LIBOR Transition – What to Expect?

Commentary

What is LIBOR?

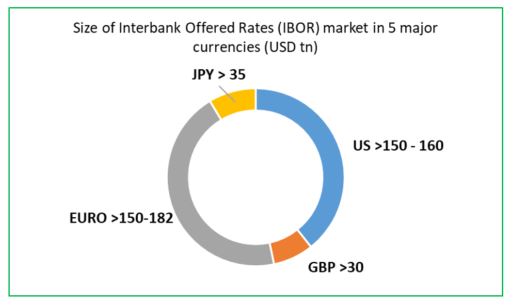

LIBOR is the London Inter-Bank Offered Rate which historically has been the generally accepted reference rate used for setting interest rates charged on many financial contracts and products. While LIBOR has been in existence since the late 1960s, it was formalized in 1986 and has been used as the basis for adjustable-rate mortgages, asset-backed securities, credit default swaps and a variety of other types of debt. Interbank offered rates are referenced in roughly USD400 trillion of wholesale and consumer global transactions.

When a person applies for a loan that is based on LIBOR, the interest rate charged on such loans is determined by adding the Libor rate to the spread or additional percentage. For example, if the interest rate on a private student loan is three month LIBOR plus 2%, if the LIBOR rate is 0.22%, the borrower will be charged an interest rate of 2.22%.

How is LIBOR Calculated?

Each day, the Intercontinental Exchange Benchmark Administration (ICE), the administrator for LIBOR, receives estimates from up to 18 global banks, known as panel banks, on interest rates they would charge for different pre-determined loan maturities if they were to borrow from other banks. These estimates are based on the outlook for their local economic conditions. To remove the extreme high or low estimates that might skew LIBOR, the ICE removes the four highest and lowest submissions before computing the average. It must be noted that LIBOR is not based on what the banks actually pay to borrow funds from each other, but is based on what they think they would pay. The mechanism of averaging after elimination of outlier rates is used to mitigate subjectivity.

LIBOR is calculated in five currencies- UK Pound Sterling, the Swiss Franc, the Euro, Japanese Yen and the U.S. Dollar and for seven tenors – overnight, one week, one month, two months, three months, six months and 12 months.

Why is LIBOR being replaced?

The transition away from LIBOR as a benchmark rate is largely due to the fallout from the global financial crisis in 2008 which resulted in a sharp reduction in the number of transactions on the interbank market.

The crash of the US real estate market in 2007 revealed the vulnerability of the financial sector as it pertained to the exposure to subprime mortgages (mortgages issued to borrowers with low credit ratings and therefore higher risk of default). Many financial companies insured risky mortgages and other complex financial products with credit default spreads (CDS). The rates on the CDS were set using LIBOR and were used to insure against potential defaults on subprime mortgages. The eventual collapse of the subprime mortgage sector and the associated financial products and securities resulted in bankruptcy filings by many large companies. Consequently, many banks became reluctant to lend to each other resulting in a sizeable contraction in interbank transactions.

In the absence of an active underlying market, in 2017 the UK’s Financial Conduct Authority (FCA) announced it would not compel panel banks to continue providing LIBOR submissions beyond the end of 2021. On 5 March 2021, the FCA pronounced that panel banks’ submissions will cease immediately after 31 December 2021 for Sterling, Euro, Swiss Franc and Japanese Yen and for all tenors. Only the one-week and two-month US dollar LIBOR submissions will conclude by year end, the remaining LIBOR settings will stop on 30 June 2023.

What can we expect?

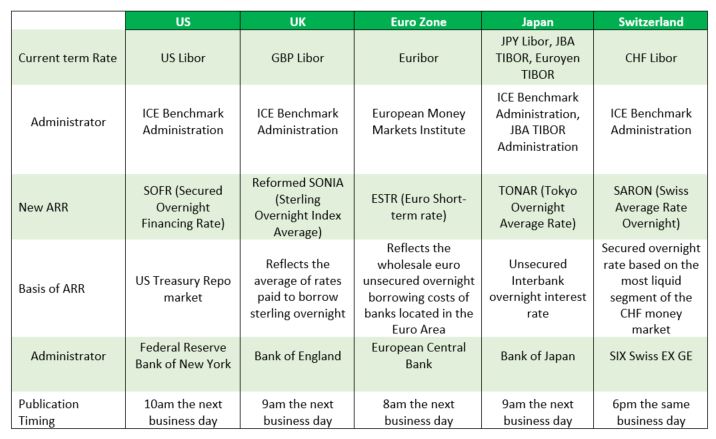

The cessation of LIBOR is expected to have a world-wide impact, as such planning for this transition has warranted a global effort involving regulators, advocacy and financial institutions. Each major jurisdiction affected – the US, UK, Switzerland, Japan and the Eurozone have created bodies and committees such as the Alternative Reference Rates Committee (ARRC) in the US and the Sterling Working Group on Risk Free Rates (RFRWG) in the UK, to identify alternative reference rates.

With each country having developed or selected their own local-currency denominated alternative reference rates, there will be fundamental differences. LIBOR was centrally managed by a single administrator across all five currencies. With the alternative reference rates (ARRs), independent authorities will govern the rates, thus creating different characteristics including the varying publication dates and times. For entities with international assets and liabilities, the timing of the valuation and pricing may be problematic.

There are also notable differences between the ARRs and the LIBOR. Two key distinctions are that LIBOR has a term (for example one month, three month) and is broadly representative of bank funding costs at differing terms. The ARRs are only overnight rates. Thus they work differently and may require new products that are built using ARRs, requiring different pricing and valuations.

All stakeholders must take steps to assess the impact of the LIBOR transition, develop and implement measures to address them and choose an ARR. With many variables still unknown, financial institutions must have a deep understanding of the complexity and challenges facing the industry in order to mitigate the impact. A multi-disciplinary approach will be required, with engagement from several units including Information Technology, Marketing, Asset Management, Finance and Legal. The transition may require a change in portfolio benchmarks, valuation methodologies, financial reporting, new product offerings, technological and infrastructure changes.

External collaboration will be helpful, with collective engagement with other banks and regulatory bodies in order to understand their approach to the LIBOR transition and coordinate as necessary. A clear organization communication strategy is critical, this should include engagement with investors and clients to educate them on the LIBOR transition, the approach of the firm and impact to them.

Proposed Alternative Reference Rates (ARR) Across Geographies

Size of Interbank Offered Rates (IBOR) Market as at 2019

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.