A Closer Look at Stock Splits

Commentary

Companies can split their stocks for a number of reasons and may be done in a variety of ways. There are two main types of stock splits, a forward stock split and a reverse stock split. The most common type of stock split is a forward stock split, which is a corporate action whereby a company splits one share of its stock into more shares. With a reverse stock split, the opposite happens whereby shares owned by existing investors are replaced with a proportionally smaller number of shares.

When one stock is split into more shares in a forward stock split, the company increases the number of shares available. Although the number of outstanding shares increases, the total dollar value or the market capitalization of the shares remains the same as the split does not add any tangible value. The price per share is also affected by a stock split. After a split, the price per share will be reduced as the number of shares outstanding has increased.

Concept of a Forward Stock Split

Stock Split Ratio

A stock split ratio tells the investor the number of new shares that will be created from one existing share. A stock can be split in many different ratios including 2-for-1, 3-for-1, 5-for-1 or even 20-for-1. If a shareholder holds 1 stock in a company which is valued at $60, a 2-for-1 stock split means that for every one share held, investors will now hold 2 shares (number of shares held x 2). While the number of shares increases to 2, the total value of the shares remains at $60 as the price of the stock falls by the divisor of the split ($60/2). Therefore, the $60 stock becomes $30 after the 2 for 1 split.

| Before stock split | After stock split | |||||

| Stock Split Options | No. of shares | Share Price | Value of Holdings | No. of shares | Share Price | Value of Holdings |

| 2 for 1 | 1 | $60.00 | $60.00 | 2 | $30.00 ($60.00/2) | $60.00 |

| 5 for 1 | 1 | $60.00 | $60.00 | 5 | $12.00 ($60.00/5) | $60.00 |

| 10 for 1 | 1 | $60.00 | $60.00 | 10 | $6.00 ($60.00/10) | $60.00 |

| 20 for 1 | 1 | $60.00 | $60.00 | 20 | $3.00 ($60.00/20) | $60.00 |

Reasons for a Stock Split

Companies whose share price has increased to a high level or are beyond the price levels of similar companies in its sector may choose to do a stock split. The main reason for this is that a stock split can make shares more affordable to the average investor. This reduced price makes the share more attractive and attainable to a larger number of investors which increases liquidity in the stock. The higher liquidity facilitates more trading and may narrow the Bid/Ask spread. The Bid/Ask spread is the difference between the highest price that a buyer is willing to pay for an asset and the lowest price that a seller is willing to accept. Increasing the liquidity of a stock makes trading in the stock easier for buyers and sellers.

A stock split increases the number of shares trading on the market. As more shares are available, this will aid in widening and deepening the shareholder base of the company. The announcement of a stock split often results in investors having a renewed interest in the company, which can also have a positive impact on the stock price.

Benefits and Drawbacks of Stock Splits

The reduced share price from a stock split will make the stock more affordable to investors who previously could not afford to buy a single share in the company. The stock split helps investors by effectively lowering the barrier to purchase shares in the company. With the multiplication of shares, existing shareholders of the company will now be able to increase their exposure and purchase additional shares in the company.

As trading volume increases following the stock split, the bid and ask spread may narrow, thus allowing investors who trade more actively to get better prices for the stock. The increased liquidity also creates the opportunity for active traders to open and close their positions in a relatively shorter period of time. Following the reduction in share price with the stock split, there may be greater upside potential for shareholders to benefit from.

For small investors and small separately managed accounts, richly priced stocks make it difficult to rebalance their portfolio however, stock splits help to correct this. While investors may be concerned that the Earnings per share (EPS) and other per-share metrics of the company will be lower following stock split, the lower share price would ensure that valuation multiples are not directly impacted.

One main drawback to investors following the stock split is that the company’s share price may experience more volatility. The stock split may also encourage new investors to buy shares for short-term gains rather than a long-term investment.

The company can also benefit from executing a stock split. This is because a stock split will aid in widening and deepening the shareholder base of the company. As the opportunity is created for new investors to purchase shares in the company, there is the possibility of increased trading activity. Unlike a secondary offering, the company will be able to successfully avoid any stock dilution by performing a stock split. While stock splits do not change the value of the Company, they are often followed by increased market activity, which when coupled with strong financial performance, tends to result in share price increases.

As the shareholder base changes following a stock split, the company must be cognisant that expectations of new shareholders may not be the same as that of legacy shareholders.

Most times a stock split is generally done when the stock price of a company has risen to a point that it might become an impediment to new investors. A stock split is often the result of growth or the prospects of future growth in the company which is a positive indication.

