Market Review: First Quarter of 2024

Insights

International Market Review

Global shares continued their upward trajectory in the second quarter of 2024, though at a slower pace, with emerging markets outperforming developed markets. Emerging markets posted superior returns, driven by Asian equity markets, as investor sentiment was boosted by support from Chinese authorities for the real estate sector. However, developed markets were weighed down by the expectation that interest rates may remain elevated for a longer period than anticipated.

US Stocks

After two consecutive quarters of double-digit growth, the momentum in US stocks slowed in Q2 2024, with a return of 3.92%, down from 10.16% in the previous quarter. The slowdown was also evident in the Dow Jones Industrial Average, which fell by 1.73% following a 5.62% gain in Q1 2024. The technology sector continued to benefit from optimism surrounding artificial intelligence (AI), reflected in the strong performance of the Nasdaq Composite Index, which rose 8.6% in Q2 2024, slightly down from 9.11% in Q1 2024.

The pullback in US equities was driven by persistent inflation and resilient economic data, leading investors to expect a slower pace of rate cuts. Although inflationary pressures in the US have cooled, it remain above the Federal Reserve’s (Fed) 2% target. The Personal Consumption Expenditure (PCE) Index, the Fed’s preferred inflation gauge, fell slightly to 2.6% in May 2024 from 2.7% in April and March. Furthermore, the US economy has maintained solid growth despite the elevated interest rate environment, expanding by 2.9% year-on-year in Q1 2024, slightly below the 3.1% growth in Q4 2023.

In terms of market capitalization, small and mid-cap stocks underperformed their larger counterparts in Q2 2024, with losses of 3.55% and 3.82%, respectively. Smaller companies, with their weaker balance sheets, are more vulnerable to the prolonged high-interest rate environment.

Europe and the United Kingdom

European stocks were negatively impacted by political uncertainties following gains by right-wing and far-right parties in the European Union (EU) Parliamentary Elections. This shift has created turmoil in Europe, potentially leading to significant changes in policies, economic approaches and the social climate, as these parties often favor protectionist policies, strict immigration controls, and oppose liberal and progressive policies.

The aftershocks of the election reverberated strongly in France and Germany as both leaders suffered defeat. In France, a coalition including President Emmanuel Macron’s Renaissance Party garnered just 14.6% of the vote while the far-right National Rally, which campaigned on an anti-immigration ticket, won 31.3% of the vote. The results prompted Macron to immediately dissolve the French Parliament and call a snap election. Consequently, volatility in stock markets increased significantly, resulting in both the CAC 40 and the German DAX stock indices to decline by 8.85% and 1.39% respectively in Q2 2024.

In contrast, improved economic performance in the UK supported stocks, with the FTSE index posting a gain of 2.66% in Q2 2024. After entering a technical recession in Q4 2023, with GDP falling by 0.30% following a 0.10% contraction in Q3 2023, the UK economy rebounded in Q1 2024, expanding by 0.30%. A recession is defined as two successive quarterly declines in gross domestic product.

Emerging Markets

Emerging equity markets began outperforming in mid-April 2024 and continued throughout the quarter, with the MSCI Emerging Markets index posting a return of 4.13% from April to June 2024. This equity rally was supported by several factors, including earlier-than-expected policy measures in China aimed at stabilizing the property sector. Additionally, the rally was bolstered by ongoing high interest in artificial intelligence developments, as Asian companies that supply chips for various AI technologies achieved strong gains over the quarter.

International Stock Indices Performance (Local Currency Returns)

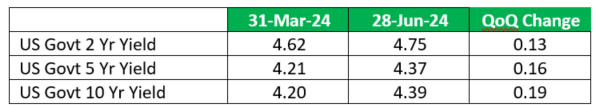

US Treasury Yields

US Treasury yields continued to rise in Q2 2024 as the market adjusted to the prospect of higher interest rates for a longer period. At the May 2024 Federal Open Market Committee (FOMC) meeting, the Fed made it clear that interest rates would remain at current levels because inflation is taking longer than expected to reach the Fed’s target. Consequently, investors reduced their expectations for the number of rate cuts in 2024 from three to one, keeping Treasury yields elevated.

US Sector Performance

From a sector perspective, five out of eleven sectors posted positive returns in Q2 2024, with two of those sectors outperforming the S&P 500 index. The Information Technology sector led the way as it increased by 13.61%, followed by Telecommunications with a gain of 9.11%.

US Sector Performance: Q2 2024

Local Market Review

The local stock market maintained its downward trend in the second quarter of 2024, led by losses in the cross listed stocks. The Cross Listed Index declined by 9.27% in Q2 2024 compared to a loss of 1.75% in Q1 2024 and the All T&T Index registered a loss of 4.85% versus a loss of 1.20% in the prior quarter.

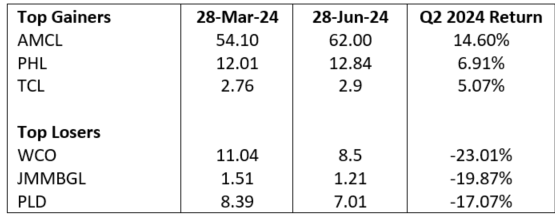

The stocks with the largest share price gains over the second quarter of 2024 were Ansa McAl Ltd (AMCL), Prestige Holdings (PHL), and Trinidad Cement Limited (TCL) as their respective share prices increased by 14.60%, 6.91% and 5.07% respectively. Leading the declines were West Indies Tobacco Company (WCO), JMMBGL and Plipdeco (PLD) as their share prices fell by 23.01%, 19.87% and 17.07% respectively.

Local Stock Indices Performance

Top Gainers and Losers

Equity Markets Outlook

In the second half of 2024, equity markets are expected to be positively impacted by lower interest rates and increased economic activity in China following policy support. As inflationary pressures ease, central banks would have room to start cutting key interest rates, a move much anticipated by investors. At its May 2024 meeting, the Swedish Riksbank implemented its first rate cut since 2016, followed by the European Central Bank (ECB) in June.

China’s economy is expected to benefit from the government’s more active role in the property market. The government announced several measures to stabilize the housing market, including further lowering down-payment requirements and setting up funding support to help reduce existing inventory. Additionally, both Moody’s and the International Monetary Fund (IMF) revised their 2024 economic growth forecasts for China upwards.

Despite this optimistic outlook, political dynamics are expected to remain significant for the rest of the year due to the numerous elections scheduled for the latter half of 2024. By staying informed, diversifying investments, and maintaining a long-term perspective, investors can position themselves to capitalize on favorable market conditions while mitigating risks. Careful portfolio management and a balanced approach will be key to navigating the challenges and opportunities that lie ahead.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.