How Central Bank Policies affect Stock Markets

Commentary

What are Central Banks and their role in the Economy?

The first central bank interest rate moves of 2025 suggest it will be a year where some important heavyweights, in both the developed and emerging parts of the world, travel in different directions for a while.

Central banks are government institutions responsible for managing a country’s money supply, currency, and interest rates to ensure economic stability. Their primary objectives include maintaining low inflation and supporting steady economic growth. Additionally, central banks often have broader goals such as managing unemployment rates, maintaining exchange rate stability, and promoting overall financial stability to foster a healthy economic environment. Major central banks, such as the U.S. Federal Reserve (Fed), the European Central Bank (ECB), and the Bank of Japan (BoJ), have a significant impact not only on their own economies but also on financial markets worldwide. Their policies shape stock market movements, investment trends, and the flow of money across borders. This global influence exists because economies today are more connected than ever. Globalization has increased trade, foreign investment, and business expansion across countries, leading to a highly integrated financial system. By adjusting interest rates and controlling the flow of money, Central Banks directly influence borrowing costs, consumer spending, and business investment. Lower interest rates encourage economic expansion by making credit more affordable, stimulating job creation and corporate growth. Conversely, higher rates help curb inflation but can slow down economic activity by making borrowing more expensive. These policy decisions shape the overall economic cycle, affecting everything from household budgets and corporate earnings to stock market trends and global trade flows.

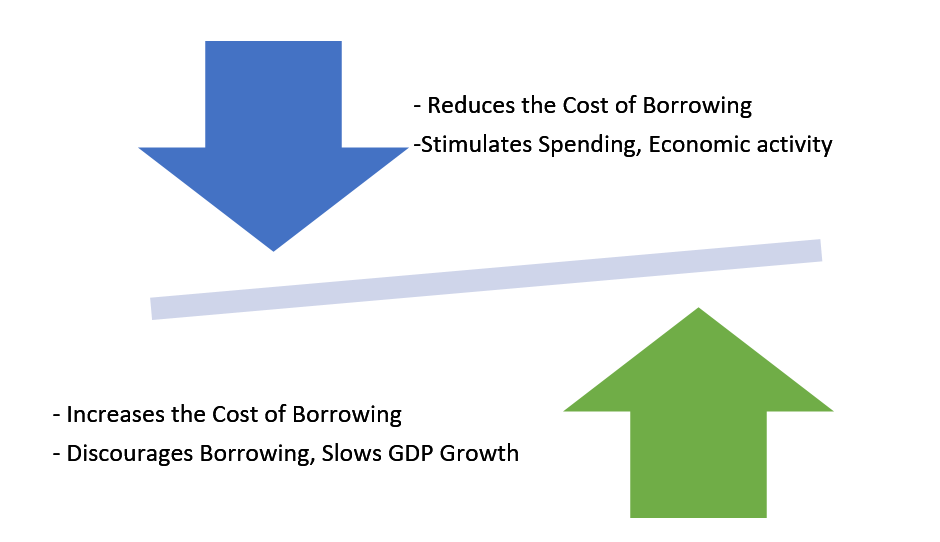

Interest Rate Adjustment

Adjusting Interest Rates and the impact of Stocks

One of the most influential tools central banks use to steer the economy is policy interest rate adjustments. Interest rates determine the cost of borrowing, directly impacting business investments, consumer spending, and financial markets.

In the U.S., for instance, the Federal Reserve (Fed) sets the federal funds rate, which serves as the benchmark for borrowing costs across the economy, including corporate loans, mortgages, and credit lines. The federal funds rate is the interest rate at which banks in the United States lend and borrow money from each other overnight and is set by the Federal Open Market Committee (FOMC). When the Fed lowers the Fed funds rate, borrowing becomes more attractive, theoretically encouraging businesses to expand, invest in capital projects, and hire more employees. Consumers also benefit from lower financing costs, driving increased spending on homes, vehicles, and other large purchases. As corporate earnings grow, equities tend to perform well, while lower bond yields often push investors toward riskier assets, such as equities, further supporting stock market gains.

Conversely, when central banks raise interest rates, borrowing costs increase, which can slow corporate expansion and dampen consumer demand. Higher rates typically compress corporate margins, impact dividend distributions, and lead to lower valuations in equity markets. At the same time, rising bond yields make fixed-income securities more attractive, prompting capital reallocation away from equities.

