Waiting to ExhaleThe Trinidad and Tobago Economy

Insights

In the recently concluded Budget presentation for the new fiscal year, which runs from 1 October 2024 – 30 September 2025 for Trinidad and Tobago (T&T), the Minister of Finance outlined the many achievements over the past years, and the economic strides made in the post-pandemic period. The somewhat favorable picture painted is not without significant risks, emanating from both the external economy as well as domestic challenges. The T&T economy is in a state of flux as the energy sector continues to face several challenges, including declining production levels domestically as well as increased price volatility caused by global conditions. On the positive side, the non-energy sector has rebounded commendably and has been able to support overall activity, but the sectors’ prospects may be constrained by the ongoing foreign exchange issue. Further, there are the inherent concerns about safety and security, which negatively impact business and investor confidence. The promise of brighter days ahead – specifically beyond the second quarter of 2027, is predominantly hinged on the cross-border gas deals which are expected to boost domestic energy sector production levels. Until then though, there is much uncertainty regarding the outlook for the economy, especially in the context of a dynamic global economy and heightened geopolitical tensions.

Recent Economic Performance

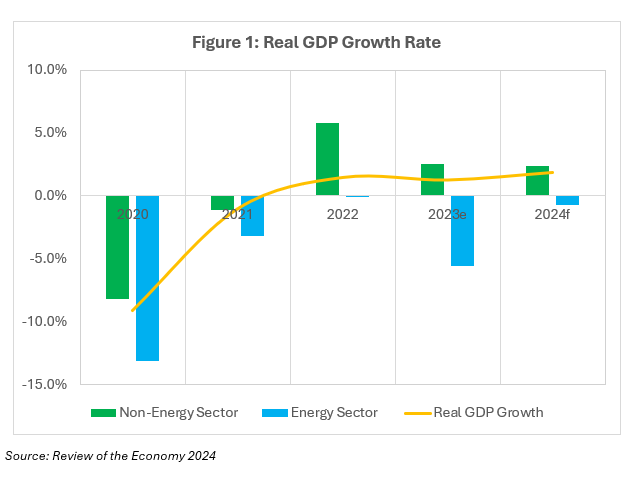

In the budget presentation, the Minister highlighted that the T&T economy has been able to achieve three consecutive years of positive economic growth since 2022, averaging 1.6% during the period 2022-2024, largely driven by the strong performance of the non-energy sector. According to the Review of the Economy 2024, economic growth is forecasted to reach 1.9% in 2024, with the non-energy sector growing by 2.4%, enough to outweigh the 0.7% decline in the energy sector. This compares to estimates for 2023 which show economic growth of 1.3%, which was driven by 2.5% growth in non-energy and a sharp contraction of 5.6% in the energy sector.

