Jamaica’s Economic Turnaround: from Debt Crisis to Success Story

Commentary

Jamaica’s Economic Turnaround: From Debt Crisis to Success Story

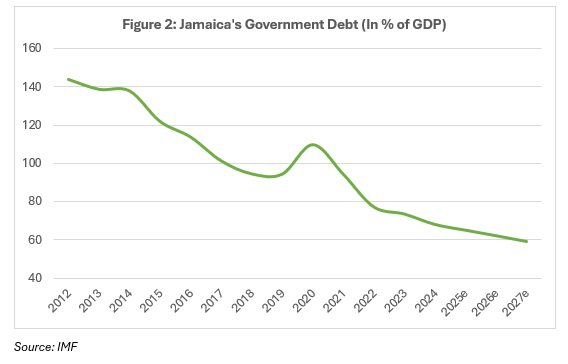

Jamaica’s economic transformation over the past decade stands as a testament to the importance of disciplined fiscal management and strategic growth initiatives. In 2012, the country faced a staggering debt-to-GDP ratio of 144%, one of the highest in the world. However, through a combination of fiscal reforms, international financial support, and an expanding tourism sector, Jamaica managed to halve this ratio to 73% by 2023. This turnaround was not merely about reducing debt; it also involved fostering economic resilience, increasing investor confidence, and ensuring sustainable growth. This article explores the journey of Jamaica’s economic recovery and highlights the key policies that contributed to this success, including the role of the International Monetary Fund (IMF), and the tourism industry’s contribution to the country’s resurgence.

Jamaica’s Economic Crisis: The Situation in 2012

In 2012, Jamaica’s economy was in crisis. The country’s debt-to-GDP ratio had ballooned to 144% (see figure 2), placing it among the most indebted nations globally. Economic growth was sluggish, and fiscal mismanagement had led to a cycle of high borrowing and limited investment in development projects. At the time, the government was spending nearly 50% of its revenue just to service its debt, leaving little room for social programmes, infrastructure, or economic stimulus.

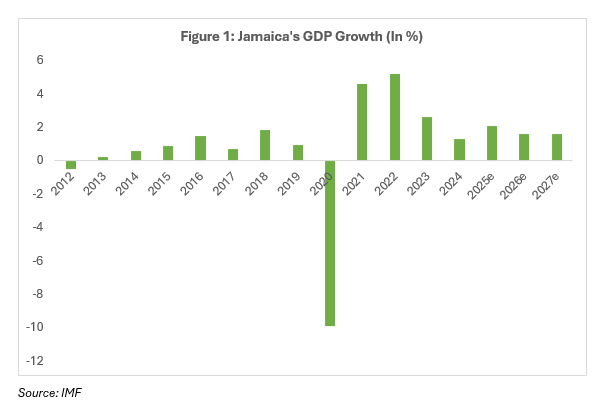

Several factors contributed to this dire economic state. Chronic budget deficits had forced the government to rely on expensive borrowing, pushing debt levels even higher. The public sector wage bill was disproportionately high, consuming a significant portion of government expenditure. Moreover, low economic growth, averaging just 0.9% (see figure 1) annually between 2000 and 2012, meant that government revenue did not keep pace with rising expenditures. Investor confidence had declined, further exacerbating Jamaica’s financial woes, as borrowing costs surged due to the country’s perceived economic instability. By 2012, it was evident that urgent intervention was needed. Without comprehensive economic reforms, Jamaica risked a full-blown economic collapse.

The IMF’s Role in Jamaica’s Economic Turnaround

Recognising the urgency of the situation, the Jamaican government sought assistance from the IMF in 2013. A USD932 million Extended Fund Facility (EFF) agreement was reached, marking Jamaica’s 16th IMF programme since gaining independence. However, unlike previous agreements, this program featured strict oversight, increased transparency, and significant engagement with key stakeholders.

The IMF programme focused on five major areas: fiscal responsibility, structural economic reforms, public sector efficiency, financial sector stability, and social protection. A key component of the agreement was the commitment to generating a primary surplus of 7.5% of GDP annually, a crucial step toward debt reduction. The government also agreed to implement strict borrowing limits, preventing future fiscal irresponsibility.

Tax reforms played a pivotal role in boosting revenue collection. The shift from direct to indirect taxation, including the introduction of a General Consumption Tax (GCT), improved the government’s ability to collect revenue efficiently. A debt exchange programme was also launched, convincing bondholders to accept lower interest rates, which reduced government interest payments.

In addition to these measures, public sector reforms were introduced to rein in the high wage bill. The government implemented wage restraint policies, capping increases in public sector salaries to prevent further fiscal strain. Furthermore, banking regulations were strengthened to enhance financial sector stability, enhancing local banks’ resilient against economic shocks.

To mitigate the impact of austerity on vulnerable populations, the government expanded social protection programmes, such as the Programme of Advancement through Health and Education (PATH). This ensured that the most economically disadvantaged citizens were not disproportionately affected by the fiscal consolidation measures.

