Impact of Inflation on Stock Markets

Insights

Inflation, the rate at which prices for goods and services rise over time, has a significant influence on financial markets. It reduces the purchasing power of money, creating ripple effects across the economy that shape investment decisions and market performance. Stocks and bonds, in particular, are impacted by inflation, as it can erode real returns—the actual earnings on an investment after adjusting for rising prices. Understanding how inflation affects these assets is essential for managing investment portfolios effectively, as it guides financial planning and helps investors adapt their strategies to preserve value and achieve their goals.

Inflation and Stock Prices

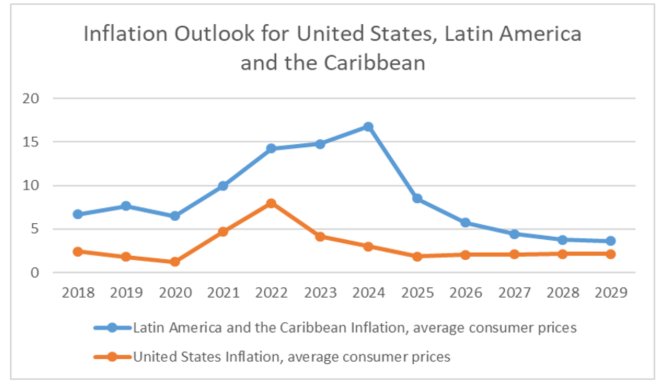

Figure 1: Inflation Outlook for the US, Latin America and the Caribbean (In %)

Stocks represent ownership in a company and offer returns in two main ways: capital gains and dividends. Capital gains occur when the value of a stock increases over time. For example, if an investor buys a stock for $50 and later sells it for $70, their capital gain is $20. This profit reflects the increase in the stock’s price, which can result from the company’s growth, improved performance, or higher demand for its shares. Dividends, on the other hand, are payments made by a company to its shareholders as a way to share its profits. Not all companies pay dividends, but those that do often distribute them regularly, such as quarterly or annually. For instance, if a company declares a dividend of $2 per share and an investor owns 100 shares, they will receive $200 in dividend income.

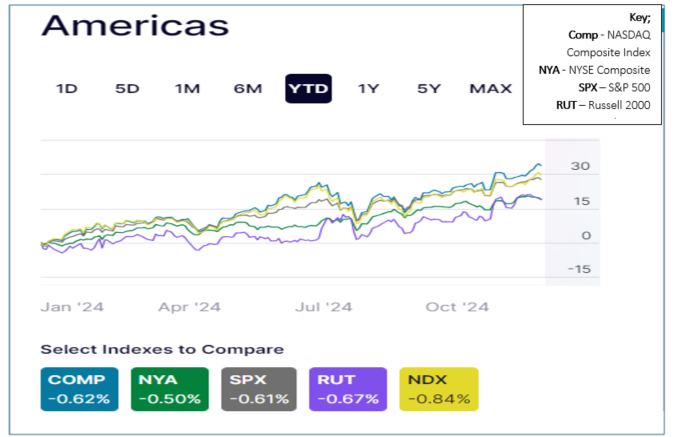

Figure 2: Top Indices in the United States

a) General Impact

Inflation can significantly affect stocks and their prices by influencing the behavior of investors, companies, and markets. When inflation rises, it increases the costs of production and operations by driving up prices for essential inputs like raw materials, labor, and energy—a phenomenon known as cost-push inflation. This occurs when production expenses rise without a corresponding increase in demand for goods and services. To cope with these higher costs, companies often raise the prices of their products to maintain profit margins. However, this can lead to reduced consumer spending, particularly on non-essential items, as households adjust their budgets to manage rising prices. Consequently, businesses that depend heavily on discretionary spending may see a drop in revenues, negatively impacting their profitability. When investors anticipate that a company’s earnings and dividends will decline due to these pressures, they may decide to sell their shares before prices fall further.

Additionally, rising inflation typically prompts central banks to increase interest rates to control price growth. Higher interest rates make borrowing more expensive, which can limit a company’s ability to secure credit for growth initiatives or manage existing debt and daily operations. This financial strain can slow business growth and reduce profitability. As a result, investors may lower their expectations for future earnings, leading to a decline in stock prices.

