The FOREX/ Interest Rate Tradeoff T&T’s Interest Rate Policy

Insights

Central Banks across the world have generally responded to the rising inflationary environment with tighter monetary policies after years of an unprecedented accommodative stance which started at the onset of the COVID-19 pandemic in 2020. Indeed, many global central bankers have hiked interest rates to historic highs as inflation soared to record levels due to a combination of both supply and demand factors. The hawkish monetary policy stance continued mostly up to mid- 2023 particularly for the advanced economies where underlying inflationary pressures remained relatively strong, even as headline inflation gradually retreated. Some Caribbean central bankers would have also adjusted policy stance to help combat rising inflation, as was the case in Jamaica. Despite the global trend of higher policy rates, the benchmark rate in Trinidad and Tobago has remained steady at the same level since March 2020.

Global Interest Rate Environment

In March 2020, the world witnessed an almost synchronized loosening of monetary policy which saw interest rates plummet to near-zero levels as central banks sought to support economies faced with a global pandemic that would eventually cripple the global economy. Major central bankers led the way with some of the most aggressive rate cuts in history as economic activity ground to a halt, countries were closed off and restrictions were placed on business activity. It was only until the first half of 2022 that economies began their slow recovery from unparalleled economic losses with the worst of the pandemic behind. This resulted in a surge in demand, created global supply disruptions and an exorbitant rise in shipping costs, which all pushed inflation higher. Russia’s invasion of Ukraine in February 2022 also caused significantly higher commodity prices – specifically for food and energy.

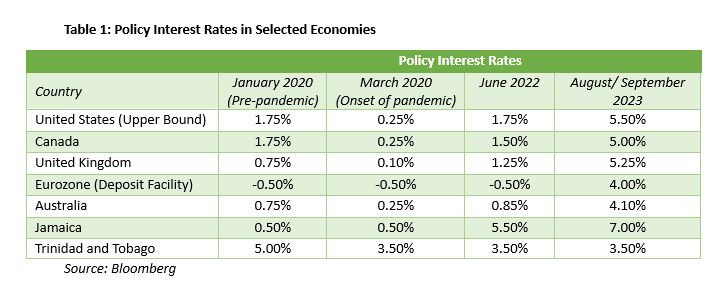

By the end of the first half of 2022, many economies were running inflation rates that were well above their target. As such, interest rates began to cautiously rise to combat what was initially believed to be ‘transitory’ inflationary pressures. However, stubbornly high, and persistently increasing prices forced monetary policymakers to quickly adjust their stance to one that was more aggressive, with historic hikes implemented consecutively. Table 1 shows the benchmark interest rate movements for some of the major economies of the world.

During September 2023, some monetary authorities shifted rhetoric to a more cautious tone and markets are now expecting a less aggressive and, in some cases, more balanced approach to interest rates. For example, after hiking rates consistently since December 2021, the Bank of England maintained its bank rate at 5.25% at its September 2023 meeting as inflation finally cooled to 6.7% from a year-to-date average of 8.9%, albeit still well above the 2% target rate. Similarly, the US Federal Reserve left unchanged its Fed Funds rate within a range of 5.25% – 5.50% but indicated that rates are likely to stay higher for longer than initially anticipated. The Fed also indicated (via the Fed’s Dot Plot) that one more rate hike may be possible before the end of the year and that fewer than expected cuts are likely next year. While US inflation has been moderating (3.7% in the 12 months to August 2023), it remains above the Fed’s target of 2%. In the Eurozone, the European Central Bank (ECB) raised its key interest rate for the tenth straight time to 4% and while average inflation for 2023 is projected to remain elevated at 5.6%, the ECB noted that September 2023’s hike may be the last for now. The Bank of Jamaica implemented a series of rate hikes since August 2021 when it moved from 0.5% to 7% in November 2022 – it has since remained at this level amid the disinflationary trend and resilient economic growth.

