How New US Tariffs Could Affect China’s Economic Growth: A Comparison of the Trump Era

Commentary

The imposition of tariffs by the United States (US) on Chinese goods has been a contentious issue shaping global trade dynamics. During Donald Trump’s presidency from 2017 to 2021, tariffs were a cornerstone of his administration’s trade policy, aiming to reduce the US trade deficit and address perceived unfair trade practices. These tariffs had significant implications on China’s economic growth. Following Trumps’ January 2025 inauguration, understanding these dynamics is crucial for assessing the trajectory of China’s economy, especially given the potential for new tariffs under Trumps’ second term in office.

Economic Impact of Tariffs During Trump’s Presidency from 2017-2021

Between 2017 and 2021, the Trump administration enacted a series of tariffs on Chinese imports, covering a wide range of goods, from electronics to agricultural products. A total of USD362 bn in tariffs were imposed on goods imported from China. Initially, tariff rates began at 3.1% at the beginning of Trump’s term and ended the term at a high of 25%.

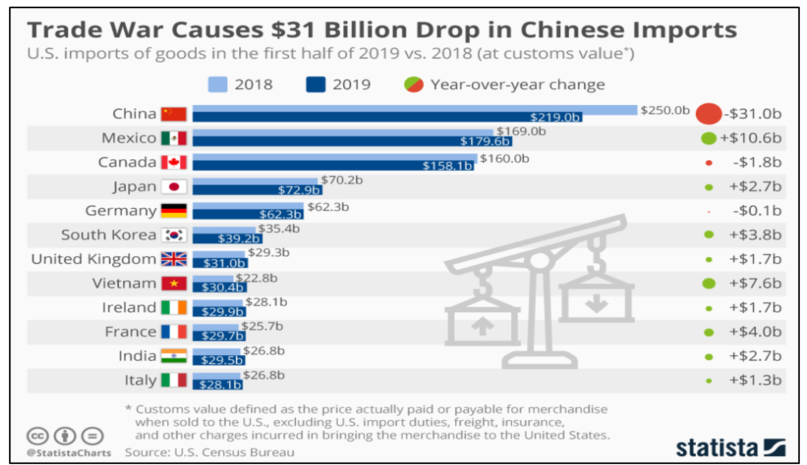

Figure 1: US imports of goods from its partners in the first half of 2019 vs. 2018.

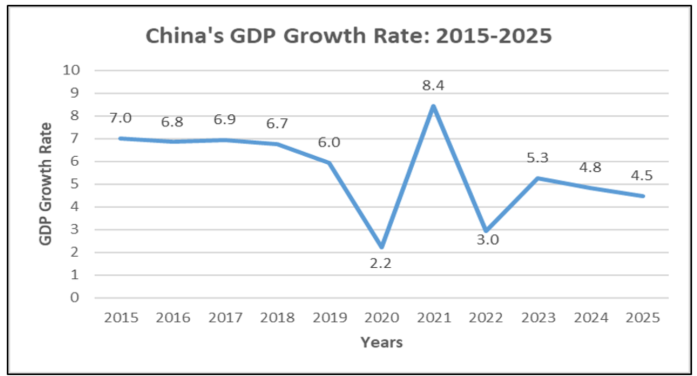

Trump’s initial term as President was marked by a notable slowdown in China’s economy. According to the International Monetary Fund (IMF), China’s GDP growth decreased from 6.9% in 2017 to 6.0% in 2019, marking its lowest rate in nearly three decades. This downturn was driven by multiple factors, with escalating trade tensions playing a significant role. Export-oriented sectors bore the brunt of tariffs, which made Chinese goods more expensive in the US market. Key industries such as electronics, machinery, and textiles were particularly affected. In addition, retaliatory tariffs imposed by China on US goods, especially agricultural products, exacerbated trade tensions and further strained global trade relations.

