Credit Card Customer Support

Welcome to our Credit Card Support page. We’re here to help you with any questions or issues you may have regarding your credit card. Below you’ll find answers to common questions, helpful tips, and contact information for further assistance.

How can I view or download my eStatements?

eStatements can be viewed or downloaded via Online Banking.

Click Here to learn more.

How do I understand my payment cycle?

Depending on your product type, the credit card statement will refresh on either the 10th, 13th or 16th monthly

Click Here to learn more.

How to understand my fees and charges?

For a full listing of our Credit Cards fees & charges.

Click Here to learn more.

How to address a declined transaction?

1. Ensure that your card is activated

2. Check your balance

3. Use your email notifications

4. Report Suspicious activity

5. Minimize wear and tear

Click Here to learn more.

Credit Card Support Videos

Credit Card FAQs

General Credit Card FAQs

What are the requirements for a Credit Card?

Credit Card Application Checklist

Scan and upload the following documents via the Online Credit Card Application Portal

- Salary slip, not more than 1 month old

- Two (2) forms of valid identification

- Proof of Address not older than 3 months* (bank statements can be provided as a proof of address)

- Job Letter addressed to First Citizens not older than 3 months old

- Politically Exposed Persons (P.E.P) Declaration for Individual Form – This is your declaration on if you are a Politically Exposed Person (PEP), which the Bank needs to know, in line with the Proceeds of Crime Act 2000 (as amended) and the Financial Obligations (Amendment) Regulations 2014, Regulations 20(3). Definitions on who qualifies as a PEP is provided on the form

- Customer Declaration – This form provides the Bank with the customer’s declaration on if he/she has any tax obligations in any jurisdiction outside of Trinidad and Trinidad. This is in line with the Tax Information Exchange Agreements (United States of America) Act 2017

- Credit Card Standing Order Form – This form allows you to easily make arrangements so that your credit card payments are automatically kept up to date via standing order options which suits you.

- Note: *If the proof of address e.g. utility bill, is not in your name, a letter of authorization from the person in whose name the bill is in should be provided, along with a copy of a valid ID of the said individual.

- ** Co-applicants must be a minimum 16 years and one form of valid identification is required

For any questions, please contact us via any of the options below:

- Chat with us via WebChat

- Email us at: cardsales@firstcitizenstt.com

How can I obtain my Credit Card statement balance due?

You can obtain your Credit Card statement balance due via:

- Monthly Credit Card statement

- Online Banking

- Telebanking

- Mobile App

What is my Credit Card statement date and when is my payment due?

Please refer to Table I below:

Table I

| Card Type | Statement Date | Payment Due Date | Minimum Balance Calculation |

| Visa Tertiary | 10th monthly | 30th of the same month | 1/24 of the outstanding balance as at the statement date |

| Visa Classic | 13th monthly | 2nd of the following month | 1/24 of the outstanding balance as at the statement date |

| Visa Purple | 13th monthly | 2nd of the following month | 1/24 of the outstanding balance as at the statement date |

| Visa 2 In 1 | 13th monthly | 2nd of the following month | Full Payment: total balance as at the statement date Minimum Payment: loan installment plus 1/24 of the outstanding balance as at the statement date |

| Vacation Lifestyle Mastercard | 13th monthly | 2nd of the following month | 1/25 of the outstanding balance as at the statement date |

| Vacation Lifestyle MasterCard Gold | 16th monthly | 5th of the following month | 1/30 of the outstanding balance as at the statement date |

| Visa Gold, Platinum Signature and Infinite | 16th monthly | 5th of the following month | 1/30 of the outstanding balance as at the statement date |

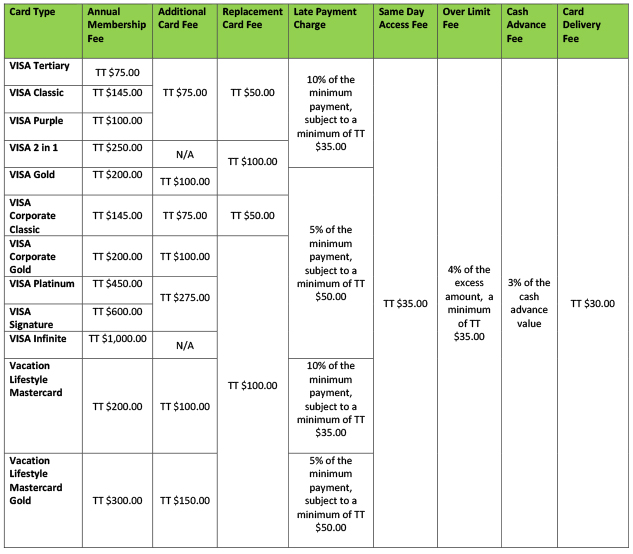

What are the fees and charges associated with my First Citizens Credit Card?

Please refer to Table II for the fees and charges associated with your First Citizens Credit Card:

Table II

How to address a declined transaction?

1. Ensure that your card is activated – Use the Mobile Application to self-activate if your card was recently received

2. Check your balance – Check Your “Real time available to spend” balance using Online Banking or the Mobile application

3. Use your email notifications – Verify the status of the transaction, including balances as you transact

4. Minimize wear and tear – Protect your chip by securing your physical card

5. Report Suspicious activity – You play a critical role in minimizing fraud. When a suspicious transaction is seen

How can I obtain my real time Credit Card available balance?

