Market Review: Fourth Quarter of 2024

Commentary

International Market Review

The final quarter of 2024 was marked by significant volatility, particularly in October and December, with US equities delivering the only positive return. In October, global equities experienced a sell-off as investor sentiment weakened due to disappointing corporate earnings from the “Magnificent 7,” uncertainties surrounding the upcoming U.S. presidential election, and the potential implications of new policies. Emerging market equities faced additional challenges, underperforming its developed peers, including concerns over rising tariffs linked to the election and the strengthening U.S. dollar, further dampening investor confidence.

November saw a strong rebound in global equities, driven by the outcome of the U.S. presidential election. Donald Trump’s decisive victory fuelled investor optimism, bolstered by the prospect of proposed corporate tax cuts and deregulation, which were seen as catalysts for U.S. economic growth.

However, this momentum faded in December as global equities declined again. The downturn was driven by rising geopolitical tensions, including escalation of tensions in the Middle East, Russia-Ukraine war, Europe and South Korea. Additionally, the U.S. Federal Reserve’s (Fed) hawkish projections for interest rates in 2025 further weighed on investor sentiment. As a result, for Q4 2024, the MSCI World Index and Emerging Markets Index recorded losses of 0.41% and 8.15%, respectively, bringing year-to-date gains to 17.00% and 5.05%.

US Stocks

October was a turbulent month for U.S. stocks, with the S&P 500 and Dow Jones Industrial Average reaching record highs mid-month before retreating to close with losses. The Nasdaq Composite also declined, weighed down by mixed earnings reports from tech giants Apple, Microsoft, and Meta.

In November, the market saw a significant turnaround, largely driven by the U.S. elections. Donald Trump’s strong victory boosted U.S. stocks to new heights as investors reacted positively to his administration’s proposed policies, which included tax cuts for individuals and businesses and reduced regulations in key sectors.

This upward trend continued into December but at a slower pace. U.S. stocks faced considerable selling pressure after the Fed announced it would reduce the number of expected interest rate cuts in 2025 from four to two. Although the Fed did implement two rate cuts in Q4 2024—one in September by 50 basis points and another in December by 25 basis points—the news about fewer cuts dampened investor enthusiasm. This change suggested a tighter monetary policy that could hinder economic growth and corporate profits. Moreover, it indicated a more cautious outlook on the economy or inflation pressures. This uncertainty likely led investors to reassess their risk tolerance and pull back from equities.

As a result, the S&P 500, Dow Jones Industrial Average, and Nasdaq all experienced slower growth in Q4 2024, recording gains of 2.07%, 0.51%, and 6.17%, respectively, compared to the stronger performances of 5.53%, 8.21%, and 2.57% achieved in Q3 2024. Despite this deceleration, the full-year results remained robust, with the S&P 500 advancing by 23.31%, the Dow Jones Industrial Average rising by 12.88%, and the Nasdaq surging by 28.64%.

In the fourth quarter of 2024, small and mid-cap stocks underperformed their larger counterparts, with both indices recording losses. This disparity was primarily driven by the Fed’s decision to slow the pace of interest rate cuts, a move that disproportionately affected mid and small-cap companies. Unlike larger, more established firms, these companies often depend heavily on external financing, making them particularly sensitive to shifts in borrowing costs. The increased uncertainty about interest rates made small and mid-cap companies more vulnerable, which added to their weaker performance compared to the strength of larger, more stable companies

Europe and the United Kingdom

The final quarter of 2024 presented significant challenges for European equities, as major indices recorded losses during this period. European stocks declined in October, weighed down by fears of a new wave of tariffs on export-reliant European companies, spurred by the prospect of a Republican victory in the U.S. elections. Investor sentiment was further dampened by higher-than-expected inflation in the Eurozone, which raised concerns that the anticipated year-end interest rate cut might be smaller than expected. Meanwhile, U.K. equities also faltered as the national budget unveiled significant borrowing plans, sparking fears of inflationary pressures and potentially limiting the scope for rate cuts in 2025.

This subdued sentiment persisted into the latter part of the quarter, exacerbated by political instability in France and Germany. In France, efforts to pass the 2025 budget aimed at tackling the country’s substantial deficit through tax hikes and spending cuts triggered widespread public backlash. On December 4, the far-right National Rally party led a successful no-confidence vote, toppling the government after just three months in office.

Germany faced a similar upheaval as tensions within the coalition government boiled over. Disagreements over economic policy, particularly fiscal discipline and budgetary issues, culminated in the dismissal of the finance minister. This move led to a no-confidence vote on December 16, resulting in the dissolution of the government. New elections are scheduled for February 2025, adding to the region’s economic and political uncertainty.

Emerging Markets

In the fourth quarter of 2024, emerging markets faced several challenges. A strong U.S. dollar, mixed economic data, and renewed worries about a potential trade war following Donald Trump’s significant electoral victory created headwinds for these markets, particularly on China.

Investor confidence was further unsettled by the partial escalation of the Ukraine war, as President Joe Biden authorized Ukraine to use U.S.-provided long-range missiles against Russian territory. Meanwhile, tensions in the Middle East heightened sharply, with intensified attacks by Israel on Hamas and Hezbollah, alongside the collapse of the Assad regime in Syria, adding to the geopolitical instability during the quarter.

