“Drill Baby Drill” – International and Local Energy Outlook

Commentary

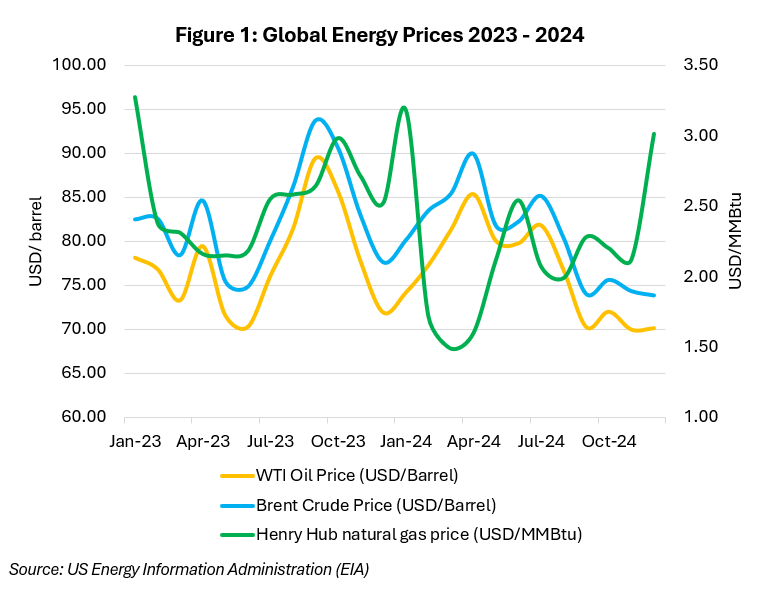

Throughout 2024 the energy market experienced a notable amount of volatility a result of ongoing conflicts, weak global demand, and OPEC+ production decisions. Oil and natural gas prices fluctuated quite significantly; data from the US Energy Information Association (EIA) shows that WTI oil prices reached a high of USD85.35 per barrel in June, and a low of USD69.95 per barrel in November, these movements resulted in annual average price of US75.63 per barrel in 2024, 1.2% lower than the annual average recorded in 2023.

The Henry Hub Natural gas spot price experienced a similar trend, with the annual average price declining by 13.4% to USD2.19 per MMBtu in 2024 Throughout the year, natural gas prices reached a low of USD1.49 per MMBtu in March 2024 and experienced a high of USD3.18 per MMBtu in January 2024. As the winter season approached, household demand increased and drove natural gas prices up to an average of USD3.01 per MMBtu in December 2024, compared to an average of USD2.12 in the previous month.

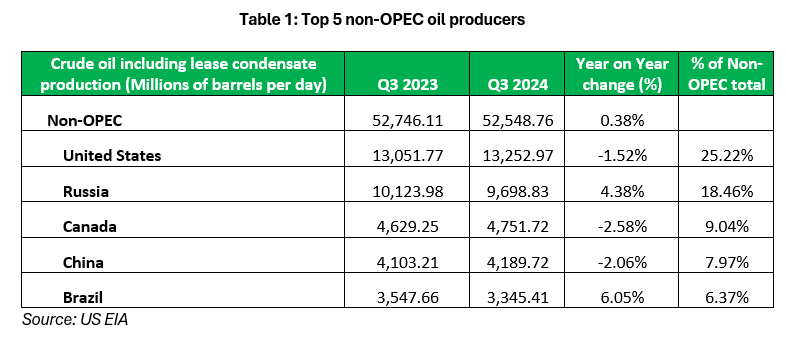

Energy prices were affected from both the production and demand side throughout 2024. For oil, weak demand from China, the second largest consumer of oil in the world, was a major factor contributing to the weaker oil prices throughout the year. Estimates from LSEG Oil Research indicates a 1.9% decline in oil imports for China, this resulted in a 1.4% decline for the wider Asia-Pacific region. On the flip side, global oil consumption increased by 0.9%, supported by increases in India (4.2%), the Middle East (1.28%), and the United States (0.3%). On the supply side, increased oil production from non-OPEC members has outstripped the production cuts implemented by OPEC+ in June 2024. US crude oil production reached a monthly record of 13.5 million barrels of oil per day in October 2024, while production from Guyana and Canada increased notably.

