Fourth Quarter of 2023 Review

Commentary

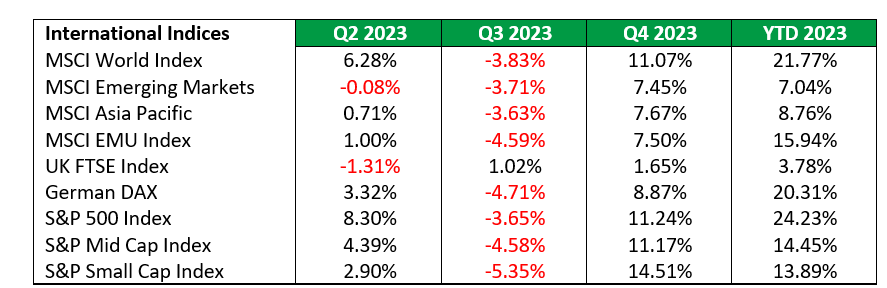

Following a lacklustre performance in the third quarter of 2023, global equities staged a robust comeback in the fourth quarter. This resurgence was fuelled by a rally in November and December, attributed to a worldwide easing of inflationary pressures and growing optimism about potential future interest rate cuts. Developed markets spearheaded the rally, while emerging markets faced challenges stemming from persistent concerns over China’s real estate sector and the ensuing economic deceleration in the Chinese economy. The MSCI World Index, a gauge of global stocks, recorded a noteworthy quarterly return of 11.07% in Q4 2023, a significant rebound from the 3.83% loss experienced in Q3 2023. Looking at the entire year, the index registered a gain of 21.77%, marking a notable turnaround from the 19.46% loss incurred in 2022.

US

After experiencing a downturn in the third quarter of 2023, marked by a 3.83% quarterly loss, US equities recovered impressively in Q4 2023. Investor confidence grew as inflation in the US subsided, with the Consumer Price Index (CPI) slowing from 3.7% in September to 3.1% by December 2023. This decline in consumer prices reinforced market expectations that the US Federal Reserve (Fed) may conclude its interest rate hiking cycle and might consider rate cuts in 2024. The Fed indeed met investor expectations by maintaining the policy rate within the 5.25% to 5.50% range during both the November and December 2023 meetings. Positive third-quarter economic data and business activity further supported US stocks, with the economy expanding by 5.2% year on year in Q3 2023, compared to 2.1% growth in Q2 2023.

The S&P 500 index posted substantial gains in Q4 2023, recording a return of 11.07%, a significant improvement from the 3.65% loss in Q3 2023. This quarterly return marked the highest for the entire year. On a year-to-date basis, the S&P 500 generated an impressive return of 24.23% by the end of December 2023, in stark contrast to the 19.44% loss experienced in 2022.

A notable portion of the gains achieved in 2023 was attributed to seven technology companies (termed the Magnificent Seven), constituting approximately 30% of the S&P 500 index, as indicated by Goldman Sachs Global Investment Research. The surge in stock prices was propelled by the proliferation of Generative Artificial Intelligence (AI) and Large Language Models (LLMs). The group, consisting of Apple, Alphabet (Google), Amazon, Meta Platforms (Facebook), Microsoft, Nvidia, and Tesla, contributed roughly 60% to the S&P 500’s annual gains in 2023.

In terms of market capitalization, small-cap stocks, which had lagged for the first nine months of the year, outperformed large-cap and mid-cap stocks in the last quarter. The Small Cap index recorded a gain of 14.51% in Q4 2023, while the Mid Cap Index achieved a return of 11.17%.

Europe

In the last quarter, European stocks increased as inflationary pressures eased more than anticipated, and there was increased optimism about potential interest rate cuts in 2024. The MSCI European and Economic Monetary Union (EMU) Index saw a notable climb of 7.50% in Q4 2023 compared to the 4.59% loss in the preceding quarter. Over the entire year, the index recorded a substantial increase of 15.94%, marking a turnaround from the 25.45% decline in 2022.

Within the Euro-zone, consumer prices exhibited a sharp decrease to 3.2% year on year in December 2023, down from 4.3% in September 2023. Aligning with the Federal Reserve’s approach, the European Central Bank (ECB) opted to keep its key interest rate unchanged during its December 2023 meeting. This decision marked a pause after a series of 10 consecutive rate hikes from July 2022 to September 2023.