Domestic Economic and Financial Conditions

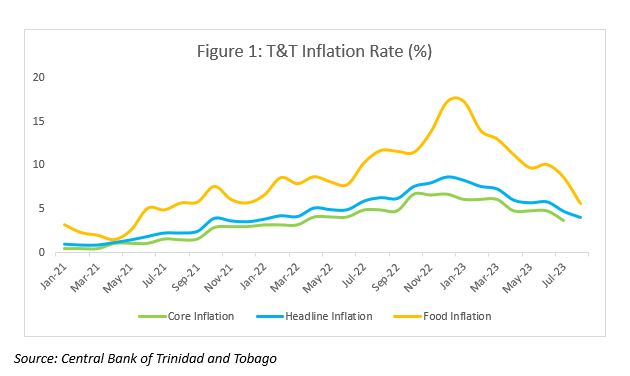

Trinidad and Tobago’s (T&T) inflation rate also experienced an uptick in line with global trends, from 0.9% in January 2021, steadily increasing to a peak of 8.7% in December 2022. Core inflation, which removes the volatility of food and energy prices and is a better indication of underlying inflationary pressures in an economy, also increased from 0.5% to 6.7% over the same period. Likewise, food prices experienced a significant upward trend from 3.2% to 17.3%. Since 2023, however, all measures of inflation have decelerated, indicating slower price increases. Indeed, up to July 2023, headline inflation stood at 4.7%, core inflation at 3.7% and food price inflation was at 8.6% and there were further signs of slowing in August when headline fell to 4% and food to 5.6%.

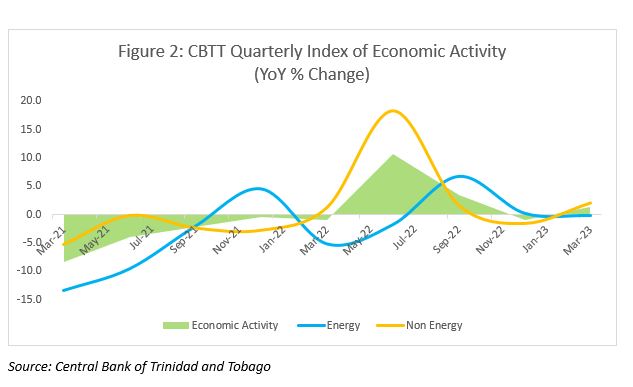

At the same time, economic activity in T&T has been slowly recovering. According to the Central Statistical Office (CSO), GDP at constant prices expanded at a 3% pace during the first quarter of 2023 year-on-year (YoY), however on a quarter-on-quarter (QoQ) basis, GDP contracted by 4%. Based on the Central Bank of Trinidad and Tobago’s (CBTT) Quarterly Index of Economic Activity, during the first quarter, overall economic activity increased 1.6% (QoQ) and 1.3% (YoY), however, the energy sector continued to lag, contracting 1.2% (QoQ) and 0.1% (YoY). There have been encouraging signs in the non-energy sector, which has posted growth of 2.5% (QoQ) and 2.1% (YoY) during the first quarter.

Liquidity in the domestic financial system remains sufficient and has averaged around TTD6.3 billion as measured by commercial banks average excess reserves, in 2023 up to August, compared to an average of TTD4.9 billion for all of 2022. Credit demand has also improved, supported by growth in both consumer loans and real estate lending. Positively, credit to businesses continues to expand – all encouraging signs that activity in the non-energy sector is picking up.

Steady Repo Rate…

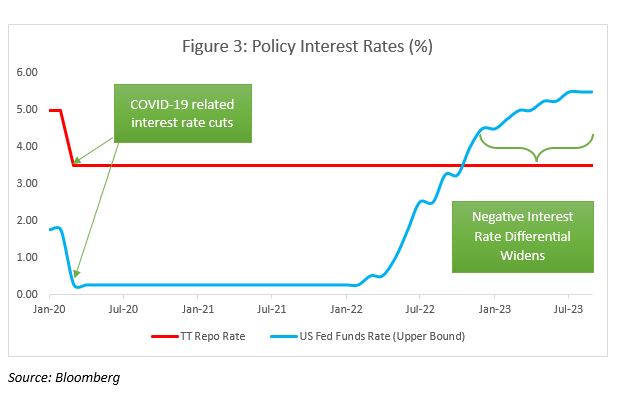

In March 2020, the CBTT slashed the benchmark repo rate, which is the rate that the Central Bank charges commercial banks for borrowing funds on an overnight basis. Therefore, adjustments to the repo rate are intended to signal changes in short-term interest rates and ultimately, the entire interest rate structure. The repo rate was cut by 150 basis points as COVID-19 emerged and was intended to support economic activity and bolster credit demand as it made it cheaper to borrow. Since then, the rate has remained unchanged, even as inflation rose, and the economy started to recover. This has been a contentious issue among market players as there is a view that local interest rates should be increased given the synchronized interest rates hikes globally and the impact that can have on the local financial system.