You can obtain your real time available balance via Online Banking, the Mobile App or the ATM

How can I make a Credit Card payment?

You can make a Credit Card payment via:

- Online Banking

- Telebanking

- Mobile Banking App

- ATM

- Fast Deposit Boxes located in any conveniently located First Citizens Branch

- A Standing Order from your First Citizens account or another Bank’s account

How soon do I have access to funds paid to my Credit Card?

You will have immediate access to funds on your Credit Card, once transferred from your First Citizens account to your Credit Card via First Citizens Online Banking, the Mobile App or Telebanking.

Please note:

- Payments made on Monday – Thursday by 3:00 pm or Friday by 4:15 pm are updated the same night

- Payments made on Fridays after 4:15 pm, will be credited to your Credit Card on Monday night

- Payments made on public holidays will be credited the night of the next business day

What Credit Card Reward programmes are offered?

There are two main Credit Card Reward programmes currently offered:

Is there insurance coverage with my Credit Card?

International Emergency Medical Services and World Wide Auto Rental Insurance are offered to Visa Platinum, Signature and Infinite Credit Cardholders.

Please click here for further information

When my Credit Card expires, how will I receive my renewed card?

Your renewed Credit Card will be directly delivered to you via TTPOST Couriers (TrackPak) to your mailing address currently on record at First Citizens. Please note, a delivery cost of TT $30.00 will be charged to your Credit Card.

What is the Foreign Currency Limit on my Credit Card?

The Foreign Limit varies for each card type, please refer to Table III for further information.

Table III

| Credit Card | USD Limit |

| Visa Tertiary | $2,000 |

| Visa 2 in 1 | $2,000 |

| Visa Purple | $2,000 |

| Visa Classic | $5,000 |

| Visa Business Classic | $5,000 |

| Vacation Lifestyle Mastercard | $6,000 |

| Vacation Lifestyle Mastercard Gold | $6,000 |

| Visa Business Gold | $6,000 |

| Visa Signature | $7,000 |

| Visa Gold | $7,500 |

| Visa Platinum | $7,500 |

| Visa Infinite | $8,000 |

How do I set a Standing Order payment to my Credit Card account?

You can log in to Online Banking:

- Click the “Payments” main tab and select “Standard Payee Payments” or

- Send a Secure Message by clicking the “My Messages” main tab and select “Send New Message” requesting a deduction of the minimum or full outstanding balance from your personal account on a specific date (the 28th is recommended).

You can also visit any conveniently located First Citizens Branch and a

Customer Service Representative will assist you.

How do I request a replacement card and/or PIN?

You can request a replacement card or PIN by logging in to Online Banking, click the “My Services” main tab, then select “Credit Card/ PIN Replacement”. Your card will be delivered within seven (7) business days and your PIN will be sent to a First Citizens Branch of your choice for collection. Please note, a delivery cost of TT $30.00 will be charged to your Credit Card.

For customers residing abroad, you can request a replacement card and/or PIN to be delivered by FedEx via Online Banking.

What should I do if my Credit Card is lost or stolen?

You are required to immediately call 62-FIRST (623-4778) to make a report and a new Credit Card will be issued and delivered to your local mailing address. Our Contact Centre is available every day from 6am to 10pm.

If you are abroad, call:

- VISA at 1-800-396-9665 when in the U.S.A /Canada, or in other countries, call 1-303-967-1098

- Mastercard at 1-800-307-7309 when in U.S.A /Canada, or in other countries, call or 1-636-722-7111

Credit Card Chargebacks FAQs

Q1: What is a chargeback?

A chargeback is a claim submitted by a cardholder to dispute the legitimacy of a transaction charged and posted to his/her credit card account.

Q2: What are valid reasons for chargeback?

A transaction can be disputed for any of the following reasons:-

• Goods Not Received

• Duplicate transaction

• Unauthorised (fraudulent)

• Difference In Amounts

• Cash Not Received

• Credit Not Received

• Service Cancelled

• Paid by alternate means

• Service not Received

• Declined but Still Charged

Q3: What should I do if an incorrect amount was charged on my Credit Card or I have not received the goods or service?

Before initiating a claim, attempt to resolve the dispute with the merchant. If you do not receive a refund from the merchant or they are unable to resolve the dispute, you can download, complete, sign and submit the Credit Card Dispute Form via email to Credit.Card_Chargebacks@firstcitizenstt.com. Be sure to include any supporting documents you may have from your contact with the merchant.

Q4: I have noticed an unauthorised transaction on my credit card account. What should I do?

If you notice an unauthorised transaction on your account, you should immediately report this to the Bank to block your card and secure your account. You also have the ability to block your card via the Bank’s Mobile Banking App card services “hotlist’ option. You are then required to complete and submit the dispute form to the Bank.

Q5: How do I submit a chargeback request with the Bank?

To submit a chargeback requestyou must download, complete, sign and submit the Credit Card Dispute Form via email to Credit.Card_Chargebacks@firstcitizenstt.com.

You must provide all relevant requested information and any supporting documents you may have from your contact with the merchant.

