Geopolitical Fragmentation

Commentary

An unprecedented reversal of global integration can have severe repercussions for the global economy. It can lead to a decline in economic interconnectivity, a surge in transportation and communication cost because of increased barriers to trade and companies, which previously employed outsourcing as a cost cutting measure, would now face the challenge of managing these costs domestically. Further, the competitive edge that globalization once offered would be diminished, eroding the economic efficiencies that businesses relied upon for decades. Globalization, a concept that took root between 1870 and 1914, revolutionized international economic activity by opening doors to resources and labour at the most competitive prices worldwide. This system benefited both producers and consumers as goods and services were not only affordable but could be easily accessed globally. However, today, while there is no definitive proof that the world is veering toward complete de-globalization, the seamless global integration once taken for granted is under pressure. Geopolitical tensions are casting shadows over the free flow of trade and capital, challenging the foundations of international economic cooperation and growth.

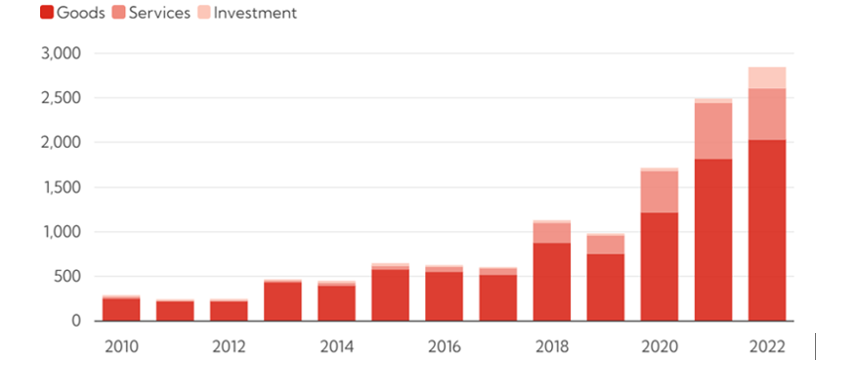

Figure 1: Number Of Trade Restrictions Imposed Annually Worldwide

Source: Global Trade Alert and IMF

What is Geopolitical Fragmentation?

According to International Monetary Fund (IMF), and the Centre for Economic Policy Research (CEPR), geopolitical fragmentation refers to the process where global cooperation and integration diminish, leading to the formation of distinct political and economic blocs. This fragmentation is often driven by geopolitical tensions, trade conflicts, and differing political ideologies among countries. It can manifest in various forms, including increased trade barriers, restrictions on technology transfer, and reduced international cooperation on global issues like climate change and debt management. Within the past decade, geopolitical fragmentation has increased drastically, largely due to the US-China Trade Disagreements, Russia- Ukraine war, Brexit, and the COVID-19 pandemic. The year 2024, holds significant uncertainty as geopolitical risks are high due to several significant countries such as United States (US), India, European Union (EU), Canada and South Africa due for elections, as well as several conflicts including the war in Ukraine, and Israel and Hamas in the Middle East.

Evidence of Geopolitical fragmentation:

US – China Relations: The ongoing trade tensions between the US and China, which began with the 2018-2019 tariff war, have continued to escalate into 2024. In a move announced on May 14, 2024, President Joe Biden stated that the US would impose additional tariffs on USD18 billion worth of Chinese goods, including vehicles, batteries, semiconductors, steel, aluminium, critical minerals, solar cells, ship-to-shore cranes, and medical products. These tariffs are in addition to the existing Trump-era tariffs on over USD300 billion in goods. The primary reasons cited for these measures are to protect national security and prevent supply chain disruptions.

In response, China launched anti-dumping investigations into key engineering chemicals imported from the US and the EU. Additionally, Beijing sold off US Treasuries, reduced agricultural imports from the US, and threatened to restrict market access for major firms like Apple and Tesla. China is also considering export controls on critical minerals, further intensifying the economic standoff.

Both the US and China are actively seeking to reduce their economic interdependence. The US is particularly focused on reshoring chip production and is heavily subsidizing this effort. Currently, South Korea, Taiwan, and China collectively account for about 70% of global semiconductor production. By increasing domestic production, the US aims to boost its share of this critical industry and reduce its reliance on imported semiconductors.

China, on the other hand, is diversifying its trade relationships to mitigate the impact of US tariffs. According to the Peterson Institute for International Economics, China has sought alternative markets for its agricultural imports. Additionally, China has ratified its participation in the Regional Comprehensive Economic Partnership (RCEP), the world’s largest free trade area by market size, and has applied to join the Comprehensive and Progressive Trans-Pacific Partnership (CPTPP). Both trade blocs provide China with access to new markets, none of which include the US.

Brexit (2016-Present) – Brexit is the United Kingdom’s (UK) withdrawal from the EU, which formally occurred on January 31, 2020. Prior to Brexit, the UK was part of the EU’s single market and customs union. The membership allowed for singe market membership which granted the advantage of free movement of goods, services, capital and people. Within the union there were no tariffs, quotas, or customs checks on goods traded between the UK and EU member states. Since the exit of the UK from the EU, trade has been governed by the Trade and Co-operation Agreement. This agreement allows for tariff-free trade between the UK and EU; however, non-tariffs is said to have peaked to an all-time high. The “red tape” which includes export declarations, documentary requirements, product standards and inspection requirements have led to complexity when it comes to trade between the two countries.