Importantly, the interest rate differential between TTD and USD must be monitored for various reasons. In its June 2023 Monetary Policy Statement, the CBTT’s Monetary Policy Committee indicated that the negative TT/ US interest rate differential is widening. At the end of August 2023, the difference between the TTD 90-day treasury bill and the US 90-day treasury bill stood at 451 basis points. What this simply means is that investors can get 4.51% more on short term US dollar assets compared to TT dollar assets, which will have implications for the country’s external accounts as well as the country’s exchange rate. An increase in the demand for US dollar assets (as investors demand higher yielding US assets) will exert pressure on the TTD exchange rate as demand for US dollar relative to TT dollars will rise. Since the exchange rate is managed, the CBTT will have to intervene in the market to alleviate the imbalances in the foreign exchange market. Year to date, total system FX sales amounted to USD4.2 billion and total purchases amounted to USD3.02 billion, resulting in a deficit of around USD1.2 billion. YTD the CBTT has intervened to the tune of USD837.5 million. This intervention is facilitated by the country’s stock of foreign exchange (FX) reserves, still leaving an implied deficit of approximately USD360 million.

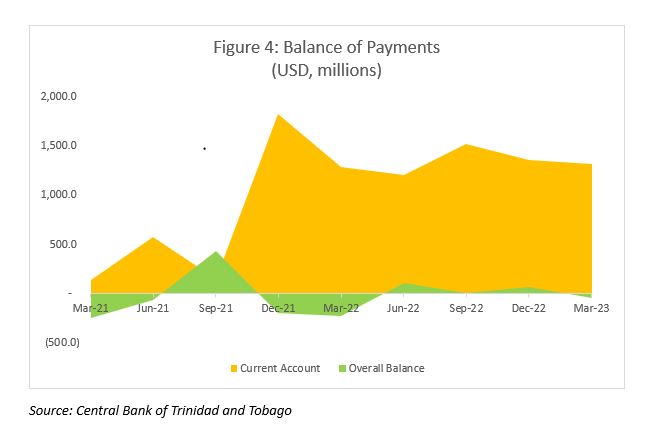

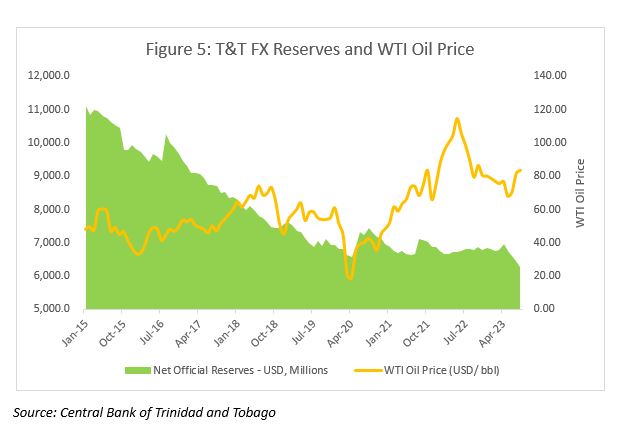

T&T’s FX reserves have been steadily declining over the past seven or eight years or so, coinciding with the crash in oil prices experienced back in 2014/ 2015. At the end of August 2023, reserves stood at USD6.3 billion, down by a significant 8.4% year to date. The rate of decline YTD 2023 considerably exceeds that of the same period in 2022 when FX reserves fell by around 1%. Over the past seven years or so, FX reserves have been on a steady downward trend, falling by around 44% relative to the start of 2015. Despite the erosion in FX reserves over the years, T&T remains a net external creditor and is expected to post external current account surpluses. Since March 2021, the current account has been posting surpluses largely due to high energy prices, which resulted in a an almost 60% increase in energy exports during the period. However, the overall balance of payment has recorded an average deficit of USD18.8 million during that same period, reflective of an average net outflow from the financial account of around USD685.4 million over the period March 2021 – March 2023. These outflows are associated with direct investments and portfolio investment transactions.

Risks to the Outlook

The recent upward trend in energy prices can again stoke global inflationary pressures, which can prompt global central banks to re-evaluate their view on interest rates. This can result in global interest rates either measuredly increasing or remaining higher for longer, which may continue to put pressure on the interest rate differential between T&T and US rates and therefore exacerbate imbalances in foreign exchange market. Heavier intervention by the CBTT to protect the TTD/ USD exchange rate in this instance will likely continue to erode the country’s FX reserves, which is already being challenged by issues in the energy sector – a major contributor to foreign exchange.

The CBTT has the task of determining whether their dovish stance can continue, having to balance a very gradual economic recovery, the ever-present inflationary risks as well as the pressures on the external accounts and the exchange rate due to the large negative interest rate differential. However, the encouraging signs in the non-energy sector, together with the current disinflationary trend domestically, may give the CBTT the flexibility to continue its dovish tone to support the recovery of the non-energy sector. The question really is how sustainable this policy stance, in the context of large foreign exchange imbalances and dwindling FX reserves, is. While a longer-term solution is to stabilize the country’s FX reserves through structural reforms (economic diversification, etc.), ultimately, in the short term, something has got to give in the context of significant divergence in TT and US interest rates – will it be continued erosion of FX reserves or a depreciation of the exchange rate?

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflects our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.