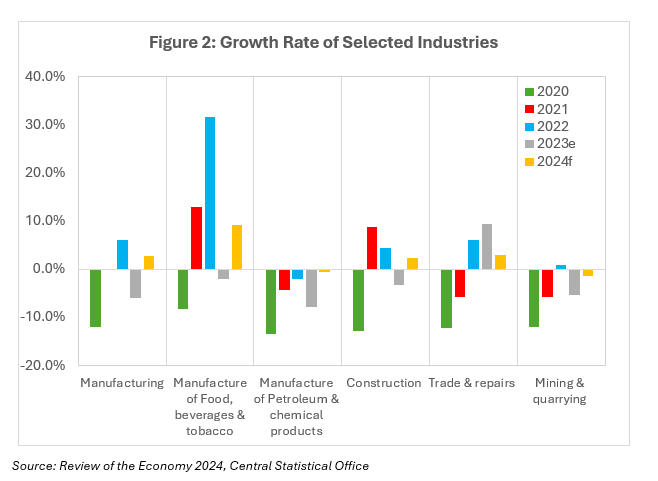

Over the period 2022-2024, the ‘trade and repairs’ industry which has contributed an average of 23.8% of GDP, averaged growth of 6.1%, while transport and storage has grown by an average of 12% but has contributed just over 3% of GDP. The vital manufacturing sector, which accounted for approximately 16.4% of GDP during 2022-2024, rebounded in 2022, registering growth of 6.1%, however, these gains were eroded in 2023, given that during the first three quarters of 2023, the sector contracted by an average of 5.5%, and for the full year 2023, it is estimated to have declined by 6.1%. For 2024, manufacturing activity is expected to have increased, driven by the food and beverages subsector, which is expected to expand by 9.1%, boosting manufacturing output growth to 2.7% for full year 2024. The manufacture of petroleum and chemical products, which is categorized as manufacturing sector activity, rather than energy sector, remains in the doldrums, estimated to have contracted by 3.5% during 2022-2024, while contributing approximately 10% of GDP.

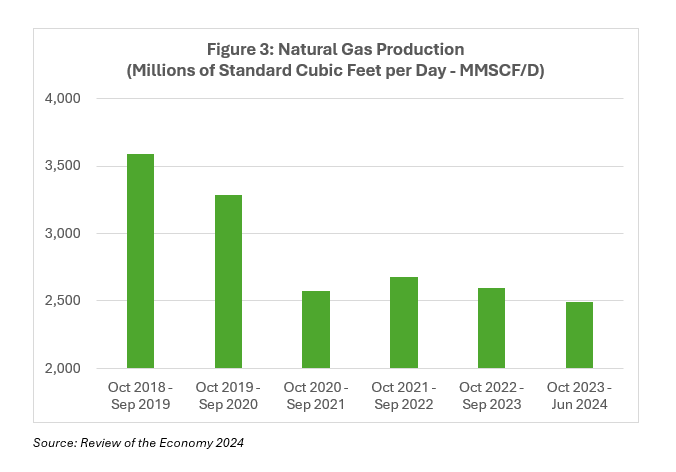

In the energy sector, natural gas production has remained constrained, averaging just around 2,596.8 mmscf/d[1] during FY 2022 up to June 2024.

There have been several discussions with major upstream producers including BPTT and EOG Resources to help shore up production in the medium term. Moreover, ongoing discussions include the cross-border initiative with the Government of Venezuela regarding the Dragon Field gas field, Shell’s Manatee project as part of the cross-border Loran Manatee fields and the Cocuina- Manakin cross-border development. In September 2023, a 30-year agreement with Venezuela was signed to develop the Dragon Gas Field and further, in May 2024, a second OFAC[2] license was awarded to the T&T government to continue work on the Cocuina-Manakin gas field which contains at least one trillion cubic feet of proven gas. In July 2024, Shell Trinidad and Tobago Limited announced a final investment decision on the Manatee Project, which is expected to start production in 2027. The budget also mentioned several projects anticipated to deliver new gas supplies in fiscal 2025, including BPTT’s Cypre project (March 2025) and the join venture between EOG and BPTT projected to deliver first gas in February 2025. In August 2025, Touchstone Exploration plans to introduce production from two new wells as well.

Fiscal Operations

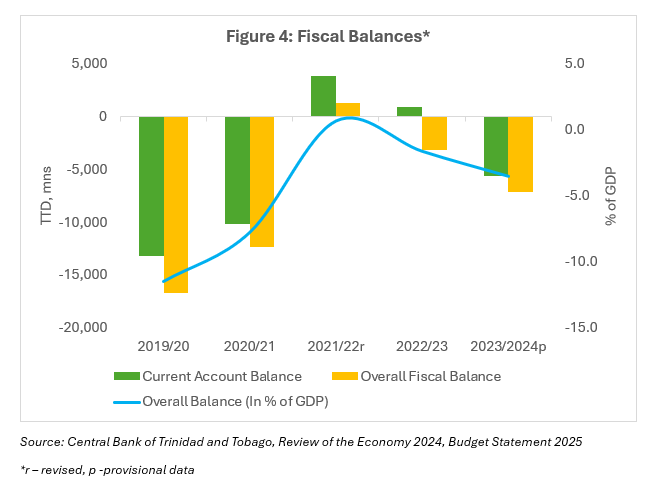

The T&T fiscal accounts have reflected the volatility of the global energy markets as well as the weaker domestic production levels over the past few years. Over the past ten years, the shortfall on the overall fiscal account has averaged 4.5% of GDP, with the only year of surplus in 2021/ 2022, when energy prices rose sharply due to geopolitical conditions globally.