Russia-Ukraine War (2022-Present) – The ongoing Russia-Ukraine war, which began in February 2022, was a pivotal moment in geopolitical fragmentation, particularly as economic and financial ties between Russia and the West were severed. The G7 nations have responded by extending additional support to Ukraine, leveraging earnings from frozen Russian central bank assets. Russia, in turn, has sought significant military support from Iran and North Korea, alongside substantial financial backing from China. Reflecting Russia’s pivot to the East, Chinese exports to Russia surged by 64% in 2023 compared to 2021, including components crucial for arms production such as machine tools, chips, telecommunications equipment, and optical devices. Trade in military and dual-use technologies between China and Russia has increased dramatically, rising from 32% in 2021 to 89% in 2023. Meanwhile, the West has ramped up its sanctions, with the US, UK, EU, Australia, Canada, and Japan imposing over 16,500 sanctions on Russia. These measures include freezing around USD350 billion (EUR276 billion) of Russia’s foreign currency reserves, which is approximately half of its total reserves. Additionally, about 70% of Russian banks’ assets were frozen, and some were excluded from the SWIFT payment system, further isolating Russia from global financial networks.

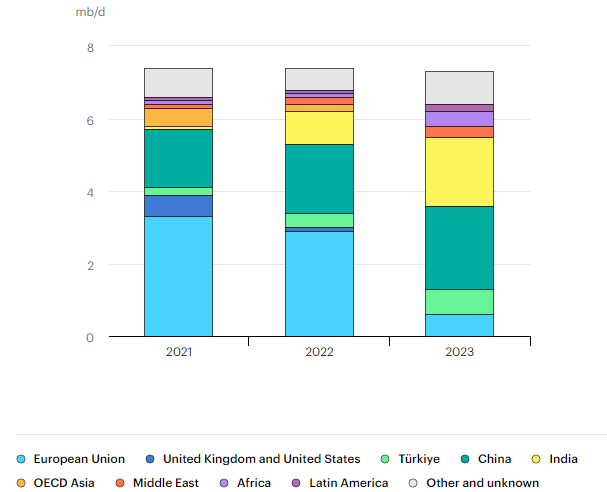

It must be noted that Russia’s oil industry was a main focus for limiting trade. Russian oil faced a formal oil embargo which took effect March 2023. Since early 2022, shipments from Russia to the EU and the US have plummeted significantly. The EU banned seaborne crude oil imports starting on December 5, 2022, while the US banned all imports of oil and petroleum products from Russia as of March 8, 2022. Further tightening the economic noose, the G7 and Australia imposed a price cap of USD60.00 per barrel from December 5, 2022, aiming to curb Russia’s energy export revenues, which constitute its largest source of income. Facing these restrictions, Russia redirected its oil shipments to markets in China, India, Turkey, Egypt, and the United Arab Emirates, with China becoming the largest importer, purchasing approximately EUR178 billion worth of Russian oil as of May 2024. This strategic shift underscores the geopolitical realignments that have enabled Russia to sustain its revenue streams and diminish the West’s control over its economic lifelines.

Figure 2: Average Russian Oil exports by country and region (2021-2023)

Source: International Energy Agency

Geopolitical Fragmentation and trade.

Globalization has led to substantial increases in global trade volumes, with trade expanding approximately forty-five times from its early post-World War II levels, marking phenomenal growth of 4500% from 1950 to 2022, as reported by the World Trade Organization (WTO). This expansion has been positively correlated with the rising interconnectivity in global trade, demonstrated by the consistent upward trend in the US dollar value of global merchandise trade. In 1990, total value of exports was valued at approximately USD1.4 billion. By 2023, this figure had surged to USD23.8trillion, underpinned by greater market access, faster technological innovation, and deeper economic integration and cooperation.

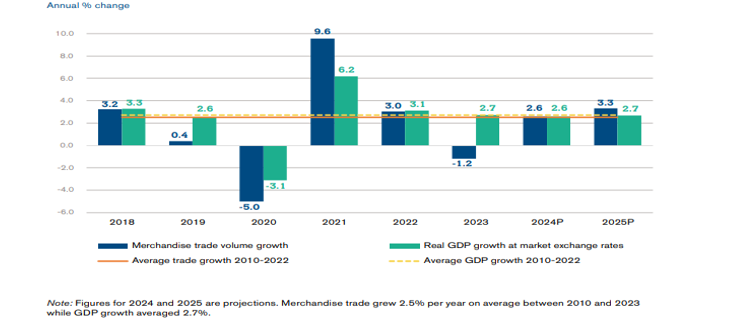

Despite this remarkable growth, global trade has faced headwinds, and in 2023, merchandise exports contracted by 4.5% compared to the previous year. This decline can be attributed to several factors: geopolitical tensions, particularly between major economies, increasing protectionist policies and trade barriers, disruptions in key global shipping routes (such as the Red Sea), and volatility in exchange rates. These challenges have underscored the vulnerability of global trade networks to external shocks, even as globalization has expanded the scale of international commerce.

According to the Global Trade Outlook and Statistics released in April 2024, “many countries have responded by becoming more sceptical about the benefits of trade, leading some governments to take steps toward re-shoring production and shifting trade toward more friendly nations.” This shift is likely to impact trade patterns and overall output. As fragmentation increases, greater international trade restrictions could potentially reduce global economic output by up to 7% over the long term, which amounts to about USD7.4 trillion, as reported by the IMF.

Figure 3: World merchandise trade volume and GDP growth (2018-2025)

Source: WTO for merchandise trade volume and consensus estimates for GDP

In conclusion, geopolitical tension is poised to reshape the global economic landscape. It presents several disadvantages to countries, economies and global stability. Its effects can be long-lasting in varying facets of a country creating economic instability, supply chain disruptions, social and political unrest and a reduction in investments. In 2024, a year that is categorized as, “The Ultimate Election Year” with at least 70 countries carded to hold national elections, which is approximately 44% of the world’s population, geopolitical tensions amongst countries will remain a major concern and a phenomenon that is constantly evolving.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.