The Eurozone grappled with adverse effects from high interest rates, witnessing a contraction of 0.10% quarter on quarter in Q3 2023. Concurrently, the region’s manufacturing activity experienced a downturn, as reflected in the purchasing managers’ index (PMI) dropping to 47.0 in December. A PMI reading below 50 indicates contraction, while a reading above 50 signals expansion. At its December 2023 meeting, the European Central Bank (ECB) revised its economic growth forecast, now projecting the Eurozone to grow by 0.60% in 2023 and 0.80% in 2024. This revision marked a downward adjustment from the September 2023 projections, attributed to tight financing conditions, the negative impact on loan growth and heightened consumer uncertainty.

UK equities increased over the quarter but lagged several developed regions, with the FTSE 100 index increasing by 1.65% over the fourth quarter of 2023, slightly up from 1.02% achieved in Q3 2023. For the year, UK equities posted a return of 3.78% compared with a 25.45% loss in 2022. Despite inflation easing, with the CPI falling to 3.9% in December 2023, down from 6.7% in September, UK equities were negatively impacted by the economic uncertainty as the economy teeters on the edge of recession, as GDP contracted by 0.10% quarter on quarter for Q3 2023.

Emerging Markets

The downward trajectory of emerging market equities that prevailed in the second and third quarter of 2023 reversed in the last quarter as the MSCI Emerging Markets Index increased by 7.45%. This turnaround was fueled by robust rallies in stocks from India, Taiwan, South Korea, Brazil, and Mexico.

Indian equities recorded substantial gains against a backdrop of moderating inflation and a strong performance by the ruling Bharatiya Janata Party in key state elections. Taiwan and South Korea benefitted from heightened enthusiasm surrounding artificial intelligence, as both countries are major producers of the high-performance AI chips which are crucial for these technologies. Brazil’s outperformance was attributed to slowing inflation and the resulting reduction in policy rates by the central bank.

Poland’s equities also saw a surge in the quarter, responding positively to the election of Donald Tusk as prime minister, leading a pro-EU liberal coalition government. This marked the end of the eight-year rule by the populist Law & Justice (PiS) party.

US Treasury Yields

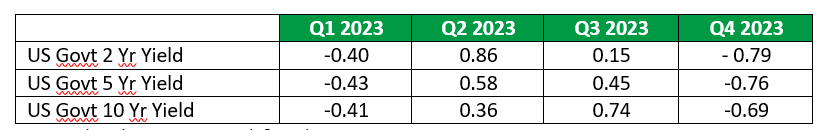

The perceived shift from a more restrictive monetary stance to the prospect of future rate cuts had a positive impact on fixed income markets. Reinforcing this anticipation was the Federal Reserve’s decision to maintain unchanged rates throughout the quarter and the adjusted dot plot, a chart illustrating Federal Open Market Committee (FOMC) projections for the federal funds rate. The dot plot now indicates an expectation of three rate cuts for 2024, an increase from the previously projected two. As a result, yields on US government bonds experienced a widespread decline in the quarter. In Q4 2023, the US 2-year, 5-year, and 10-year yields dropped by 79, 76, and 69 basis points, respectively.

International Stock Indices

Quarterly Change in US Treasury Yields

US Sector Performance

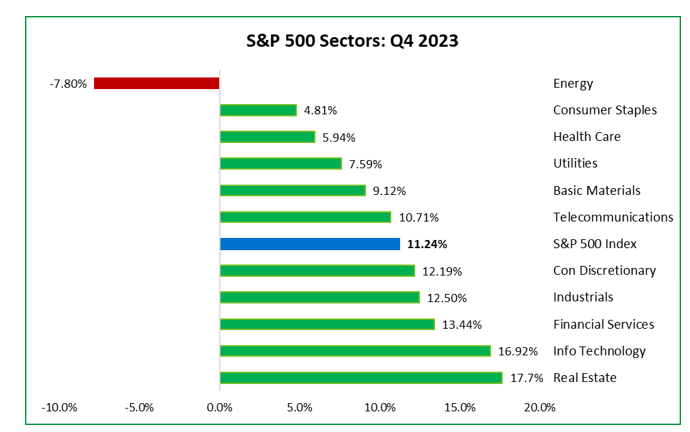

From a sectoral standpoint, Energy emerged as the worst performer, being the sole sector to experience a decline in the quarter. The Energy index dropped by 7.80% in Q4 2023, in contrast to gains in the other 10 sectors. Real Estate led with a 16.92% increase, followed by Information Technology (13.44%) and Industrials (12.50%).