Preliminary data from the International Energy Agency (IEA) indicate that global consumption of natural gas increased by 2.8% year on year in 2024. Much of this increase came from the Asia-Pacific region, particularly in the industrial sector. On the supply side, Natural gas production increased by 1.4% in 2024. Additionally, LNG production increased by 2.5% in 2024, well below the 2016 – 2020 average of 8%. Project delays and feed gas supply constraints were the cause of the shortfall in LNG production. Despite these results, the average natural gas price for 2024 declined due to weak demand driving prices down in the first half of the year.

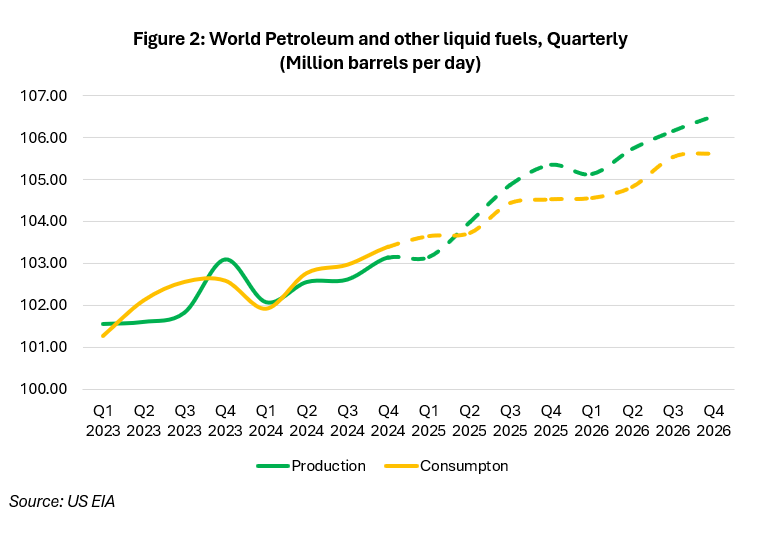

Already, 2025 is shaping up to be one of the most turbulent years for energy since the COVID-19 pandemic. Some key recent events include the ceasefire agreement for the Israel and Hamas War, OPEC+ delaying the decision to unwind supply cuts by three months, and US President Donald Trump’s executive order to “drill baby drill” set to significantly increase US oil and gas production. Global oil prices are expected to continue their decline as a result of global production growth outstripping the increase in global demand. Oil production is expected to increase by 1.4% as OPEC+ is expected to gradually unwind their production cuts, and non-OPEC oil production is expected to pick up, particularly in the US, Guyana, and Canada. Sanctions imposed by the US on 10 January 2025 against 183 Russian-controlled oil tankers, which will prohibit the access to US based petroleum services and order the winding down of transactions with Russia’s energy sector, may have an impact on global supply as Russia’s exports are affected. The US EIA forecasts the WTI oil price to average USD70 per barrel (2025), and USD62 per barrel (2026).

Global gas demand is expected to increase by 2.5% in 2025 according to the IEA, largely supported by the Asia region. Throughout the EU, substitution from Russian natural has increased overall demand and this is expected to persist throughout 2025 and 2026. This is coupled with declining natural gas inventories in the EU which the World Bank estimated to be 82% of capacity in December 2024. Natural gas demand in 2025 will also be driven up by the US supported by expectations of a colder winter season. On the supply side, natural gas production is forecasted to increase by 2.2% in 2025 as several projects come online, being outstripped by increased demand. These upward pressures will push the Henry Hub Natural gas price to average USD3.10 per MMBTU (2025), and USD4.00 per MMBTU (2026).