Upon receipt, you will receive an acknowledgment email informing you of the estimated timeframe within which the request would be completed.

Q6: What information or documents are needed to file a dispute?

The more information you provide to support your chargeback claim, will assist the Bank to be able to present your claim. In addition to the chargeback form, information in the form of invoices, receipts and evidence of conversations with the merchant e.g. online chat or emails are required.

Q7: How long does the chargeback process take?

According to both Visa and MasterCard Regulations, the process can be completed and the dispute resolved within a minimum of ten (10) weeks to a maximum of six (6) months.

Q8: Who should complete the dispute form?

The dispute form(s) must be completed and signed by the primary cardholder on whose credit card the disputed transaction was observed.

Q9: How long do I have to make a chargeback claim?

Transactions must be disputed within fourteen (14) calendar days from the date after an unfamiliar transaction is noticed. Register for the Bank’s Online and Mobile Banking and email notification alerts to monitor your account in real time.

Q10: What is the maximum number of transactions which can be disputed?

Based on card brand rules, the maximum number of transactions that can be disputed in any given submission is thirty five (35).

Q11: How do I check the status of my chargeback request?

An email can be sent to Credit.Card_Chargebacks@firstcitizenstt.com to inquire on the status of a chargeback request

Q12: Is there a fee for disputing a transaction?

There is no fee for disputing a transaction. However, upon investigation, if the disputed transactions is found to have been conducted by the customer, a fee of TT$50.00 will be applied for every disputed transaction.

Q13: How is the value of the chargeback determined?

The value claimed cannot exceed the value of the original transaction. Where a partial refund has already been made, the chargeback will cover the remaining amount of the original transaction only.

Q14: What is the difference between a chargeback and a refund?

When you make a chargeback claim, the Bank will request a refund from the merchant on your behalf. There is no guarantee that the merchant will agree to the request or that the Bank will be able to recover the money.

With a refund, the merchant accepts responsibility for refunding you directly, without the need to make a claim through the Bank. You should always request a refund from the merchant first before making a chargeback claim.

Q15: When I dispute a transaction will my card be replaced?

Your card will only be blocked and replaced if your dispute is submitted for an unauthorised transaction.

Q16: Can I dispute a Chip & PIN transaction as unauthorised?

No, based on the card brand rules and regulations there are no dispute rights for transactions authorized using the card’s PIN for cards with Chip & PIN technology.

Q17: Who governs the chargeback process?

MasterCard) rules. While there is no guarantee that the Bank will recover the money through the chargeback process, all claims received are assessed and feedback provided by the Bank.

What is the 2 in 1 Credit Card?

The 2 in 1 Credit Card is a credit card with 2 parts: (i) a “loan” facility and (ii) a core credit card facility.

The customer benefits from a lower interest rate and convenient repayment terms on the loan facility; triggered by a purchase amount that falls within the two dollar value ranges stated below.

| Amount Ranges: From – To | Length of Term | Interest Rate % |

| $5,000 – $8,000.99 | 24 months | 15.00 |

| $8,001 – $15,000 | 24 months | 15.50 |

Once a purchase is done for $4,999.99 or less, a 24% interest rate will apply, with normal credit card terms and conditions.

As the customer repays the loan facility, the repaid funds become available for use on the credit card side of the product.

What is the advantage of a 2 in 1 Credit Card?

The 2 in 1 Credit Card gives the customer the greatest convenience to make their aspirational or big ticket purchase, through a lower interest rate and convenient repayment terms, while at the same time getting access to a revolving line of credit.

How can the 2 in 1 Credit Card be used?

This credit card can be used as follows:

– for a single big ticket purchase which falls between $5,000 to $15,000 (mandatory for lower interest rate to apply)

– for normal credit card purchases, at merchants worldwide or online

– for cash advances, at ATMs or at bank branches worldwide

What is the limit range on the 2 in 1 Credit Card?

The minimum limit is TT$5,000 and the maximum limit is TT$15,000.

Who can get a 2 in 1 Credit Card

The facility will be assessed as any other credit card facility. Therefore normal borrowing requirements apply.

What are qualifying criteria for a 2 in 1 Credit Card?

Normal qualifying criteria apply:

– a job letter, not more than 6 months old

– your most recent salary slip

– two (2) forms of identification

– proof of address e.g. utility bill (TSTT, TTEC, WASA)

What costs are associated with the 2 in 1 Credit Card?

– an annual fee of $250.

All other normal credit card fees e.g. over the limit, late charges, will also apply.

Will additional cards be given on the 2 in 1 Credit Card?

Additional cards will not be issued on the 2 in 1 Credit Card product.

How long is the 2 in 1 Credit Card valid for?

The credit card is valid for three years. However the repayment period for the loan facility is 2 years.

Am I required to make a payment monthly?

Yes, once an outstanding balance exists on the account when the credit card statement is generated a payment will be required, payable by the payment due date.

What are the payment options available?

(i) repay the monthly loan installment plus the full balance on the credit card side of the product (defined to be “Payment in Full” and avoids interest charges on the credit card side of the product)

(ii) repay the monthly loan installment plus the minimum payment on the credit card side of the product (defined to be “Minimum Payment” and will pay interest on the credit card side of the product)

Can I pay off the loan facility before the end of the 24 month term?

