Initial Public Offerings (IPOs): An Introduction and How to Invest

Commentary

What is an IPO?

An Initial Public Offering (IPO) is when a private company offers its shares to the public for the first time. This process enables the company to raise capital from investors to support its growth, reduce debt, or meet other financial needs. Once a company goes public, its shares are listed on a stock exchange, allowing anyone to buy and sell them.

Key Reasons Why Companies Go Public

The primary goal of launching an IPO is to raise capital from public investors. The funds acquired through an IPO can be allocated for a variety of purposes, including business expansion, research and development, debt repayment, and overall growth.

Before going public, many private companies rely on funding from individual investors such as venture capitalists and angel investors. Venture capitalists (VCs) manage large pools of capital from sources like wealthy individuals, pension funds, and major corporations, and invest in startups that are poised for rapid growth. In contrast, angel investors provide their own money to support early-stage businesses, often when these companies are just beginning. Going public allows these early investors to liquidate their investments by selling their shares.

An IPO also enables a company to diversify its ownership structure by offering shares to a broad spectrum of investors, including both institutional and retail investors. This shift reduces the concentration of ownership among a few investors.

Moreover, an IPO can significantly enhance a company’s visibility and credibility. The process often garners extensive media attention, drawing interest from journalists, analysts, and investors. This increased exposure raises the company’s profile among a wide audience, including potential customers, industry peers, and business partners. As a result, the company benefits from greater public awareness and stronger recognition of its brand and offerings.

Types of IPO

There are two primary types of IPOs, each involving distinct processes for determining the initial share price and making them available to the public. The first type is the Traditional IPO, also known as the Book Building process. In this approach, the company collaborates with investment banks, or underwriters, to determine the share price. The underwriters conduct preliminary work by reaching out to institutional investors, such as mutual funds and pension funds, to gauge their interest and assess potential pricing. This process helps “build a book” of demand. Based on the feedback received, the company sets a price range and invites institutional investors to place bids, specifying how many shares they want and at what price within that range. The final share price is then established according to the demand indicated in these bids, which often results in a price that reflects current market conditions.

The second type is the Fixed Price IPO, where the company and its underwriters set a predetermined price for the shares before the IPO is launched. This price is established in advance and disclosed to investors, allowing them to know exactly what they will pay per share.

How to Invest in an IPO

Investing in an Initial Public Offering (IPO) can be an exciting opportunity, but it involves understanding the process and following several key steps. To participate in an IPO, investors need an account with a brokerage firm that offers access to these offerings. Since not all brokers provide this service, it’s important to verify this in advance and select a broker that does.

Before investing, thorough research on the company is crucial. A key document in this research is the IPO prospectus, which provides comprehensive details about the company’s business operations, financial health, risks, and future plans. The prospectus is designed to equip investors with all the necessary information to make an informed decision about purchasing shares during the IPO.

Understanding the company’s business model, market position, and industry is essential. Investors should evaluate how the company operates, its revenue generation methods, and its growth prospects to determine the viability and long-term potential of the business.

Once an IPO is identified, investors can request shares through their broker. Sometimes, depending on the level of interest, the demand for IPO shares may be high and it is common for investors not to receive their full request. When the demand exceeds the available shares, the IPO is considered oversubscribed. In such cases, shares are allocated using various methods, including Pro-rata allocation. This method distributes shares based on the proportion of each investor’s original request relative to the total demand.

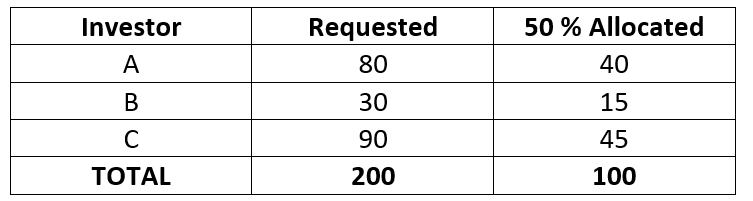

For example, if a company offers 100 shares in an IPO but investors request 200 shares, the IPO is oversubscribed by a factor of 2 (200 requested ÷ 100 available). Consequently, each investor receives 50% of the shares they requested (100 available ÷ 200 requested = 50% allocation).

After making an investment, it is important for investors to monitor their investment by keeping up with market and company performance. Investors should review market news, earnings calls, and financial reports on a regular basis in order to decide whether to sell or hold the shares.

Risks and Points to Consider When Investing

While IPOs are great investments, there are several risks that investors should be aware of. Newly listed companies often have limited financial histories, making it challenging to assess their performance across various economic conditions and market cycles. This lack of historical data can hinder the evaluation of the company’s stability, growth, and profitability. As a result, investors may need to rely heavily on projections and estimates from the IPO prospectus, which can be speculative and overly optimistic.

Newly issued shares may also experience high levels of speculation, with early trading often driven more by hype than by fundamental value. This can lead to significant price fluctuations in the initial trading days, potentially deterring investors from trading actively and affecting the stock’s liquidity.

Additionally, investors should be aware of any lock-up periods, which restrict early investors and company insiders from selling their shares for a set period. Once this lock-up period ends, a large number of shares may enter the market, potentially putting downward pressure on the share price.

Investing in IPOs offers both potential rewards and risks. To navigate these effectively, it’s crucial to conduct thorough research and understand the associated risks. By carefully considering these factors and aligning the IPO with their investment goals and risk tolerance, investors can make more informed decisions and better manage their investment strategy.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.