Divergent Economic Recovery: Advanced vs. Developing Economies

Commentary

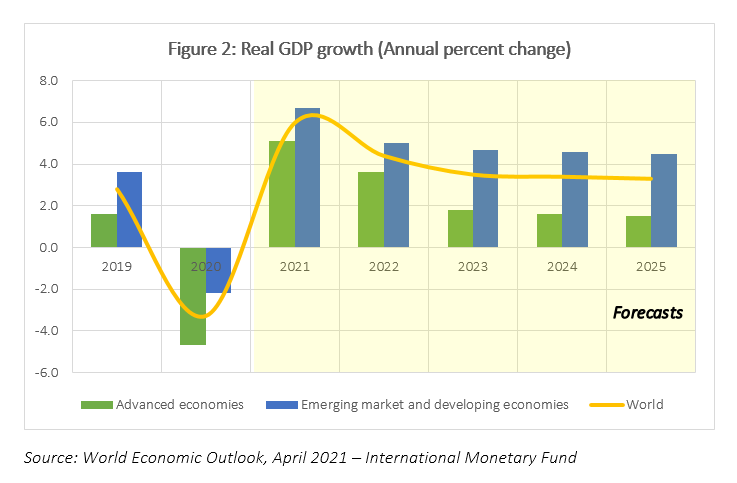

The outlook for the global economy has generally been more optimistic, largely driven by the aggressive vaccination programs underway, particularly in the large and advanced economies. Countries globally recorded historic contractions in output and sharp increases in joblessness in 2020 and many believe that vaccinating the population is the only way out of the global pandemic. There remains significant uncertainties and risks that taint the economic outlook for this year with some countries not expected to return to pre-pandemic output levels until much later on. The forecasts for economic growth between regions and countries have shown some level of divergence as the advanced economies are set to recover faster and more sustainably then the emerging and developing economies. There are several reasons for the uneven recovery including the ability to secure vaccines, monetary policy flexibility as well as lack of fiscal space for governments to proactively implement policy.

Access to Vaccines

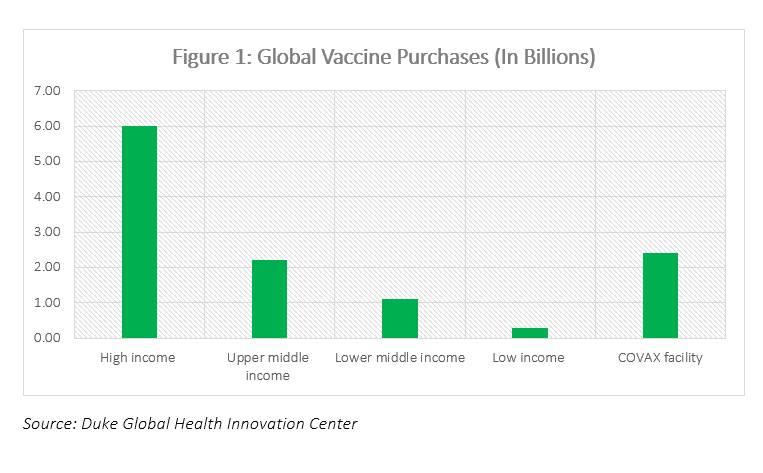

According to John Hopkins University and Medicine, as at 28 June, 2021 over 180 million cases of Covid-19 cases have been reported globally, with 3.9 million deaths. Among the top 10 countries with the highest number of cases, six are considered to be developing and emerging economies. As at 28 June 2021, approximately three billion vaccine doses have been administered across the world. However, the vaccination programs vary significantly by country with some countries yet to report a single dose. According to data from the Duke Global Health Innovation Center, high income countries have accounted for just around 50% of the all purchases of vaccines worldwide, while lower income countries only account for 10%, leaving this group of countries dependent on the COVAX facility, which has set a goal of vaccinating 30% of the population in all countries by the end of 2021.

Policy Flexibility

At the onset of the pandemic in 2020, most countries were quick to activate strong policy responses to protect the most vulnerable segments of the population as well as to maintain some level of economic activity. Central banks and other monetary authorities announced significant easing of monetary policy which saw record low interest rates and unprecedented liquidity support measures. However, the extent of fiscal support varied widely across the world. Some countries were in a position to exponentially increase expenditure on critical health care and support measures to safeguard lives and livelihoods. However, most developing countries were already struggling with onerous debt and very limited fiscal flexibility. Based on data from the IMF, advanced economies’ discretionary response to covid-19 was significantly higher than that of emerging and developing economies. While the large fiscal stimulus was able to contain an even more severe economic contraction and much more sizeable job losses, the result of higher spending alongside the squeeze in revenue, caused fiscal deficits to widen to 11.7% of GDP for the advanced economies and 9.8% of GDP in emerging markets in 2020. Continued policy support is critical to the economic recovery, however, given the already high fiscal deficits and rapidly increasing indebtedness in emerging markets, the ability to extend fiscal stimulus measures will be significantly curtailed. This is likely to delay the economic recovery for more vulnerable sovereigns.

Looking Ahead…

Based on the latest forecasts from the IMF, the world economy is likely to recover in 2021 to growth of 6%, with emerging markets expected to average 6.7%, driven largely by expectations of strong rebound in both China and India. Given the surge in cases in India, the economic outlook is highly uncertain. Renewed waves of covid-19 infections along with the spread of mutations of the virus will also delay the global economic recovery, especially in those countries where the vaccination rate remains low, which are mostly the lower income countries. While policy support is advised to continue, those countries with limited fiscal space should prioritize spending for health and transfers to safeguard social safety nets. The IMF has noted that the outlook for the global economy remains highly uncertain, with developments dependent on the following factors:

- the path of the pandemic

- policy actions

- the evolution of financial conditions and commodity prices

- the capacity of the economy to adjust to health-related impediments to activity.

On 1 June, 2021, ahead of the G7 Summit, the heads of the IMF, World Bank, World Health Organization and World Trade Organization highlighted the increasing trend of a ‘two-track pandemic’ where richer countries have access to vaccines while poorer ones are left behind. Accordingly, the group called on wealthier countries to assist in funding to accelerate vaccine distribution globally. They suggested that “at an estimated USD50 billion, it will bring the pandemic to an end faster in the developing world, reduce infections and loss of lives, accelerate the economic recovery, and generate some USD9 trillion in additional global output by 2025.” In its concluding statement, the G7 countries have pledged one billion covid-19 vaccines doses to poor countries, either directly or indirectly through the COVAX facility. While the scheme’s target is 30% of the population in all countries by the end of this year, contributions such as this from the G7 as well as further investments can help to surpass this initial target to get more persons vaccinated especially in the poorer countries.

However, in the meantime, policy inflexibility in the emerging markets as well as still limited vaccine procurements may likely result in more prolonged lockdowns and restrictions, which will hinder economic activity. As a result, there may be significant lags in economic recovery between the world’s advanced economies and the developing countries in the short to medium term.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have not acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report..