wage growth which continue to fuel consumer spending. The median headline global inflation rate remains elevated at 7.2% in April 2023, down from a peak of 9.4% in July 2022, according to the World Bank. Interestingly, in the EMDEs, core inflation has decelerated within recent months, while in the advanced economies, it has picked up. It is therefore anticipated that underlying price pressures will persist, and global inflation is projected to remain above its 2015- 2019 average for a longer period than initially assumed.

The stubborn inflationary environment complicates policymakers’ decisions, as they balance weakening economic growth with inflation that remains outside target levels. The response has been an aggressive stance to interest rates to curb the rise in prices. Major central banks across the advanced economies have implemented historic hikes in benchmark interest rates since the start of 2022.

The rapid interest rate adjustments by the advanced economies, but more so by the US Fed, poses significant challenges for the EMDEs. The US remains the largest economy by GDP size up to 2022 and high interest rates will likely soften US economic growth, which will have spillover effects on external demand, dampening economic activity in the EMDEs, including exports and capital flows. Further, the higher interest rate environment in the US usually leads to higher domestic interest rates in the EMDEs as well as widening spreads and lower equity prices. Debt servicing also becomes more expensive when US Interest rates increase if debt is US dollar denominated as interest costs rise. Moreover, as the US dollar becomes more attractive because of higher US rates, other currencies become less attractive and will depreciate, resulting in an increase in the domestic-currency cost of repaying US dollar debt. The depreciation of the local currency can also exacerbate domestic inflation which may require further monetary policy tightening within the EMDEs.

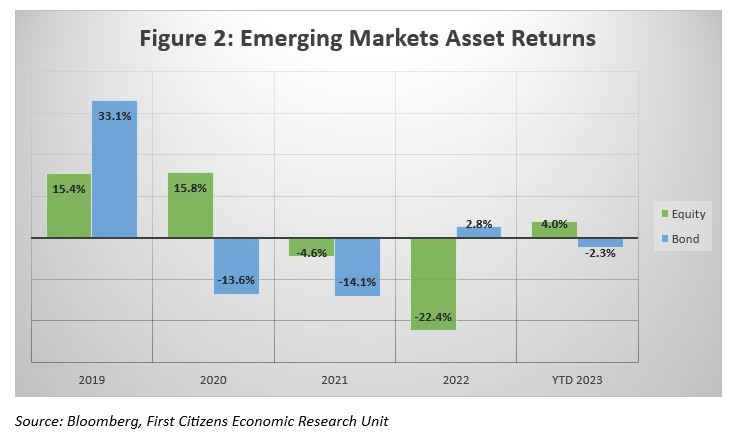

Figure 2 shows that both bonds and stocks[1] have performed poorly since the pandemic began and they continue to be impacted by risk averse sentiment associated with the uncertainties which are dragging the global economic outlook. The aggressive monetary policy tightening has also significantly affected EMDE financial markets. Year to date 2023 however has seen a moderate reprieve in the EM equity markets, evidenced by a 4% rally up to 26 June 2023. However, EM sovereign bond spreads widened slightly during that same period moving from 375 basis points at the end of 2022 to 384 basis points.

The uncertainty and volatility in the financial markets may likely continue in the short to medium term. Global economic growth is widely projected to be much softer in 2023 and 2024 which will continue to negatively impact economic activity in the EMDEs. At the same time, core inflationary pressures remain sticky and are expected to decelerate at a much slower pace. This will complicate central bankers’ policy decisions, since it may mean that interest rate hikes may persist, or rates may remain higher for longer. In this case, EMDEs can face financial distress including currency volatility, banking sector challenges as well as sovereign debt crises. Countries that are fundamentally weaker, specifically those with ‘twin deficits’ (fiscal and current account) and with lower credit ratings may be faced with a greater level of risk which can result in much higher sovereign risk premiums and more exaggerated increases in their local bond yields.

While EMDEs have become increasingly resilient over the past decades, they are not immune to external economic shocks. It is imperative that appropriate policy is implemented to ensure that financial contagion is minimized and to restore economic sustainability in these fragile economies.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.

[1] EMDE bond performance is measured by the JP Morgan EMBI+ Sovereign Spread while the MSCI Emerging Markets Index is used to measure the returns on EMDE equities.