For investors, understanding the direction of monetary policy is essential for portfolio positioning. Rate cuts can create a favourable environment for equities and alternative investments, while rate hikes may warrant a shift toward fixed income or defensive asset classes. Ultimately, central bank decisions shape liquidity conditions, risk premiums, and market sentiment, reinforcing the importance of strategic asset allocation in response to evolving monetary policy.

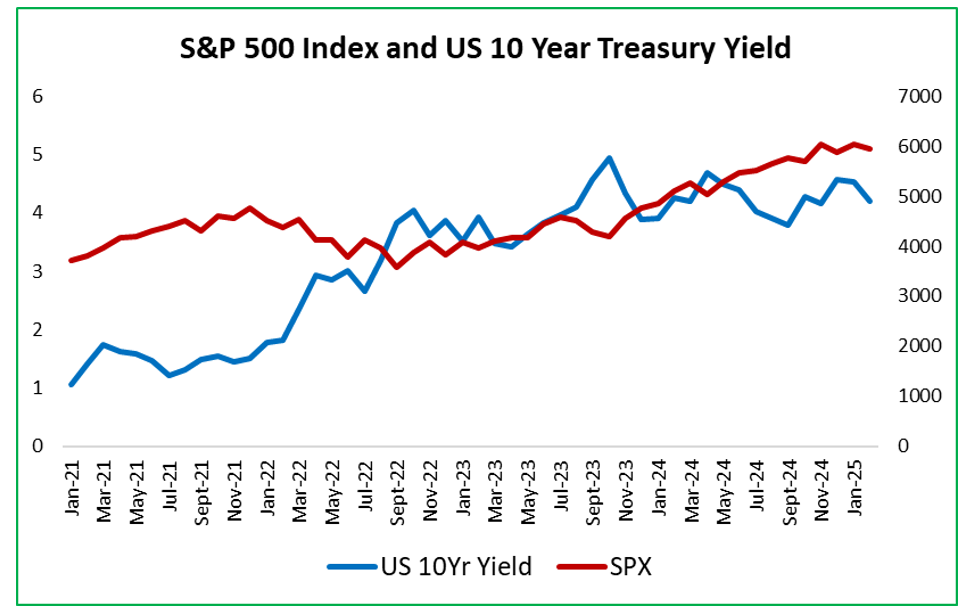

S&P 500 Index vs U.S 10 Year Treasury Yield

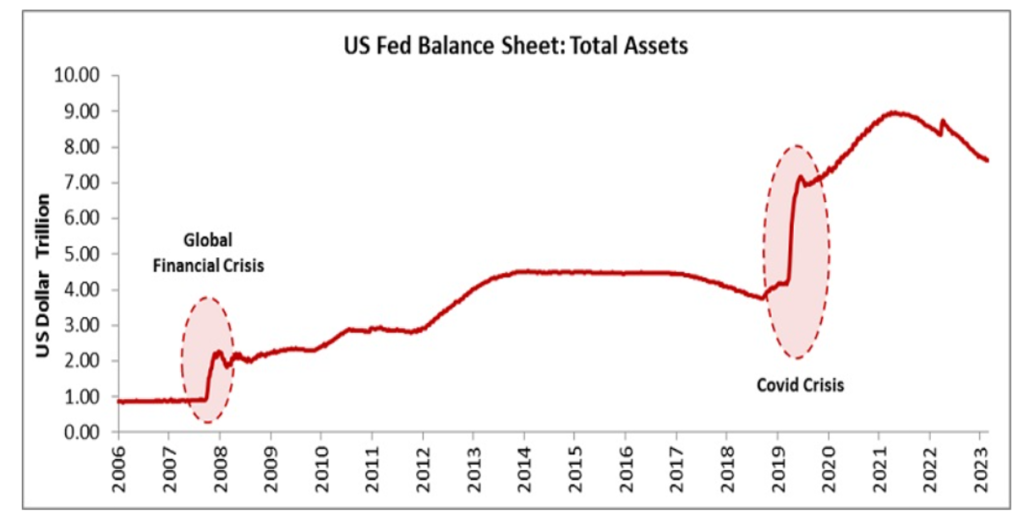

QE and QT and the impact of Stocks

Quantitative easing (QE) is when a central bank buys large amounts of financial assets, such as government bonds, to increase the amount of money in the financial system. This makes borrowing cheaper because it pushes interest rates lower, encouraging businesses to invest and expand. As companies grow and earn higher profits, stock prices often rise because investors become more confident in the economy. QE is typically used during economic downturns to stimulate growth. In 2008 with the global financial crisis and in 2020 for the COVID-19 pandemic, many countries utilized QE in an effort to stabilize their economies.