By 2016, Jamaica had successfully completed the EFF programme. Building on this progress, the country entered into a USD1.64 billion Precautionary Stand-By Agreement (PSBA) with the IMF in 2017. Unlike previous agreements, this programme was precautionary, meaning Jamaica did not need to draw on the funds. Instead, the IMF acted as a financial backstop while the country continued to implement its economic reforms.

Tourism: A Catalyst for Economic Growth

While fiscal discipline was essential for debt reduction, economic growth was equally important in sustaining Jamaica’s progress. One of the most significant contributors to this economic revival has been the country’s thriving tourism sector.

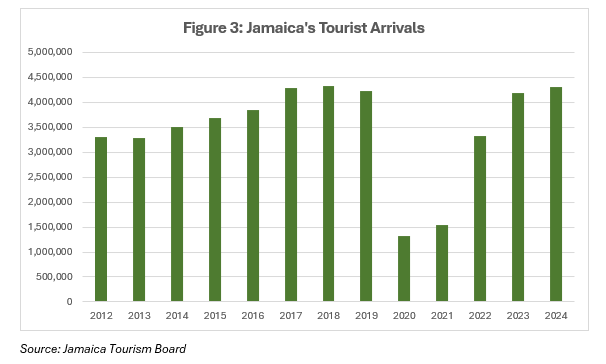

Jamaica’s tourism industry has experienced remarkable growth over the past decade, becoming a key driver of GDP, employment, and foreign exchange earnings. In 2022, the country welcomed approximately 3.3 million international tourists, marking a strong post-pandemic recovery (See Figure 3). By 2024, tourist arrivals had increased to a record 4.3 million, generating USD4.3 billion in revenue. The tourism sector now accounts for 18.64% of GDP and provides employment for over 350,000 Jamaicans.

Several factors have contributed to this boom in tourism. Jamaica has significantly increased its global marketing efforts, promoting itself as a premier travel destination through campaigns such as “Jamaica – Heartbeat of the World.” Major events like Reggae Sumfest and Carnival in Jamaica attract thousands of visitors each year, boosting local businesses and increasing tourism revenue.

Improved accessibility has also played a crucial role in expanding the tourism sector. The government has secured 1.6 million airline seats for the 2023-2024 winter season, ensuring easier access for international travellers. Major airlines, including American Airlines, JetBlue, and British Airways, have increased flights to Jamaica, reflecting rising global demand for Jamaican vacations.

Additionally, the government has worked to diversify Jamaica’s tourism offerings. While beach tourism remains the country’s primary attraction, new initiatives have promoted eco-tourism, adventure tourism, and cultural tourism. Investments in community-based tourism have allowed visitors to experience Jamaica’s rich heritage while supporting local economies.

Safety and infrastructure improvements have further boosted Jamaica’s appeal as a travel destination. Increased police presence in resort areas and investments in roads, airports, and ports have enhanced the overall visitor experience. As a result, the government has set ambitious targets for the sector, aiming to attract five million tourists and generate US$5 billion in tourism earnings by 2025.

Jamaica’s Economic Achievements and Future Outlook

Jamaica’s economic reforms and tourism boom have led to significant improvements in the country’s overall economic stability. The debt-to-GDP ratio has declined from 144% in 2012 to 72% in 2023, with further reductions projected, reaching 53.13% by 2029. This improved fiscal health has enabled Jamaica to access international capital markets at lower interest rates, reducing the cost of borrowing.

Economic growth has also picked up, averaging around 2% annually in recent years, a substantial improvement compared to the pre-reform period. Unemployment has fallen to 6.6% in 2023, reflecting increased job opportunities in tourism, infrastructure, and business process outsourcing (BPO). Moreover, Jamaica has experienced record levels of foreign direct investment (FDI), particularly in tourism-related infrastructure projects.

The country has also built strong financial buffers, with foreign exchange reserves at healthy levels, making Jamaica more resilient to external shocks. During the COVID-19 pandemic, these financial reserves allowed the government to implement relief measures without significantly disrupting fiscal stability.

Despite these achievements, Jamaica still faces several challenges. The country remains vulnerable to external shocks, particularly those affecting the tourism industry, such as global economic downturns and natural disasters. Crime and security issues continue to be a concern, impacting both residents and tourists. Income inequality also remains a challenge, with rural communities struggling to benefit from the country’s economic gains. Furthermore, climate change poses a significant threat, with rising sea levels and increasingly frequent hurricanes endangering Jamaica’s coastal infrastructure and agricultural sector.

Conclusion

Jamaica’s economic turnaround is a remarkable success story, demonstrating the benefits of disciplined fiscal management, international financial support, and strategic sectoral growth. By implementing strict fiscal measures, partnering with the IMF, and leveraging its booming tourism sector, Jamaica has significantly improved its economic outlook.

While challenges remain, the government’s continued commitment to fiscal responsibility, economic diversification, and social development bodes well for the future. With ongoing efforts to expand tourism, attract investment, and foster sustainable growth, Jamaica is well-positioned to maintain its economic progress and continue as a regional leader in economic resilience and recovery.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.