During FY 2024, the government collected less than expected energy revenues, which worsened the fiscal deficit to 3.5% of GDP from 1.7% of GDP recorded in FY 2023. The energy price assumptions which started the fiscal year at USD85/ barrel for oil and USD5.00/ mmbtu for natural gas were subsequently revised downwards at the mid-year review to result in total revenue of TTD51 billion – 5.6% below initial estimates, based on a new projected oil price of USD80.25/ barrel and USD3.87/ mmbtu for gas. At the same time, the expenditure estimates rose by 2.3% at the mid-year review relative to what was initially budgeted – the result was an adjusted overall fiscal deficit of TTD9.6 billion, significantly higher than the initial budget of TTD5.2 billion.

FY 2024 ended with a provisional overall deficit of TTD7.1 billion, largely because of a containment in total expenditure, which was 5.1% lower than the adjusted mid-year estimate. On the expenditure side, transfers and subsidies, which have averaged approximately 60% of current expenditure in the last five years, fell moderately by 5.8% relative to FY2023. Spending on goods and services also declined by 3.5% during FY2024. Countering these declines were increases in outlays for wages and salaries and interest payments, which rose 11.2% and 8.1% respectively. Energy revenue was significantly eroded in FY 2024, with provisional data showing that it fell approximately 50% below that of FY2023 to around TTD14.7 billion.

The total general government debt is estimated to have increased by 1.2% in FY2024, reflecting an increase in the net effect of principal repayments, disbursements and issuances of new financing. This represents around 77% of GDP, an increase from 74.8% of GDP in FY2023. The adjusted general government debt, which excludes borrowings for open market operations (OMOs), was estimated at 75.6% of GDP, up from 72.1% in FY2023. Of this, domestic debt accounts for the vast majority of adjusted general government dent of 73.9% and represents around 55.9% of GDP.

During the fiscal year, the government issued eleven bonds on the domestic capital market totaling TTD8.1 billion – two of which were used for refinancing purposes in the amount of TTD2.2 billion. The remaining nine bonds, which totaled TTD5.9 billion were issued for budgetary support.

Notably, debt management bills issued for the purpose of budgetary support accounted for 8.6% of central government domestic debt and 4.5% of adjusted general government debt. This is expected to decline to TTD6.4 at the end of FY2024 from TTD6.6 billion in FY2023.

External Accounts

Data available for January – March 2024 show that the balance of payments deficit widened to USD736.1 million from USD47.8 million in the same period of 2023. The position resulted from a significantly lower current account surplus of USD470.5 million, a 65% decline relative to the corresponding 2023 period. Driving this performance was a 22% contraction in energy exports to just under USD2 billion from USD2.5 billion a year earlier. Gas and petrochemical exports fell by 38.6% and 25.4% respectively during the period. Adding to the pressure on the current account was a drop of 7.2% in non-energy exports as well. Further fueling the lower current account surplus was a 31.8% increase in imports. The overall balance of payment was also negatively impacted by lower net outflows on the financial account. These combined effects resulted in gross official reserves of USD5.5 billion at the end of the March 2024 period.

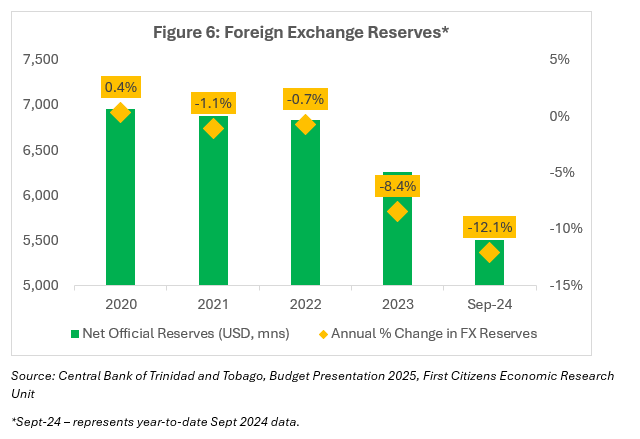

Since then, the country’s net official reserve position has fluctuated, reaching a high of USD5.98 billion in June 2024, following the issuance of the 10-year Eurobond on 26 June 2024. However, the general trend is down, ending September 2024 at USD5.5 billion or 7.7 months of import cover. From a historical context, FX reserves have been steadily declining, reflecting the weaker energy sector. Since January 2019, reserves have fallen by around 28%. Figure 6 shows the annual change in net official reserves since 2020, with the steepest declines in 2023 and for the year-to-date period up to September 2024.