Quantitative tightening (QT) is the opposite of QE. Instead of buying assets, the central bank sells bonds or lets them mature without reinvesting. This reduces the money supply, causing interest rates to rise, making borrowing more expensive for businesses and consumers. As a result, companies may slow down expansion, leading to lower corporate profits and stock prices. QT is usually used when the economy is growing too fast, and inflation needs to be controlled.

U.S Federal Reserve Balance Sheet: Total Assets

Central Bank Guidance, Investor Expectations and Market Volatility

Central banks also use forward guidance, a communication tool that helps shape expectations about future interest rates and monetary policy decisions. This is important because stock markets react not only to what central banks do today but also to what investors expect them to do in the future.

The Federal Reserve’s stance in late 2023 serves as a strong example of how central bank communications and policy signals can significantly influence market sentiment and investor behaviour. As inflation pressures began to ease, Fed officials signalled that rate cuts could be expected in 2024. This sentiment resulted in stock market rallies, as investors positioned themselves for a more accommodative monetary environment. The S&P 500 gained approximately 24% in 2023, fuelled in part by these expectations. Conversely, when Central Banks suggest tightening policy ranges, as seen in 2022 when the Fed indicated aggressive rate hikes to combat inflation markets experience sharp selloffs. That year, the S&P 500 declined by approximately 19.4%, reflecting investor concerns over rising borrowing costs and slower economic growth.

Investors closely monitor economic data releases such as inflation rates, employment reports, and GDP growth to gauge how central banks might respond. If policymakers hint at maintaining low interest rates, risk appetite tends to increase, leading to higher equity investments. On the other hand, when central banks indicate a more restrictive stance, investors often shift toward fixed-income securities and defensive sectors, reducing exposure to high-growth, rate sensitive stocks.

However, when central banks deviate from market expectations, volatility can spike. For example, in September 2023, the Fed’s decision to maintain rates higher for longer caught some investors off guard, leading to a sharp market correction. Bond yields surged, and equity markets faced increased pressure as investors recalibrated their portfolios. This underscores the importance of a clear and consistent central bank communication policy approach which reduces uncertainty and helps markets adjust gradually, preventing sudden swings in asset prices.

Since markets are highly sensitive to expectations, any unexpected policy shift—such as an interest rate hike when investors expected rates to stay unchanged, can trigger sharp market reactions. If investors feel caught off guard, they may rush to sell stocks, leading to a market sell-off and increased volatility. By providing clear and consistent guidance, central banks help reduce uncertainty, allowing markets to adjust gradually rather than reacting with sudden swings.

The Global Impact of Major Central Banks

Central banks in major economies, especially the U.S. Federal Reserve (Fed), have a strong influence on global stock markets. This is because the U.S. dollar is the world’s primary reserve currency, meaning it is widely used in international trade and finance.

When the Fed raises interest rates, it makes U.S. assets more attractive to investors because they offer higher returns. As a result, international investors often move their money out of emerging markets and into the U.S., causing stock prices to fall in those countries. This shift can lead to slower growth in developing economies that rely on foreign investment.

On the other hand, when the Fed lowers interest rates, U.S. investments become less appealing, and investors look for higher returns in global markets. This can boost stock prices in other countries as money flows into foreign investments, strengthening their economies.

Other major central banks, like the European Central Bank (ECB) and the Bank of Japan (BoJ), also affect global markets. Their policies influence currency exchange rates, trade, and international investments, creating ripple effects across economies worldwide.

Central banks’ policies have a profound impact on stock markets, influencing both the short-term volatility and long-term trends in equity prices. Through monetary tools such as interest rates and quantitative easing, central banks can significantly alter the financial landscape. Furthermore, central banks in major economies like the Federal Reserve have a global impact. Thus investors should strive to closely monitor central bank decisions, interest rate trends and policy announcements so they can make informed decisions and successfully navigate stock market fluctuations more effectively.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment, or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.