Economic Pandemonium- The Dutch Disease

Commentary

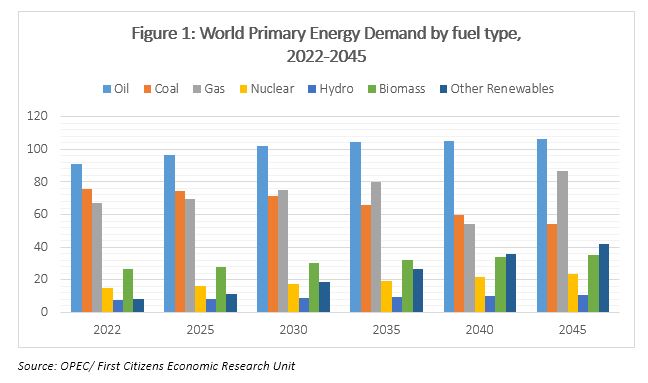

Oil, the lifeblood of modern economies, stands at a pivotal intersection. Despite the escalating momentum of renewable energy, the recent World Oil Outlook (WOO) published by the Organization of the Petroleum Exporting Countries (OPEC) depicts a scenario of potential increase in global oil demand when contrasted with alternative primary energy sources. Nevertheless, the prevailing pessimism in recent markets and weakened demand in key markets such as China introduce an air of uncertainty to this otherwise positive outlook. The projection envisions a 23% upswing in global oil demand by 2045, forecasting an increase from approximately 291 million barrels per day (mboe/d) to nearly 359mboe/d (refer to Figure 1)—an additional 68mboe/d. Yet, amid the optimism surrounding an era of oil-driven prosperity, a significant historical cautionary tale looms large: the Dutch Disease.

As nations anticipate potential economic windfalls from oil, the Dutch Disease emerges as a subtle menace, named after the Netherlands’ encounter with natural gas wealth. Envision a country suddenly inundated with petrodollars. Gross Domestic Product (GDP) soars, a sense of euphoria permeates, and dreams of boundless prosperity take hold. However, if not meticulously managed, this initial wealth surge can pose intricate economic challenges. The Dutch Disease, cautioned by the International Monetary Fund, delineates the complex process wherein a resource boom diminishes non-resource sectors.

In layman’s terms, with the influx of oil wealth, the national currency appreciates. This, akin to a reverse Midas touch, renders exports from other sectors—like manufacturing and agriculture—less competitive globally. These pivotal industries falter, leading to job losses and creating gaps in the economic structure. Amid oil abundance, governments might overlook diversification, fostering an economy dangerously reliant on a finite natural resource. This downward spiral places a nation on the brink of an economic precipice, destined for a painful descent when the oil well eventually dries up.

For nations sitting on vast oil wealth, the challenge goes beyond counting barrels. It is about strategic foresight – how to smartly wield this double-edged sword for lasting prosperity. Many countries have unfortunately not been able to avoid the Dutch Disease risks and to diversify their economies with shrewd moves to foster sustainable growth and development.

From a petro-paradise to a pauperized nation…

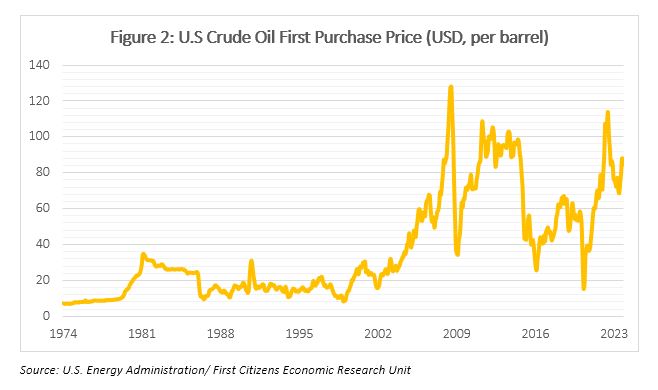

Despite boasting one of the world’s largest proven oil reserves, Venezuela’s current economic situation emphasizes the vital need for responsible resource management and economic diversification. Venezuela’s energy sector represents around 95% of export earnings and contributes to a quarter of the country’s GDP according to the World Bank, highlighting the precarious dependence on a single and very volatile industry. The 2000s witnessed a significant surge in oil prices, exceeding USD100 per barrel in 2014, resulting in substantial windfalls for the country according to data from the U.S. Energy Information Administration (EIA). The windfall revenue resulted in a significant increase in government spending, particularly in social programs and further deepening the nation’s dependency on oil. However, the subsequent decline in oil prices, dropping to under USD30 per barrel in early 2016, severely squeezed the economy and was the main catalyst of Venezuela’s social unrest. (see Figure 2).