Yes. The customer will be required to call into the First Citizens 62 FIRST Contact Centre (623-4778 Option 3) to obtain relevant pay off information.

Are rewards offered on the 2 in 1 Credit Card?

Yes, cash back rewards, 0.75% of purchases, is offered on the card.

Will this card be accessible on the Mobile, Online, Telebanking and ATM systems?

Yes, information will be available for this product on the above channels as follows:

Obtaining posted transaction history: Mobile, Online and Telebanking Making payments to card: Online, Telebanking and ATMs

Does this card qualify for VISA sponsored benefits?

Yes, as a sub segment of the VISA Classic product, this card accesses the same benefits e.g Travel Accident Insurance, Emergency Card and Cash Replacement

Please contact your branch or 62-FIRST for further details.

Can I close an existing credit card and transfer the balance to a 2 in 1 Credit Card?

No, balances cannot be transferred to this product.

Cash Back FAQs

How does Cash Back work?

You earn Cash Back for every purchase made with your Credit Card at a rate of 0.80% of the value of each transaction. In the case of corporate Credit Cards, with every international purchase, a rate of 0.40% is earned.

How often can I expect to receive my Cash Back?

Rewards are credited directly to your Credit Card every month based on your Credit Card statement date.

| Credit Card Type | Statement Date |

| VISA Tertiary | 10th of every month |

| VISA Classic VISA Purple VISA 2 in 1 VISA Business Classic | 13th of every month |

| VISA Gold VISA Platinum VISA Signature VISA Gold Business | 16th of every month |

How can I view my Cash Back earned?

You can view your Cash Back earned via your Credit Card statement.

How is Cash Back different from Bonus Points?

Cash Back is a direct credit to your Credit Card, whilst Bonus Points were issued in the form of a certificate and received via post.

Key differences

– Quicker access to your Rewards

– Paper-less and hassle-free

– The Cash Back credit reduces your outstanding balance

– You can shop at any merchant – locally or internationally

Contactless FAQs

What is Contactless technology?

This feature allows you to simply ‘tap-and-go! The terminal and card communicate using Near Field Communication (NFC) technology which allows you to tap your card over the merchant’s point-of-sale device to make a payment instead of inserting the card.

Why use Contactless technology?

Contactless technology brings you added convenience when making payments. With just a tap, you can make quick and secure payments.

How do I use the Contactless feature on my credit card?

Once the merchant point of sale device is enabled with Contactless technology, you can tap or wave your card 2 inches over the device to make a payment.

How can I determine whether I can use Contactless at a merchant?

The Contactless icon (see below) will be displayed on the merchant’s machine.

Will Contactless transactions require a Pin?

Each transaction is assessed “individually” and you will be prompted if you’re required to enter your Pin.

Is Contactless payment secure?

Contactless uses the same secure and robust technology as Chip & PIN.

When making a payment via Contactless, your personal card information is protected.

How can I be notified of a Contactless transaction?

First Citizens offers Email Alert Service which delivers convenient, fast and secure real-time notifications. Each notification will provide you with a brief transaction description that includes the merchant’s name, the transaction status (whether approved or declined), transaction value and your real-time available card balance.

Existing Credit Card Customers FAQs

These FAQs will be of special interest to existing First Citizens credit card customers.

It is however highly recommended that all persons review the “General Frequently Asked Questions on First Citizens Credit Card with Chip and PIN technology” which provides the basic but very essential information on the change of the First Citizens suite of credit cards to “Chip and PIN” technology.

Definition: “Chip and PIN”/ “Chip and PIN technology” – refers to a First Citizens credit card that carries both the magnetic stripe technology and the Chip and PIN technology.

When will I receive my First Citizens Credit Card with Chip and PIN technology?

The conversion of credit card accounts and all credit cards on the account to Chip and PIN technology will be triggered by the earliest expiry date of any card on the account, whether it is the primary card or any additional card.

As such, you will receive your First Citizens Credit Card with Chip and PIN technology upon the renewal of the card with the earliest renewal date on the credit card account.

As per usual, the primary cardholder who is the owner of the account will be contacted in writing to collect the renewed credit card/s which will be sent to your branch of choice, as recorded on our files.

Note: VISA Platinum and VISA Signature credit cards have already been converted from magnetic stripe technology to Chip and PIN technology and so the above does not apply to these customers.

Will all cards i.e. primary and additional cards, on the credit card account be converted to Chip and PIN technology upon renewal?

Please refer to the answer to Question 1 above.

When will my new First Citizens Credit Card with Chip and PIN technology expire?

Upon renewal, each card will be renewed for 3 years.

Can I safely continue to use my First Citizens Credit Card with magnetic stripe technology until my card is renewed and converted to Chip and PIN technology?

Yes, your current First Citizens Credit Card, with magnetic stripe technology can continue to be safely used at merchants and ATMs worldwide.

Can I request that my existing magnetic stripe First Citizens Credit Card be converted to Chip and PIN technology if it is not due for renewal?

As previously noted in Question 1, the Bank’s approach to converting existing credit cards to Chip and PIN cards is based upon the earliest renewal date of a credit card on the account.