Renewable Energy

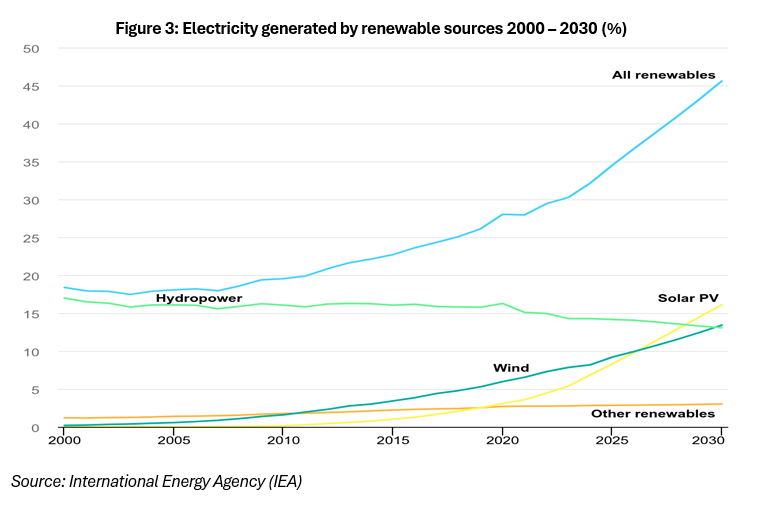

Renewable energy has made significant progress in supplying global energy demand, moving from 18% in 2000 to 30% in 2023 according to data from the IEA. Recent years of elevated inflation partly due to higher energy prices have seen governments across the globe seeking alternatives to traditional fossil fuels. Europe saw growth in renewable energy gaining significant momentum with the war in Ukraine in 2022 leading to the design of the REPowerEU plan. In the US, under the Biden administration, ambitious goals were set to achieve 80% energy generation in the US from renewable sources by 2030, with the full decarbonisation of electricity by 2035. It is unclear whether these goals will be revised with the new Trump administration, which has already pulled out of the Paris climate agreement and signed an executive order to significantly ramp up US energy production.

Renewable energy production has been and remains dominated by China, which produced roughly 37% of all global energy wind and solar energy in 2023. This momentum is expected to be maintained throughout the medium-term with the operationalization of several key projects. IEA forecasts show that China will produce 60% of global renewable energy by 2030.

Figure 3 shows the share of renewable energy sources in global electricity generation; renewable energy accounted for 30% of generated electricity in 2023, with hydropower remaining the largest source of renewable energy, making up 14.3% of global electricity in 2023, this was followed by wind (7.8%) and solar power (5.4%). Current forecasts see renewable energy contributing 46% of global electricity needs by 2030.

Trinidad and Tobago

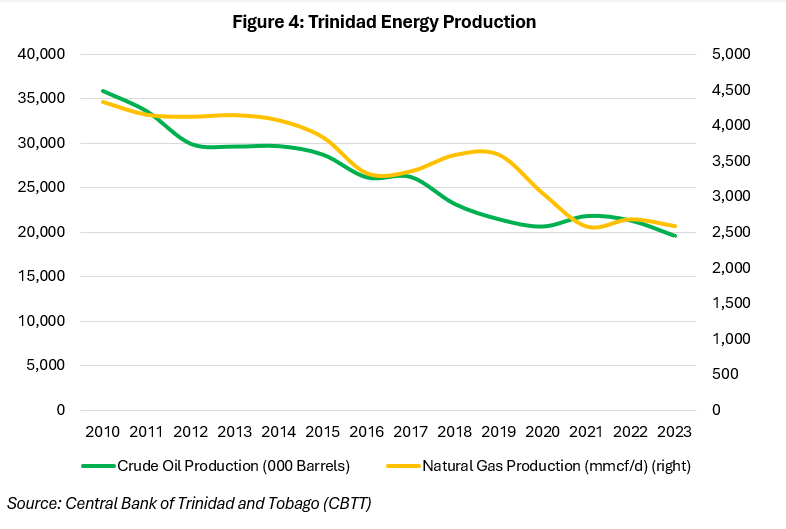

The energy sector of Trinidad & Tobago (T&T) continues to face challenges, with natural gas production estimated to have declined by 4.4% between January 2024 – September 2024. Oil production followed a similar trend, falling in the first nine months of 2024 by 8% when compared to the same period in 2023.

