Age of Change: Economic and Workforce Implications of Aging in LATAM and the Caribbean

Commentary

Introduction

An aging population is defined by a growing proportion of elderly individuals, typically those aged 60 and above, within the total population. This demographic shift is becoming increasingly prominent in Latin America and the Caribbean (LATAM & Caribbean), driven by longer life expectancies and declining birth rates. These changes have significant and far-reaching economic and labour force implications. It is important to understand and address these impacts to ensure sustainable economic growth and to maintain labour market stability. This demographic trend brings about increased pressure on healthcare systems, pension funds, and public finances which requires policy innovations and economic adjustments that could help mitigate the adverse effects.

Demographic Trends in LATAM & Caribbean

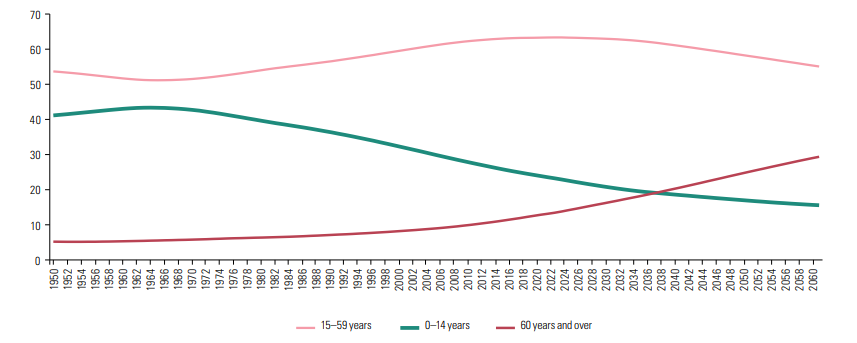

According to data from the United Nations Economic Commission for Latin America and the Caribbean (ECLAC), population aging is a significant demographic trend in Latin America and the Caribbean, noting that as of 2022, 88.6 million people aged 60 and older live in the region, making up 13.4% of the total population. The United Nations defines a country as ‘ageing’ when 10% or more of its population is over the age of 60 years. This proportion is expected to increase to 16.5% by 2030. The region is experiencing a rapid aging process, which will result in older adults comprising 25.1% of the population (193 million people) by 2050, effectively doubling the number of older persons from 2022. Additionally, life expectancy for both men and women has risen significantly, from 48.6 years in 1950 to 75.1 years in 2019. Although the COVID-19 pandemic caused a temporary decline, reducing life expectancy by 2.9 years in 2021 compared to 2019, it is projected to rise again, reaching 77.2 years by 2030.

Mexico

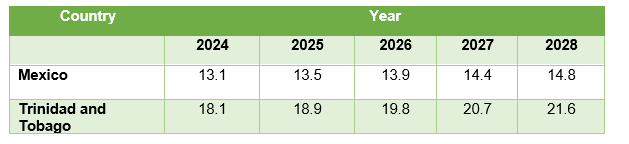

Mexico is one of the largest and most economically significant countries in Latin America, and it faces substantial challenges due to its aging population. The country’s demographic shift is expected to result in a significant increase in the elderly population, from 10% in 2020 to over 25% by 2050. This shift will have profound implications for the country’s economy, particularly in terms of healthcare costs, pension system sustainability, and labour market dynamics. The Mexican Government has begun to implement policies aimed at addressing these challenges, including healthcare reforms and pension adjustments. However, more comprehensive strategies are needed to fully address the economic and social impacts of an aging population. The focus needs to be on ensuring that the aging population can contribute to the economy through extended work life and that adequate social support systems are in place to sustain them.

Trinidad and Tobago

Trinidad and Tobago serves as a valuable case study for examining the economic and labour market impacts of an aging population in the Caribbean. The country’s demographic data reflect the broader regional trend of an aging population, with the percentage of individuals aged 60 and above expected to reach 28% by 2050.The aging population in Trinidad and Tobago has already begun to impact the local economy and labour market. The UN World Population Prospects 2024 indicated that in 2023, 18% of Trinidad and Tobago’s population was aged 60 and over, significantly surpassing the 10% threshold therefore classifying them as an ‘aging’ population. The healthcare system is under increasing pressure to provide services to a growing number of elderly individuals, while the pension system faces sustainability challenges. Additionally, the shrinking workforce poses risks to economic productivity, particularly in industries that rely on younger workers. The government of Trinidad and Tobago has recognized the challenges posed by an aging population and has implemented several initiatives to address them. These include healthcare reforms aimed at improving elder care services, pension system adjustments to ensure long-term sustainability, and programs to retrain older workers for new roles in the economy. However, further efforts are needed to fully address the economic and social impacts of an aging population, including more robust policies to attract younger workers and improve the skills of the existing workforce.

Figure 1: Latin America and the Caribbean population trends and projections by major age group, 1950–2060

Financial Burdens on the Economy

As the population ages, the financial burdens on national economies in LATAM & Caribbean are expected to increase significantly, especially in healthcare, pensions, and public expenditure.