Figure 2: China’s GDP Growth Rate: 2015-2025

In an effort to cushion the impact of the tariffs, US companies sought to diversify supply chains, relocating manufacturing to other countries in Southeast Asia, such as Vietnam and Malaysia. This trend reduced China’s dominance as the world’s manufacturing hub and resultantly weakened the Chinese yuan against the US dollar.

Overview of the New Tariffs

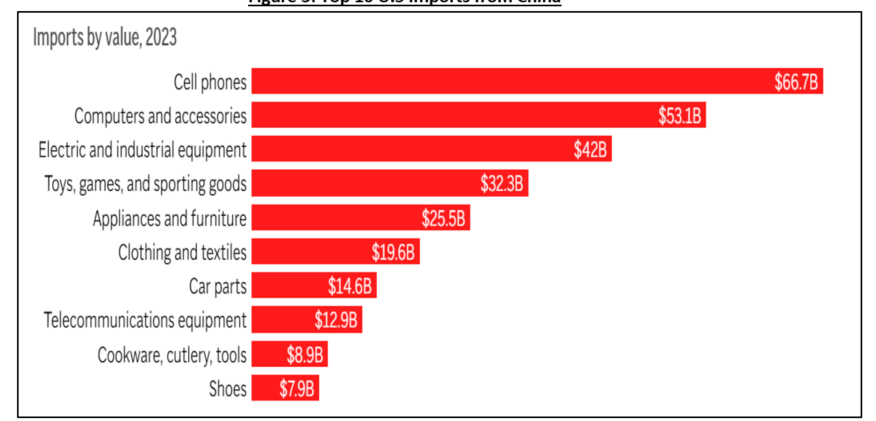

On February 1, 2025, President Donald Trump signed an executive order imposing a 10% tariff on all goods imported from China. This new tariff took effect on February 4, 2025, affecting more than USD400 billion worth of Chinese products. This 10% tariff applies to all Chinese imports, adding to the existing tariffs already in place on certain products. It is part of Trump’s broader trade policy aimed at reducing the trade deficit, securing economic independence from China, revitalizing the American auto industry, bringing supply chains back to the US, restricting government contracts for companies that outsource jobs, and strengthening domestic manufacturing.

Figure 3: Top 10 U.S Imports from China

Potential Impact of New U.S Tariffs on China’s Economy

- Immediate Economic Impact on China

The proposed tariffs are anticipated to exert additional pressure on China’s economy, as they will compound the existing tariff burdens, further elevating the cost of Chinese goods in the U.S. market. As a result, Chinese products may become less competitive compared to alternatives from other countries, leading to a drop in demand and declining exports.

The impact is expected to extend to China’s job market, particularly in industries that rely heavily on exports to the US. With higher costs reducing demand, many Chinese manufacturers may be forced to cut jobs or scale back production to maintain profitability. This downturn could also affect suppliers of raw materials and components, triggering additional job losses across the supply chain.

Historically, tariffs have led to retaliatory trade measures, as seen during Trump’s first term. In a swift response to the new tariffs, China announced its own set of countermeasures just minutes after the US announcement. These include a 15% tariff on American coal and liquefied natural gas, along with a 10% tariff on US crude oil, agricultural machinery, and large-displacement vehicles, mirroring the trade tensions of 2018.

- Long-term effects on China’s Economy

The long-term impact of the new US tariffs on China’s economy is expected to be significant and far-reaching. These tariffs will likely cause a further slowdown in China’s export growth, as higher costs make Chinese goods less competitive in the US market.