We do understand that there may be exceptional circumstances, i.e. specifically travel to Europe, and advise that if such a situation arises, you would be required to provide a written request to the Credit Card Centre, 1st Fl, 62 Independence Square, Port of Spain.

This can be done via any First Citizens branch or via the Secure Message option of the First Citizens Online Banking Service. The Credit Card Centre must receive this request two (2) weeks prior to the travel departure date.

How will the following situation be treated? : A single customer having several First Citizens credit cards, each with a different renewal date? For eg. A single customer who has a VISA Classic, a VISA Gold and a MasterCard Gold credit card?

Each credit card account will be converted to Chip and PIN technology based on the earliest renewal date on a card on the credit card account. The current magnetic stripe technology First Citizens credit card can continue to be used worldwide, where VISA and MasterCard credit cards are accepted.

How do I get my PIN for my First Citizens Credit Card with Chip and PIN technology?

The current PIN in your possession will work with your First Citizens Credit Card with Chip and PIN technology.

If you cannot remember or otherwise need a PIN please submit a written request to the Credit Card Centre, First Citizens Bank, 1st Fl, 62 Independence Square, Port of Spain or through the Secure Message option of the First Citizens Online Banking Service. The standard fee for a replacement PIN will apply.

The requested PIN will be sent to your branch of choice, as recorded on our files.

What is the importance of my PIN with my First Citizens Chip and PIN Credit Card?

Your PIN is required to process purchase transactions at chip-enabled point of sale machines as well as for cash withdrawals at chip and non-chip enabled ATMs.

Therefore your PIN has now become even a more central security element for your purchase transactions, similar to how you process LINX transactions. Whilst a sizeable number of point of sale machines in Trinidad and Tobago may be non-chip enabled, it is strongly recommended that you remember your PIN, as you never know when you will interact with a chip-enabled point of sale machine, either locally or internationally.

Your First Citizens Chip and PIN Credit Card will be blocked after three (3) inaccurate PIN attempts.

Do all the cardholders on my credit card account need an individual PIN for the First Citizens Credit Card with Chip and PIN technology?

Yes, as per usual, each cardholder receives an individual PIN, which should be known only to the cardholder. The primary cardholder can request and collect PINS on and behalf of all the cardholders on the account.

Kindly advise if PINs are required for each cardholder via a written request to the Credit Card Centre, First Citizens Bank, 1st Fl, 62 Independence Square, Port of Spain or through the Secure Message option of the First Citizens Online Banking Service.

Do I need a separate PIN to do purchases and to do cash withdrawals using my First Citizens Credit Card with Chip and PIN technology?

No, the same PIN is used in all instances, for purchases and cash advances.

Does the introduction of Chip and PIN technology on my First Citizens Credit Card affect the process of doing online purchases?

No, the process for doing online purchases remains unchanged. However, as per usual, the expiry date of the credit card is critical to a successful online purchase transaction and so, this information should be updated when you receive your renewed First Citizens Credit Card with Chip and PIN technology.

What happens to my First Citizens magnetic stripe credit card after I receive my First Citizens Credit Card with Chip and PIN technology?

For your safety, once you receive your First Citizens Chip and PIN Credit Card, you will be required to hand in your magnetic stripe card for destruction.

What are the additional fees on the First Citizens Chip and PIN Credit Card?

The sole fee which may apply is the cost of a replacement PIN if the cardholder requests same. There are no additional fees.

What will be the process if my First Citizens Credit Card with Chip and PIN technology is lost or stolen?

The current process to handle lost or stolen credit card applies. You are required to immediately report the loss via 62-FIRST (623-4778) locally or to VISA/ MasterCard if abroad at the numbers at the back of your card. Keep those numbers sate at all times.

The lost/stolen credit card will be disabled and you will be provided with a new credit card and PIN at your branch of choice. Standard charges for lost/stolen cards will apply.

Will the chargeback/ dispute process change for the cardholder in any way due to the introduction of the Chip and PIN technology on the First Citizens Credit Card?

No, the chargeback/dispute process remains unchanged.

What do I do if the chip on my credit card is damaged?

If the chip is damaged, please submit a written request for a replacement card to the Credit Card Centre, First Citizens Bank, 1st Fl, 62 Independence Square, Port of Spain or through the Secure Message option of the First Citizens Online Banking Service.

Please note though that your card will continue to work at non-chip enabled merchants, which process purchases based on the magnetic stripe rather than the chip.

Foreign Exchange Limit FAQs

What are the revised Foreign Currency limits on Credit Cards?

Why has First Citizens reduced Foreign Currency limits on Credit Cards?

The Bank continues to use its best efforts to address the foreign currency requirements of our customers and limits will be adjusted based on the availability of foreign currency. Your Credit Card continues to offer you the convenience of personal shopping both at home and abroad and access to online shopping and e-commerce. Your ability to conduct foreign currency transactions has always been and will continue to be, subject to the availability of foreign currency.

Can I request access to additional foreign currency via my Credit Card after I have fully utilized my monthly threshold?

Yes, you may request, for consideration, the ability to make additional international purchases on your Credit Card. Please submit your request via your home Branch, Commercial Officer or Corporate Banking Officer or contact Contract Centre at 62-FIRST (623-4778) or email us at easybanking@firstcitizenstt.com. Your requests will be logged and the respective representative will contact you on the status of your request.