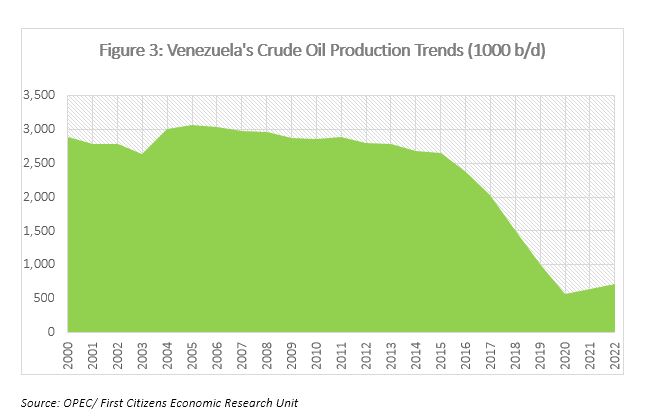

The plunge in oil production, a result of insufficient investment and maintenance, was severe, dropping from an average of three million barrels per day to a mere 800,000 barrels per month by 2019 (refer to Figure 3), reflecting a 70% decline according to OPEC.

Beyond production challenges, Venezuela’s reliance on oil had additional detrimental effects. The initial oil boom flooded the nation with foreign currency, causing the Venezuelan Bolivar to appreciate, a fundamental characteristic of the dreaded Dutch Disease. Consequently, this made other exports, such as agricultural goods, less competitive on the global stage, which intensified the economic crisis.

Venezuela has undergone a severe aftermath, experiencing the most substantial economic decline in the history of the Western Hemisphere. The populace has struggled with rampant hyperinflation, widespread poverty, and shortages of essential goods. Nevertheless, recent indications point towards a potential economic recovery, with a projected 5% GDP growth in 2023, set to increase to 8% in 2024 according to Venezuela’s President, Nicolas Maduro. This coincides with signs of improved relations between the United States and Venezuela. Despite these positive developments, Venezuela’s situation serves as a stark reminder of the inherent risks associated with the Dutch Disease.

Norway’s Success Story…

Diverging from Venezuela’s cautionary narrative, Norway emerges as a compelling example of effectively sidestepping the pitfalls associated with the Dutch Disease. In the 1960s, the discovery of substantial oil and gas reserves in the North Sea propelled Norway into a formidable oil powerhouse, contributing around 22% to its GDP by 2022.

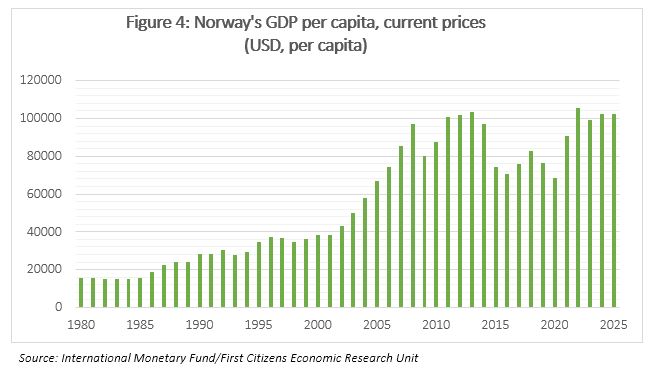

Rather than succumbing to impulsive spending, Norway strategically diversified its economy by nurturing sectors such as technology, fisheries, renewable energy, and tourism. The diversification efforts further underscore Norway’s resilience and prudence, evident in its impressive GDP per capita of USD105,825.9 as of 2022 (refer to Figure 4), ranking among the highest globally, and an exceptionally low unemployment rate of 3.4%. By taking these prudent measures, Norway not only successfully navigated the challenges posed by the Dutch Disease but also fortified its competitiveness, laying the foundation for enduring economic prosperity.