Inflation also tends to increase volatility in financial markets. When central banks adopt tighter monetary policies to combat inflation, economic growth can slow down, creating uncertainty. Investors may react not only to current inflation data but also to expectations about future trends and monetary policy changes. This speculative behavior can lead to rapid price movements as traders buy or sell based on news releases or economic indicators related to inflation, resulting in heightened trading activity and volatility.

Moreover, rising inflation can significantly impact investor sentiment. High inflation often raises fears of economic instability, causing investors to become more risk averse. This shift can lead to flight to safety, where investors move their capital from stocks into safer assets like bonds or cash equivalents. Such reallocations can trigger sudden sell-offs in the stock market, contributing to increased volatility as prices adjust to changing demand.

b) Value vs Growth Stocks

Inflation can also have diverse effects on the different stock types. There are essentially two types of stocks – value stocks and growth stocks. Value stocks are shares of companies that are priced lower than their true worth, based on their financial performance. These companies typically have strong fundamentals, like solid cash flows, steady dividends, and stable business models, but may be undervalued by the market due to temporary challenges or negative perceptions. Value stocks are often established companies with steady revenue and profits. These businesses typically generate consistent cash flow, which makes them more resilient during inflationary periods when costs are rising.

In contrast, growth stocks are shares in companies that are expected to grow at a significantly faster rate than the overall market or their industry peers, often in innovative sectors like technology, health care and consumer goods. These companies prioritize reinvesting earnings to fuel rapid expansion, and often do not pay dividends like growth stocks, resulting in impressive revenue and profit growth over time. Growth stocks often struggle during periods of rising inflation. As these companies expand quickly, the increased costs associated with inflation can make it more expensive for them to operate, making it harder to maintain profit margins. With potential profits under pressure, these companies may experience slower growth, which can dampen investor enthusiasm.

c) Large, Mid and Small Cap Stocks

Companies are often categorized based on their market capitalization, which is the total value of their outstanding shares in the stock market. There are three (3) categories based on market capitalization – Large-cap, mid-cap and small-cap. Large-cap companies are the biggest companies in the stock market, typically with a market capitalization of USD10 billion or more. These companies are well-established, usually leaders in their industries and have a history of steady growth and strong earnings. Mid-cap companies are medium-sized companies, with a market capitalization typically between USD2 billion and USD10 billion. Such companies are in the growth phase of their business and have the potential to become large-cap companies in the future. Small-cap companies are smaller companies with a market capitalization typically under USD2 billion and usually comprise new startups or businesses in niche markets.

In a rising inflation environment, large-cap companies generally perform better because they have the resources and market dominance to manage higher costs. These companies often enjoy pricing power, enabling them to pass on increased costs to consumers without significantly reducing demand for their products or services. This resilience makes large-cap stocks more stable during inflationary periods. However, rising inflation often leads to higher interest rates, which can increase borrowing costs and potentially slow growth, causing volatility in their stock prices.

Mid-cap companies, being in their growth phase, are more vulnerable to inflationary pressures. These firms typically reinvest most of their earnings back into the business and lack the financial reserves or market leverage of their larger counterparts. This makes it harder for them to absorb rising costs or negotiate favourable terms with suppliers. Moreover, mid-cap companies often rely on borrowing to fund expansion, and higher interest rates resulting from inflation make loans more expensive. This can limit their ability to grow or cover operational expenses effectively.

Small-cap companies face the greatest challenges during periods of rising inflation. These firms generally lack the financial strength and market influence of larger businesses, leaving them less equipped to handle increased costs or transfer them to consumers. Small-cap companies also tend to rely heavily on borrowing to finance their operations, and higher interest rates make this borrowing costlier. Additionally, their revenues often come from niche or localized markets, which may not provide the diversification needed to withstand inflation’s effects. As a result, small-cap stocks are seen as riskier during inflationary periods, leading investors to favor the stability of larger firms.

Figure 3: Returns: Large Cap and Small Cap Indices

Outlook

The possibility of inflation rising again looms given US President Trump’s proposed trade tariffs, including a baseline 10% tariff on imports and significantly higher rates on goods from China. These measures could drive up the cost of imported goods, fuelling inflation as businesses pass higher costs onto consumers. To navigate this environment, investors should consider positioning their portfolios to weather inflationary pressures by focusing on sectors that historically perform well in such environments, such as energy, consumer staples, and financials. Diversifying geographically to markets less impacted by the tariffs and reducing exposure to growth and small-cap stocks, may also help mitigate risks and potentially limit downside volatility.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.