Can I utilise my Foreign Currency Limit for the billing cycle in one transaction?

Considerations on spend are provided on a case-by-case basis and will apply to urgent transactions, particularly related to medical and educational needs. You are required to notify the Credit Card Centre to facilitate this payment. You may also be required to provide supporting documentation such as invoices. Requests are to be submitted in-person to the Credit Card Centre or via email addressed to the Contact Centre at enquiries@firstcitizenstt.com.

Can I access my Foreign Currency limit via cash withdrawals/advances at the ATM while abroad?

Yes, for your safety and convenience, you can access up to $880 US for the day which will be reset every five (5) days until your Foreign Currency limit is exhausted.

Is the foreign currency limit based on my Credit Card Limit?

Your Credit Card limit remains fully accessible in TTD currency while the foreign currency limit is in accordance with the limits outlined in Table 1 above.

Is the revised foreign currency limit a temporary measure?

The Bank reviews the foreign currency limit periodically and customers will be advised in a timely manner of any adjustments.

When will the most recent change become effective?

This change will come into effect on September 10, 2021, in keeping with the September 2021 billing cycle.

Will the foreign currency limit be further reduced?

Periodically, the Bank reviews the foreign currency limits and this may, at times, result in adjustments to customer limits.

Email Notification FAQs

First Citizens email alert service delivers convenient, fast and secure real time notifications. Receive email alerts via your mobile device/personal computer after every credit card and prepaid card transaction. Our email alert service will help you to identify any suspicious transactions. Each notification will provide you with a brief transaction description that includes the merchant’s name, the transaction status (whether approved or declined), transaction value and your real time available card balance.

- Get easy access to real time available card balances

- The service is FREE to you

- Detect fraudulent transactions faster and easier

Signing up for email alerts is simple!

New and existing credit card and prepaid cardholders can register for email alerts by providing your full name, a valid email address and telephone contact via:

- First Citizens Online Banking. Send a secure message to our Electronic Banking Unit.

- Email. Send us an email at fcttcreditcardnotifications@firstcitizenstt.com

- Telephone. Call 62-FIRST (34778) and select option 3 to speak with a service representative, our contact centre is available every day from 6am to 10pm

- Any First Citizens branch or our Credit Card Centre (1st Floor, 62 Independence Square, Port of Spain).

Fast activation!

Upon receipt of your request, a representative from the First Citizens Electronic Banking Unit will contact you.

Subsequently, an email will be sent to you with the terms and conditions of the email alert service for your confirmation. The service will be activated within 24 hours upon receipt of your confirmation email.

Questions?

For any concerns or questions, feel free to send us a secure message via online banking, email fcttcreditcardnotifications@firstcitizenstt.com or call 62-FIRST (34778) and select option 3.

*Registration of the First Citizens email alert is applicable only to the primary card holder.

This service is not applicable to First Citizens business credit cards.

Kindly note internet and/or data services must be enabled on your mobile device/personal computer to receive email alerts.

One Time Passcode (OTP) Authentication FAQs

Visa Money Transfer FAQs

What is Visa Money Transfer?

Visa Money Transfer is a service that gives you a fast, easy and safe way to receive money from abroad directly on your First Citizens Visa Credit Card.

What do I need to provide to the sender to receive a Visa Money Transfer on my Credit Card?

To receive a Visa Money Transfer, simply provide your 16-digit Visa Credit Card number to the sender.

Is a Visa Money Transfer considered a payment?

No, Money Transfers are classified as credits to your account which increases your available funds. You will still need to make a payment based on your credit card statement outstanding balance.

Is there a fee for receiving Visa Money Transfers to my Visa Credit Card?

No fees are charged to cardholders for receiving the funds.

Which currency can I receive a Money Transfer?

All Visa Money Transfers will be received in Trinidad and Tobago dollars (TTD) on your Visa Credit Card.

Is there a limit for receiving Visa Money Transfers?

Yes, you can receive up to a maximum of US $200 daily or US $300 weekly.

Is it possible to receive Visa Money Transfers from other countries?

Yes, it is possible to receive Visa Money Transfers from other countries with the exception of Office of Foreign Assets Controls (OFAC) sanctioned countries. Click here for a list of OFAC countries.

How long will it take for the money to reflect on my credit card after the transfer is done?

In keeping with Visa’s guidelines, funds will be available in 30 minutes or less after the payment instruction is approved. However, we recommend that you check with the sender to confirm when funds were sent.

Is it possible to receive a Visa Money Transfer from other banks with Visa Money Transfer credentials?

Once the sender’s bank provides a service which allows money transfers to Visa Credit Cards, you can receive funds on your card.

Is it possible to receive a Visa Money Transfer from a Credit Card on another payment system?

You can only receive a Visa Money Transfer from another Visa Credit Card.

Are Visa Money Transfers safe?

Yes, Visa Money Transfers are safe. Visa is a trusted global network that provides reliable protection for all transactions ensuring constant monitoring and encryption of transmitted information to avoid fraud.

Is sharing my Visa 16-digit credit card number safe?