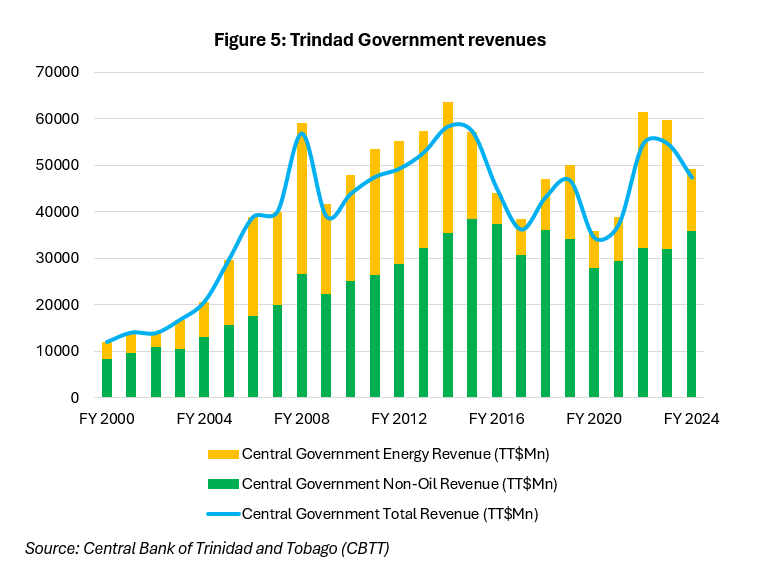

Energy revenues were also affected throughout 2024 because of lower prices, particularly in H1’24. Latest data from the CBTT indicates that Government energy revenues for the period January 2024 – July 2024 was 48.8% lower than the same period in 2023. This major shortfall in energy revenues was a factor contributing to Moody’s Ratings revising the outlook on T&T’s credit rating from Positive to Stable on 14 June 2024.

Looking ahead, medium-term outlook of T&T’s energy sector is mixed, with a more optimistic outlook for natural gas. Upcoming projects include:

- The Mento platform joint venture by bpTT and EOG Resources expected to bring first gas in 2025. The Mento field is estimated to contain around 1 trillion cubic feet of natural gas.

- The Cypre field operated by bpTT expected to bring first gas in 2025. The field is estimated to contain 1 trillion cubic feet of natural gas and the project will deliver up to 300 million cubic feet of gas per day at peak production.

- The Final Investment Decision for the Calypso field is expected as early as the end of 2025, should everything go as planned first gas is expected in 2027. The field is estimated to contain 3.5 trillion cubic feet of natural gas.

- The Coconut gas field, a joint venture between bpTT and EOG is expected to produce first gas in 2027. At the time of writing, specific estimates of the gas reserves in the Coconut field have not been made public.

- The Manatee gas field contains roughly 2.7 trillion cubic feet of natural gas and is operated by Shell Trinidad and Tobago Ltd. It is expected to start production in 2027.

- The Manakin-Cocuina field is expected to begin production in 2025. The field is being developed by bpTT and the National Gas Company of Trinidad and Tobago Limited (NGC); the field itself is a cross-border venture between Trinidad & Tobago and Venezuela.

- The Dragon Gas field is a joint venture between Shell Trinidad and Tobago and NGC on the cross-border project between Trinidad & Tobago and Venezuela. The current license granted by the US Office of Foreign Asset Control (OFAC) which grants the exploration and exploitation of the Dragon gas field is set to expire on 31 October 2025. Should the OFAC licence be renewed upon expiration, production is expected to begin in 2027 from the field. The Dragon field is estimated to contain 4.2 trillion cubic feet of natural gas.

Despite the planned projects, T&T will be directly affected by the increased supply that comes with higher US production. Added to this is a level of uncertainty surrounding both the Manakin-Cocuina, and Dragon Gas deals with the new Trump administration.

Conclusion

After a volatile 2024, global energy is set to experience another year of volatility as production from non-OPEC countries outweigh OPEC+ supply cuts. Added to this is the continued growing presence of renewable energies as countries continue to seek alternatives to fossil fuels. Declining prices will have a direct effect on the domestic economy given the dependence on the energy sector for economic activity and foreign exchange. Gains from increased production capacity through the operationalization of several energy projects over the next few years bode well for the outlook for the sector, however the industry may be faced with weaker international energy prices.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.