Another pivotal move in Norway’s success was the 1990 establishment of the Government Pension Fund Global (GPFG), the country’s sovereign wealth fund (SWF). Fitch Ratings reports the GPFG’s current value exceeds USD1.3tn, acting as a crucial shock absorber shielding Norway’s economy from unpredictable fluctuations in global oil prices while ensuring long-term savings. This sovereign wealth fund, became the cornerstone of Norway’s success, sequestering the majority of oil revenue. By preventing direct currency inflation and undermining non-oil sectors, the GPFG acts as an intergenerational wealth fund, ensuring prosperity beyond oil’s lifespan. In essence, Norway’s strategic diversification and the establishment of the GPFG collectively form a resilient economic framework that mitigated the impact of the Dutch Disease and secured long-term prosperity.

Guyana’s Balancing Act in the Face of Oil Wealth…

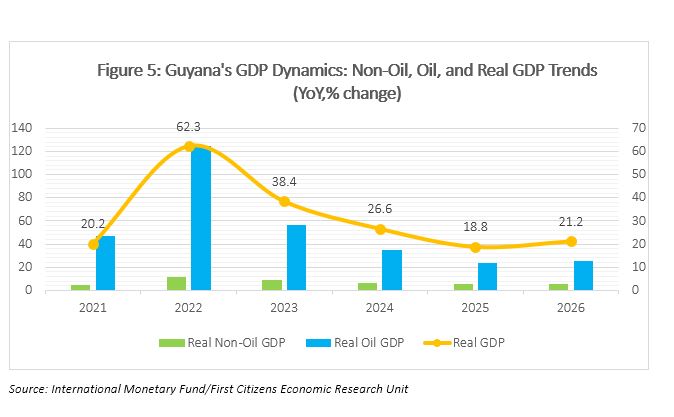

Guyana envisions a remarkable 26.6% surge in GDP for 2024 (refer to Figure 5), following a significant 38.4% upswing in 2023, positioning the country to attain middle-income status according to the latest IMF projections. With escalating oil output, spot markets for Guyana’s crude grades like Payara, Liza, and Unity Gold have flourished. European refiners actively seek these crude grades, introducing a competitive dynamic, particularly against local grades such as Norway’s Johan Sverdrup crude. Projections suggest that production is anticipated to reach approximately 620,000 b/d at Payara’s maximum capacity, exceeding 1.2 million b/d by 2028, according to Standards and Poor’s. However, as the nation navigates this journey drawing valuable lessons from both success stories and cautionary tales will be critical.

To counter the risk of Dutch Disease, the World Bank advocates for diversification, emphasizing the need to broaden the variety of exports, products, and assets within the economy. The institution also recommends the establishment of a Sovereign Wealth Fund if resource rents are expected to persist long-term. In response to this, the Guyanese Government has implemented prudent measures, including amending the Natural Resource Fund Act and prioritizing education and human capital development. These measures underline a commitment to responsible resource management, taking a proactive stance to mitigate potential pitfalls associated with sudden resource wealth.

Actively pursuing diversification, Guyana has signalled its continued focus on agricultural expansion. According to the Economic Commission for Latin America and the Caribbean (ECLAC), the agriculture, forestry, and fishing sector expanded by a 10.9% in the initial six months of 2022, and a further increase of 11.9% by the end of the same year. Additionally, Guyana leads the regional charge, urging CARICOM to reduce its food import bill by 25% within the next three years. In February 2024, Guyana’s President indicated that the Enmore Sugar Estate, which was closed in 2018 will be converted into a sugar refinery, with the revitalization of the sugar industry an area of focus for the current government.

While Guyana is diligently working to avoid succumbing to the Dutch Disease and the condition is not yet present, these strategic measures and forward-thinking initiatives position the country to navigate the complexities associated with newfound oil wealth. As Guyana charts its economic course, their ongoing commitment to diversification and responsible resource management form the cornerstone of the country’s resilience, paving the way for sustained prosperity beyond the challenges of the Dutch Disease.

Conclusion

In summary, as global oil demand grows, countries face the challenge of managing energy windfalls without succumbing to the pitfalls of the Dutch Disease. While Venezuela serves as a cautionary tale of over-reliance on oil, Norway exemplifies successful diversification and strategic wealth management. Guyana, with a projected economic upswing, stands at a crucial juncture. Can it learn from the experiences of other countries to navigate the complexities of oil wealth, avoiding the Dutch Disease and ensuring sustainable development and prosperity? With optimism for Guyana’s future, the potential for sustainable growth radiates with promise, igniting a beacon of hope inspired by insights drawn from global experiences.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.