Sharing your Visa credit card number in order to receive a Visa Money Transfer is safe. Do not share your Personal Identification Number (PIN) and Card Verification Value/Card Validation Code 2 (CVV/CVC2) with anyone.

What happens if the sender of a Visa Money Transfer incorrectly enters my Visa Credit Card number?

If there is an error, the sender should directly liaise with the merchant for assistance.

How would I be notified of a Visa Money Transfer?

After the transfer is successfully completed, both the sender and the receiver will receive an email notification of the transaction. The email notification will include details such as the transfer amount, the date and time of the transfer and the transaction numbers.

Can I cancel or make changes to a Visa Money Transfer transaction after it is sent?

As the receiver of a Visa Money Transfer, you are unable to cancel or make changes to the transaction.

The ability to cancel or make changes to a Visa Money Transfer depends on the policies and the terms of the merchant’s platform being utilised. If there is a need to cancel or make changes to a Visa Money Transfer, please contact the sender to directly liaise with merchant.

What is MasterCard ID Check?

MasterCard ID Check is a service offered by First Citizens to our MasterCard credit cardholders which strengthens the security of and confidence in online shopping with your First Citizens credit card.

How does MasterCard ID Check work?

The MasterCard ID Check service strengthens the security of your First Citizens online shopping experience by capturing key data elements during your online shopping. This information is then utilized to analyze and trend customer behaviour to authenticate your online purchase.

When you shop online at participating merchant sites you will see the MasterCard ID Check badge.

Whether you’re using a desktop, mobile or other digital device, you may be guided through an additional check to verify your identity. This helps the bank know you’re really you, and it better protects you from fraud.

This service helps make shopping online more secure by protecting against unauthorized use of your MasterCard.

What is the benefit of the MasterCard ID Check service to me?

The MasterCard ID Check service provides enhanced security and confidence for your online purchases.

Through this service, you have an added layer of protection that helps reduce the unauthorized use of your MasterCard while shopping online. This service helps the bank know you’re really you and most importantly it helps to protect you from fraud.

No Hassle, No inconvenience. No Enrolment – No Confirmation – No Purchase. Only Peace of Mind. And it is FREE of charge.

Is there any direct impact of the MasterCard ID Check service on me as a First Citizens MasterCard credit cardholder?

First Citizens MasterCard cardholders are automatically enrolled for the service when you complete an online transaction.

What happens when (i) my First Citizens credit card expires, or (ii) my credit card limit changes or (iii) I receive a new card after my last card was either lost, stolen or compromised?

- In situation (i) your transaction would be declined however,

- In situation (ii) and (iii) you would not be required to take any action. You can proceed with your online shopping.

Can I use both my credit & prepaid cards?

Yes. This service was designed for both MasterCard credit and prepaid cards when shopping online.

How will I know if my online purchase has the added layer of protection?

This service automatically works at checkout with participating merchants. Remember, there is no need to download anything, install software or register your account to get this added layer of protection. When using this service, you may occasionally be prompted at checkout to verify your identity, but this is to ensure you are you and protect you from fraud.

What happens when I finish shopping?

As you complete the transaction, you may be prompted to verify your identity if additional authentication is required. It’s important to take special precautions when shopping online. This extra verification step helps ensure the person using your card is you.

If I do encounter this extra layer verification step, what will the extra check be?

You will receive a one-time passcode to your email on file. If you encounter this extra step, simply follow the instructions on your screen to verify your identity.

I used to see the MasterCard Secure Code on your website. Is this service different?

No. Although the MasterCard Secure Code name is no longer in use, the same technology is in place to help protect you. In fact, this service was enhanced to make transactions more secure and the user experience more seamless.

What is the cost for the MasterCard ID Check service from First Citizens?

This service is free to all First Citizens MasterCard cardholders.

Enrolling for MasterCard ID Check/Security and Privacy

Why do I need to enrol for the MasterCard ID Check service?

- All cardholders are automatically enrolled for the service upon completion of an online transaction. Enrollment into this service strengthens the security of your online transactions at 3D Secure Merchants.

- Enrollment is completed per card.

What and how many cards would be enrolled for the MasterCard ID Check service?

All of your First Citizens MasterCard credit cards would be enrolled for this service. There is no limit.

How does MasterCard ID Check protect me?

No enrollment, No Confirmation, No Purchase. You enjoy enhanced security and confidence in your online purchases.

Chargebacks

From time to time, “transaction disputes” or “chargebacks” may arise on a credit card account. A credit card chargeback is often submitted by a cardholder when a credit card charge was unauthorised, a product or service purchased online was not delivered or the product purchased was defective. With the exception of unauthorised charges, a chargeback request should only be initiated after unsuccessful attempts to obtain a refund from the merchant

To submit a chargeback request, download, complete and submit a Credit Card Dispute Form via email to Credit.Card_Chargebacks@firstcitizenstt.com and a representative will contact you.

What should I do if my Credit Card is lost or stolen?

You are required to immediately send a WhatsApp message to 774-CARD (2273) or call 62-FIRST (623-4778) option 1 or 3 to make a report and a new Credit Card will be issued and delivered to your local mailing address. Our Contact Centre is available every day from 6am to 10pm.