Performance of Companies which completed Stock Splits

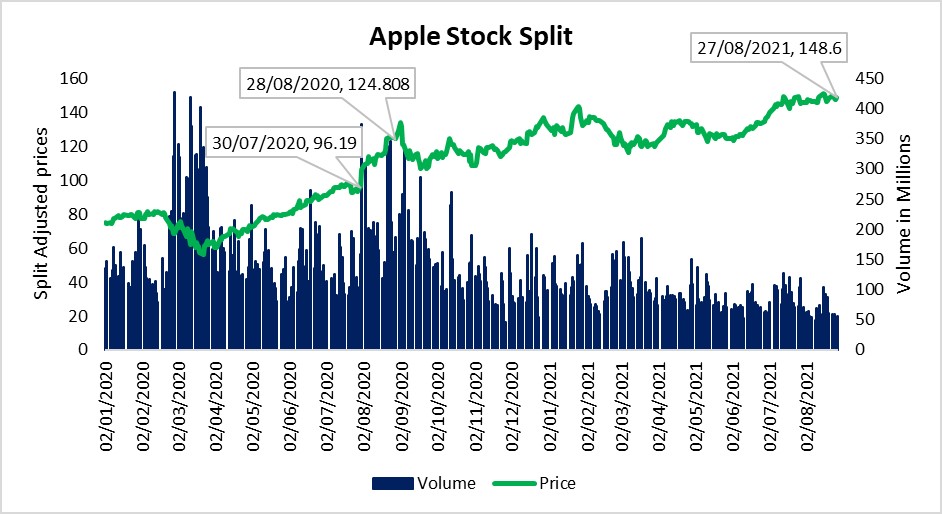

Stock splits occur more frequently in the US stock market when compared to the local and regional stock markets. One of the more prominent companies that had a stock split in 2020 was Apple Inc. Apple’s stock has split five times since the company went public in 1980. The stock split which occurred on August 28, 2020 was a 4-for-1 split. Shares closed on August 28, 2020 at $499.23 and opened on August 31, 2020 at around $124.81. One year after the split, the share price has since appreciated registering a 19.06% gain.

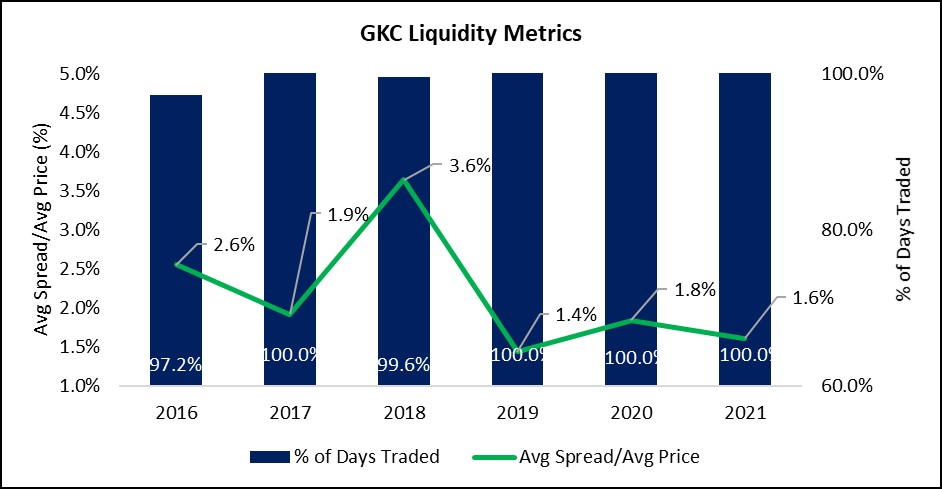

On the Jamaican Stock Exchange, GraceKennedy Limited (GKC) entered into a 3-for-1 stock split on August 11, 2016. After the stock split, the company’s shares experienced a significant improvement in its liquidity as measured by the higher percentage of days traded which moved from 97.2% in 2016 to 100% in 2017. There was also a considerably lower Bid/Ask spread which moved from 2.6 % in 2016 to 1.9% in 2017.

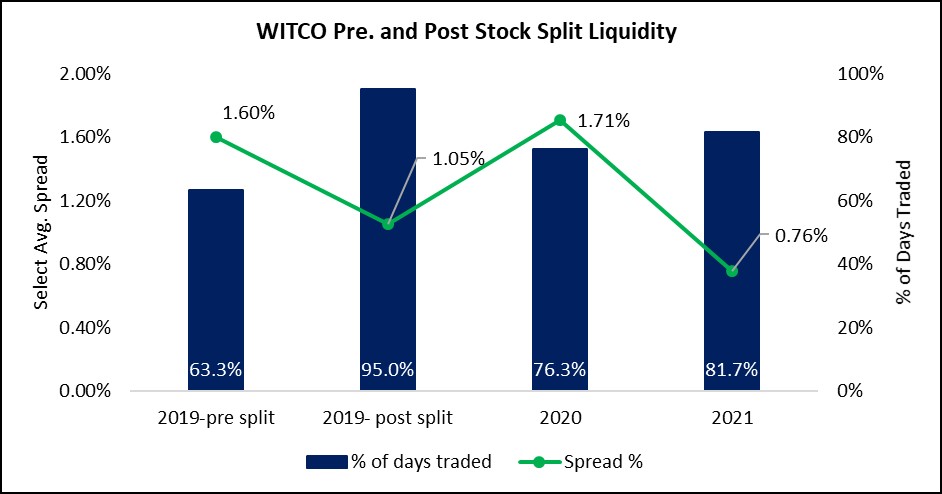

On the Trinidad and Tobago Stock Exchange, the West Indian Tobacco Company (WITCO) entered into a 3-for-1 stock split on November 28, 2019. After the stock split, the company experienced a significant improvement in liquidity of its shares as measured by the higher percentage of days traded which moved from 63.3% before the split in 2019 to 95.5% after the split in 2019. The Bid/Ask spread was also lower reaching 0.76% in 2021 which is the lowest recorded since 2019.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.