Energy stocks faced challenges due to a significant drop in prices for natural gas and crude oil as the sector was adversely affected by surplus supply, resulting from record production in the US, Brazil and Guyana, coupled with an economic slowdown in several major economies, including Europe and China. The West Texas Index (WTI) crude experienced a substantial 21% decline in Q4 2023, sliding from US$90.79 at the end of September to US$71.65 by the close of December 2023, following a 29% gain in Q3 2023.

US Sector Performance: Q4 2023

Local Market Review

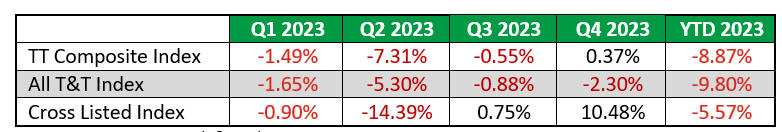

The Cross Listed index sustained its upward momentum in the fourth quarter, achieving a quarterly return of 10.48%, up sharply from the 0.75% recorded in the previous quarter. The T&T Composite Index saw a gain of 0.37% in Q4 2023, marking a positive shift after experiencing consecutive losses in the preceding three quarters. Conversely, the All T&T Index continued its downward trend, reporting a quarterly loss of 2.30%. For the year, all indices registered their second consecutive losses, with the All T&T Index leading with 9.80%, followed by the TT Composite Index with 8.87%, and the Cross Listed index with 5.57%.

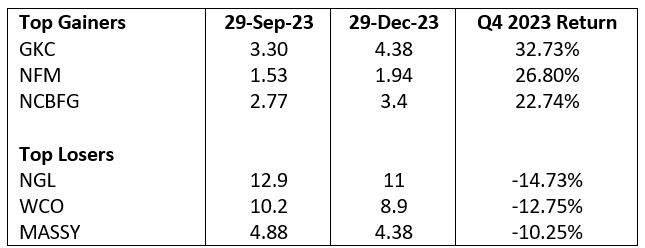

The stocks that exhibited the most significant share price gains during the three-month period ending December 2023 were GraceKennedy Limited (GKC), National Flour Mills (NFM), and NCB Financial Group (NCBFG) with returns of 32.73%, 26.80%, and 22.74%, respectively. Leading the declines were Trinidad & Tobago NGL (NGL), West Indies Tobacco Company (WCO), and Massy Holdings Limited (MASSY) with returns of 14.73%, 12.75%, and 10.25%, respectively.

Local Stock Indices

Top Gainers and Losers

Capital Markets Outlook

The world economy is projected to slowdown in 2024, primarily influenced by elevated interest rates. Nevertheless, there is optimism regarding the anticipation of future interest rate cuts, which could prove beneficial for both households and businesses, positively impacting corporate earnings.

However, amidst these optimistic prospects, there loom significant challenges that could potentially dampen growth. Elevated geopolitical risks, fuelled by ongoing conflicts and impending national elections in numerous countries, including the US, cast shadows over the outlook.

The latest risk emerged in November 2023 with attacks by Iran-backed Houthi militants on commercial vessels in the Red Sea and Suez Canal which have disrupted global trade. The Red Sea shipping route via the Suez Canal is the quickest, most cost-effective means to connect Asia and parts of Africa to Europe. Additionally, this route facilitates oil shipments from the Gulf to North America. The Red Sea’s importance as a trade route also increased as the Panama Canal has been challenged by severe drought conditions.

In response to the ongoing attacks, numerous shipping firms have halted operations in the Red Sea, choosing longer routes around the Cape of Good Hope. However, this diversion entails a two-week delay, potential bottlenecks, potential shortages and additional costs. Notably, companies such as France’s CMA CGM have already doubled their shipping rates. As a result, there is a significant likelihood of a resurgence in inflationary pressures in 2024, which could hinder central banks’ plans to reduce interest rates.

In the midst of ongoing uncertainty, investors must remain vigilant to economic and market risks and prudently manage their portfolio’s risk and return objectives. It is crucial to concentrate on establishing and maintaining a well-balanced portfolio capable of withstanding unforeseen market surprises and fluctuations. Through these measures, investors can better position themselves to navigate the uncertainties and potential challenges that may arise in the future.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.