If you are abroad, send a WhatsApp message to 868-774-CARD (2273) or call:

- VISA at 1-800-396-9665 when in the U.S.A /Canada, or in other countries, call 1-303-967-1098

- MasterCard at 1-800-307-7309 when in U.S.A /Canada, or in other countries, call 1-636-722-7111

- Any time you think your credit card may have been compromised, don’t forget that you can always “block” your card from within the First Citizens Mobile Banking App. To do so, log into your mobile app, select “Cards”, then “Services.” Select the “hotlist” option and an immediate permanent block will be placed on your Credit Card.

- To prevent unauthorized use of your card when you are not using the card, log into your mobile app select “Cards”, then “Services”. Select the “block” option and an immediate “temporary” block will be placed on your credit card. Follow the same steps to turn your card “on” again by selecting ‘unblock” once you feel it’s safe to do so.

Credit Card Forms

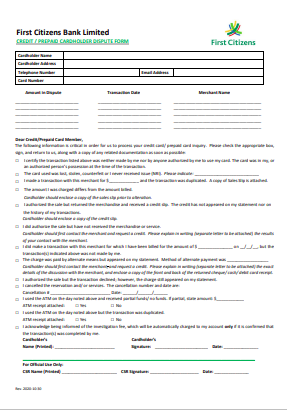

Credit Cardholder Dispute Form

This form allows you, the cardholder to query the legitimacy of any unauthorized credit card transaction posted in your credit card history.

As this process is important, we urge you to take a few minutes to familiarise yourself with some further details on the dispute process. Please click here for further details.

- Print form and tick option applicable to you.

- Provide relevant requested information and documents as required.

- Sign the form where indicated.

- Scan your completed forms and documents to Credit.Card_Chargebacks@firstcitizenstt.com

- Upon receipt, you would be contacted by or advised further by one of our Chargeback Officers.

Additional Cardholder Form

This form allows you to add that person who is most important to you to your credit card account. Follow the simple steps below:

- Print form and provide requested information.

- Sign the form where indicated (both primary and additional cardholder/s).

- Visit any branch with the completed form along with original plus a copy of the following documents. One (1) ID for the primary and each additional cardholder e.g. electoral id, passport, drivers permit. The IDs are to be certified at the branch.

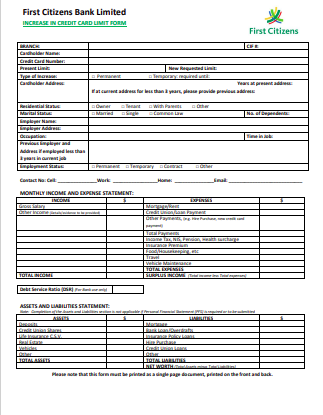

Increase in Credit Card Limit Form

This form allows you to start the application process to increase your credit card limit. Follow the simple steps below:

- Print, complete and sign form where indicated.

- Visit branch with form and original plus a copy of the following documents. The documents are to be certified at the branch. – (One (1) ID e.g. electoral id, passport, drivers permit along with a salary slip not more than one (1) month old.)

- Proof of address dated within three (3) months may be required if the increase in limit results in a change in the type of credit card.

- A Personal Financial Statement (PFS) may be required if the increase in limit results in a change in the type of credit card.

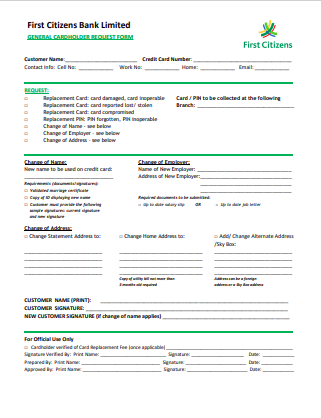

Card & PIN Replacement/ Name & Address Change/ Contact Information Change Form

This form allows you to provide the Bank with all the required information to do the most common amendments required for credit cards. You may follow the simple steps below:

- Print form and tick option applicable to you.

- Provide relevant requested information and documents as required.

- Sign the form where indicated.

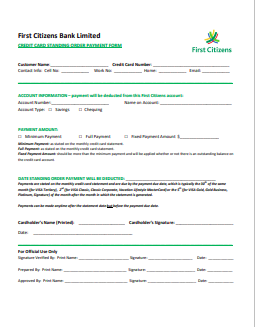

Credit Card Standing Order Payment Form

This form allows you to easily make arrangements so that your credit card payments are automatically kept up to date via standing order options that suit you. Follow these simple steps:

- Print form and tick option applicable to you.

- Provide relevant requested information and documents as required.

- Sign the form where indicated.

Support and Contact Information

| For Credit Card Activations | Activate using the Mobile Banking Application via Google Play Store or the App Store |

| For Lost, Stolen or Compromised Cards | Call us via 62-First Option 3 or email authorizations@firstcitizenstt.com Block and request your replacement card using the Mobile Banking Application via Google Play Store or the App Store |

| For support with Approvals or Declined transactions including Unauthorized transactions | Call us via 62-First Option 3 For suspicious activity Block card using the Mobile Banking Application |

| Skip the line, for queries about past transactions on your statements | Send us a Secure Message |

| Skip the line, for general information | Send us a Secure Message or continue to browse our Frequently Asked Questions on this Website |

| Skip the line, for Alert Management | Send us a Secure Message or email notifications@firstcitizenstt.com |