Increased Healthcare Costs

The rising demand for healthcare services is one of the most immediate consequences of an aging population. Elderly individuals are more likely to suffer from chronic diseases such as diabetes, cardiovascular conditions, and arthritis, which require ongoing medical attention and long-term care. The International Monetary Fund (IMF) projects that healthcare spending in the region could increase by 1.5% to 2% of GDP by 2050 as a direct result of population aging. In Mexico, this is particularly concerning, as the country’s healthcare infrastructure is already under strain.

Trinidad and Tobago is facing similar challenges. The Central Bank of Trinidad and Tobago reports that healthcare expenditure is expected to rise sharply in the coming decades, driven by the growing demand for elder care services and the management of chronic conditions prevalent among the elderly. These rising costs place significant pressure on public healthcare systems, often requiring governments to divert resources from other critical areas such as education and infrastructure.

Figure 2: Current Health expenditure as a % of GDP for Mexico and Trinidad and Tobago for the years 2000-2021

Pension System Strains

Another significant challenge posed by an aging population is the strain on pension systems. As more individuals retire, the number of people drawing from pension funds increases, leading to potential sustainability issues. In many LATAM & Caribbean countries, pension systems are already facing challenges due to inadequate funding and demographic changes that reduce the ratio of working-age individuals to retirees.

Mexico’s pension system is particularly vulnerable. The IMF notes that without reforms, Mexico’s pension liabilities could increase by 7% of GDP by 2050, creating substantial fiscal pressures. The government is currently exploring options such as raising the retirement age and revising contribution rates to ensure the long-term sustainability of its pension funds.

In Trinidad and Tobago, the National Insurance Board (NIB) is also under significant strain due to a rising gap between contributions and payouts according to the National Insurance Board (NIB) Annual report 2022. Over the last five years, the deficit grew from TTD226 million in 2018 to TTD1.198 billion in 2022. Contributions have remained relatively stable at around TTD4.7 billion, but a rapid rise in benefit payouts—largely pensions—has exacerbated the deficit. In 2022, long-term benefits, including retirement pensions, accounted for 87% of total payouts, amounting to TTD5.43 billion. To bridge the gap, TTD1.259 billion from liquidation of NIB investments had to be used. This withdrawal, along with unrealized losses, reduced the NIB’s investment portfolio by 3%, leaving it at TTD29.04 billion.

Since 2013, the NIB has paid out more in benefits than it receives in contributions. This is primarily due to demographic shifts, including a shrinking working population and increasing life expectancy. With the system’s long-term viability at risk, the government is considering reforms such as raising the retirement age from 60 to 65, as well as adjusting contribution rates. These measures are intended to sustain the pension system and address the growing financial strain brought on by an aging population and insufficient inflows.

Impact on the Labour Force

One of the most immediate impacts of an aging population is the shrinking of the workforce, which poses significant challenges to economic productivity and growth. As the proportion of elderly individuals in a population increases, the number of working-age people declines, in addition to fewer young people entering the labour market. This trend is evident in Mexico, where the elderly population is projected to constitute 19% of the total population by 2030. The increasing dependency ratio, with more elderly individuals relying on a smaller base of working-age individuals, could slow GDP growth by as much as 1% annually by 2050. This demographic shift is particularly concerning for industries like manufacturing and services that rely heavily on a steady influx of young workers.

In Trinidad and Tobago, the situation is similarly dire. The elderly population is expected to make up 25% of the population by 2030, up from just 9% in 2000. The strain on the pension system is cause for significant concern, with projections indicating that the National Insurance Fund could be depleted by 2030 due to the growing number of retirees and fewer contributors. In response, the government is considering raising the retirement age from 60 to 65, a move that could alleviate some financial pressures but may also reduce the quality of life as individuals are required to work longer.

These trends highlight the urgent need for policies that address the challenges of an aging population. Extending working lives, encouraging lifelong learning, and implementing targeted immigration strategies to attract younger workers are crucial steps to sustaining economic productivity in both Mexico and Trinidad and Tobago.

Table 1: Dependent population total (64+), % Total of Population Forecasted for Trinidad and Tobago and Mexico, 2024-2028

Conclusion

The demographic shift towards an aging population in LATAM & Caribbean, particularly in countries like Mexico and Trinidad and Tobago, presents significant challenges for economic growth and labour force dynamics. The financial burdens on healthcare, pensions, and public expenditure are substantial, while the impact on the labour force includes a shrinking workforce and a growing skills gap. Addressing these challenges requires proactive and comprehensive policies. Strategies such as extending working life, promoting lifelong learning, and attracting younger workers and skilled immigrants are essential. These measures will help ensure that economies in the region remain resilient and capable of supporting both the elderly and the working-age population. The experiences of Mexico and Trinidad and Tobago underscore the importance of early intervention and sustained policy efforts. By taking these steps, LATAM & Caribbean nations can navigate the complexities of an aging population and secure a stable and prosperous future for all their citizens.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.