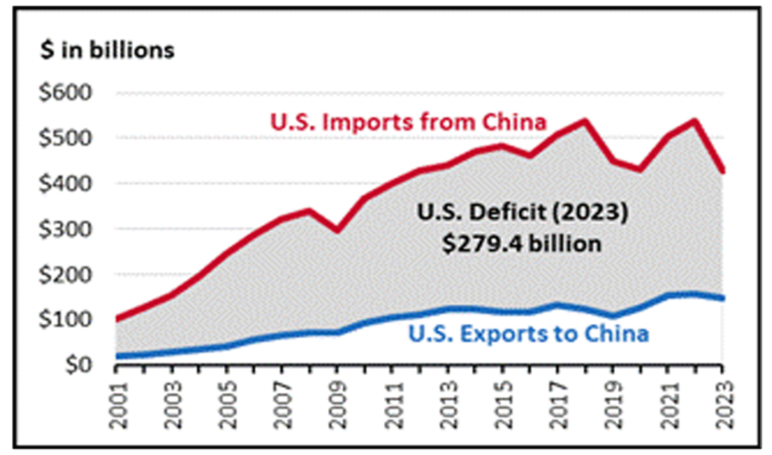

In 2023, US imports from China dropped by 20.4%, driven by China’s economic slowdown and a global shift in supply chains away from China. The new tariffs could accelerate this trend, further reducing demand for Chinese exports and reshaping global trade dynamics.

Figure 4: U.S-China Goods Trade (2021-2023)

The newly imposed tariffs are expected to disrupt established supply chains, compelling Chinese companies to re-evaluate their sourcing and production strategies. Many manufacturers may need to seek alternative markets or suppliers outside the US, which could lead to higher costs and inefficiencies in production. These disruptions may in turn, slow down China’s industrial growth as businesses adjust to a more uncertain trade environment.

In response, China may strengthen its trade partnerships with other countries, reducing its reliance on the US market. This could involve expanding trade agreements and increasing exports to regions with fewer trade restrictions, allowing China to diversify its economic ties and minimize the impact of US tariffs.

Meanwhile, US companies affected by higher costs may choose to shift manufacturing operations out of China to countries with lower or no tariffs. While this helps businesses maintain competitive pricing, it could erode China’s position as the world’s leading manufacturing hub. As a result, foreign direct investment (FDI) into China may decline, as investors seek more stable markets with fewer trade uncertainties. A slowdown in capital inflows can potentially impact China’s economic growth and technological progress.

Impact on Financial Markets

Industries most affected by tariffs, such as manufacturing and technology, may experience lower revenues and profitability, especially for companies that rely heavily on Chinese raw materials and supply chains. Such companies may be challenged to maintain their current dividend payouts – especially if the payout ratio is already high. Furthermore, reduced profitability can also lower cash flows which are critical to funding dividend payments. If lower earnings are anticipated, companies may decide to cut or suspend dividend payments in an effort to preserve cash. Such actions would directly affect income-focused investors.

The tariffs are expected to increase the level of volatility in stock markets. When new tariffs are imposed and there is the potential of an escalating trade war, markets are unsure about the long-term effects on companies, sectors, and economies. With each new development in the dispute, uncertainty deepens, making it increasingly difficult to predict the long-term consequences, which can lead to large fluctuations in stock prices.

In the fixed income market, bondholders—especially those invested in Chinese companies or US firms reliant on Chinese imports, may face increased financial risks. Rising production costs and weaker sales could strain companies’ cash flow, making it more difficult to repay debts on time. As their financial health weakens, credit rating agencies may downgrade these companies’ bonds, signalling higher risk and increasing their borrowing costs. This could trigger a downward spiral, where businesses struggle to meet their financial commitments, leading to delayed payments or even defaults.

Investors with exposure to China-linked bonds should also prepare for potential credit downgrades and falling bond prices. As concerns over financial stability grow, many investors may sell off their bonds, driving prices lower. Those looking to exit before maturity could face losses, while financially distressed companies may be forced to restructure their debt, resulting in reduced interest payments or partial repayments to bondholders.

Effectively managing the challenges of US-China trade tensions require investors to remain vigilant and adaptable. By closely tracking economic trends, diversifying their investment portfolios, assessing exposure to vulnerable industries, anticipating potential retaliatory actions, staying informed on policy changes, and evaluating currency risks, investors can position themselves to navigate the uncertainties of China’s shifting economic landscape with greater confidence and resilience.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment, or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.