Contributing to the strength of the country’s external position is the Heritage and Stabilization Fund (HSF) which stood at USD6.1 billion at the end of September 2024.

Risks and Outlook

The Budget that was presented can be described as expansionary, given the budgeted overall deficit of 2.91% of GDP in FY2025 or a shortfall of TTD5.5 billion. There are several projects that have been outlined to support government revenue, including divestment of state assets, including CLICO, the Point a Pierre Refinery and Magdalena Grand Hotel. The budget envisages a 7.7% increase in total revenue and grants, notwithstanding a 3.9% decline in energy revenue. Expenditure is budgeted to increase by 3.9% relative to FY2024.

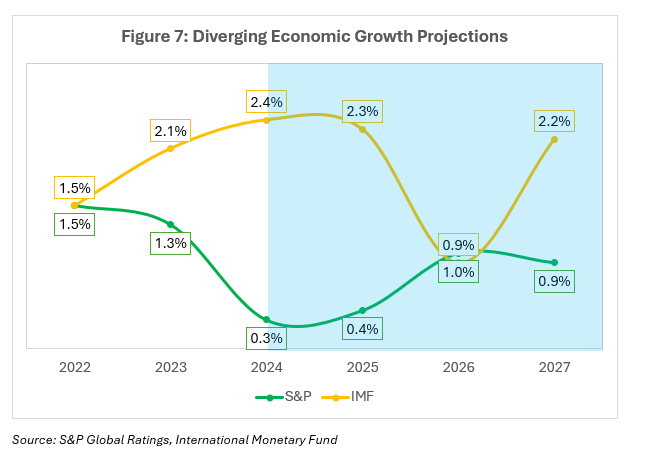

There are diverging perspectives on the outlook for the T&T economy, with projections by different institutions varying by wide margins, especially in the short term. In its June 2024 Article IV Consultation report on T&T, the International Monetary Fund (IMF) projected that the T&T economy will grow by 2.4% in 2024 and 2.3% in 2025, driven by growth in both the energy and non-energy sectors. S&P Global Ratings remains much more conservative with projected real GDP growth of 0.3% and 0.4% in the same period.

In September 2024, S&P affirmed T&T’s credit rating at BBB- with a stable outlook, based on stable institutions and still-strong external assets while the stable outlook reflects their expectation that ‘economic, fiscal and debt metrics will stabilize near current levels over the next two years before improving when major new gas fields come online’. However, economic growth is expected to remain weak in the near term due to declining hydrocarbon production and this will likely contribute to fiscal deficits and rising debt.

The economic outlook for T&T is almost wholly contingent on the energy projects that have been highlighted, which are expected to increase energy production after 2026. However, short-term risks remain relatively high, especially in the context of weakened energy sector performance, which will adversely impact overall economic activity, government revenue and external liquidity through the continued erosion on foreign exchange reserves. The consequences of continued imbalances on the foreign exchange market will also negatively affect the non-energy sector, due to difficulties in accessing US dollars.

From a fiscal sustainability perspective, there is need for alignment in the government operations – and while an expansionary budget may be necessary at this point to spur economic growth, especially in the non-energy sectors, it is imperative that a medium-term fiscal strategy be formulated. This will help in achieving some level of fiscal responsibility and accountability as well as to devise a strategy to curtail the rising debt trend of the past years and to sustainably start reducing the debt load.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.

[1] MMSCF/ D – Millions of standard cubic feet per day

[2] Office of Foreign Assets Control (OFAC) of the US Department of the Treasury