International Stock Indices Performance (Local Currency Returns)

US Treasury Yields

Yields on U.S. Treasury securities rose sharply in Q4 2024, fuelled by an elevated inflation outlook tied to the potential implementation of tariffs in 2025 and the Fed’s decision to scale back the projected number of interest rate cuts. In response, investors demanded higher yields to offset the anticipated increase in inflationary pressures and the likelihood of an extended period of elevated interest rates.

The yield on the 10-year Treasury note climbed from 3.78% at the end of September to 4.24% by December, marking a rise of 60 basis points. Shorter-term bonds experienced similar gains, with the 2-year Treasury yield increasing from 3.64% in September to 4.24% by year-end. Heading into 2025, US Treasury yields are expected to rise further, reflecting investor caution regarding the potential effects of tariffs and other policy measures.

US Treasury Yields

US Sector Performance

In the fourth quarter of 2024, the Consumer Discretionary sector emerged as the top performer, delivering remarkable returns of 14.06%. This success was largely driven by major retailers and discretionary companies capitalizing on the seasonal surge in holiday sales, which significantly bolstered their earnings.

The technology sector emerged as the second-best performer, delivering an impressive return of 8.60%, driven by the continued rapid ascent of Artificial Intelligence and other breakthrough technologies. Close behind, the Financial Services sector achieved a strong gain of 6.67%, supported by rising interest rates. These higher rates enabled banks to lend at wider margins, boosting their profitability and fuelling growth across the sector.

On the other hand, the Healthcare sector faced considerable headwinds, recording the largest loss of 10.67% during the quarter. This decline stemmed from concerns over the Trump administration’s potential stance on pharmaceutical pricing and new drug approvals, following the nomination of Robert Kennedy Jr. as Secretary of the Department of Health and Human Services. Kennedy’s outspoken views on public health raised the prospect of sweeping policy changes, unsettling investors and weighing heavily on the sector.

The Real Estate sector also struggled, posting the second-largest loss of 8.76%. The rising interest rate environment played a significant role in this decline, as higher borrowing costs dampened demand for real estate, reducing affordability and negatively impacting sector performance.

US Sector Performance: Q4 2024

Local Market Review

In the final quarter of 2024, the local stock market in Trinidad and Tobago experienced a notable resurgence, rebounding from the losses incurred throughout the earlier part of the year. This recovery was led by the Cross Listed Index, which achieved an impressive gain of 8.36% during the quarter. The TT Composite Index also saw a positive movement, increasing by 1.94%, while the All T&T Index marginally increased by 0.09%.

Despite this fourth-quarter turnaround, all local stock indices ended the year in the red. The TT Composite Index and the All T&T Index both suffered double-digit declines, reflecting the challenges faced by the market earlier in the year. The Cross Listed Index, although performing well in Q4, still closed the year with a modest decline of 7.74%.

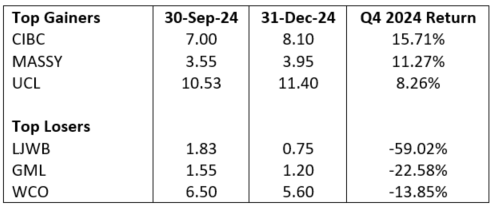

The stocks with the most significant price gains in Q4 2024 were CIBC Caribbean Bank Limited (CIBC), formerly known as First Caribbean International Bank Ltd (FCI), Massy Limited (MASSY), and Unilever (UCL), with their share prices rising by 15.71%, 11.27%, and 8.26%, respectively. On the other hand, the largest declines were recorded by LJ Williams (LJWB), Guardian Media Limited (GML), and West Indies Tobacco Company (WCO), with their share prices falling by 59.02%, 22.58%, and 13.85%, respectively.

Local Stock Indices Performance

Top Gainers and Losers

Equity Markets Outlook

Global equities, excluding U.S. stocks, are likely to face subdued performance in the first quarter of 2025, largely due to the anticipated strength of the U.S. dollar. The dollar’s appreciation is expected to be driven by President Trump’s proposed tariffs, which could increase the cost of imported goods and heighten inflation expectations. In response, the Federal Reserve may adopt a more aggressive stance by raising interest rates in an effort to temper inflationary pressures, attracting foreign capital and further strengthening the dollar. This environment may create challenges for non-U.S. stocks, as a strong dollar makes their exports less competitive and reduces the value of earnings when converted back to their local currencies.

The uncertainty surrounding tariffs is also expected to impact global investor sentiment, as such protection measures usually leads to heightened trade tensions. When tariffs are imposed, affected countries often respond with retaliatory measures, escalating tensions and potentially leading to broader trade conflicts. Additionally, tariffs can disrupt global supply chains, forcing companies to reassess their sourcing and production strategies. This re-evaluation can lead to significant disruptions, as finding alternative suppliers or relocating production facilities is both time-consuming and costly.

Against the backdrop of such turbulence, investors usually prefer safe-haven assets such as U.S. Treasury bonds and gold. These safe-haven assets are favoured during periods of heightened market uncertainty, as they provide a measure of stability and liquidity.

In an effort to minimize risk, investors can strive to diversify their portfolio holdings across the various asset classes. As it relates to equities, emerging markets stocks and companies whose operations rely on export, are expected to underperform. However, U.S. equities may outperform due to the US dollar’s appeal and investor preference for safer assets within a stable economic environment.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.