Review of Equity Markets over the 3rd Quarter 2021

Commentary

International Market Review

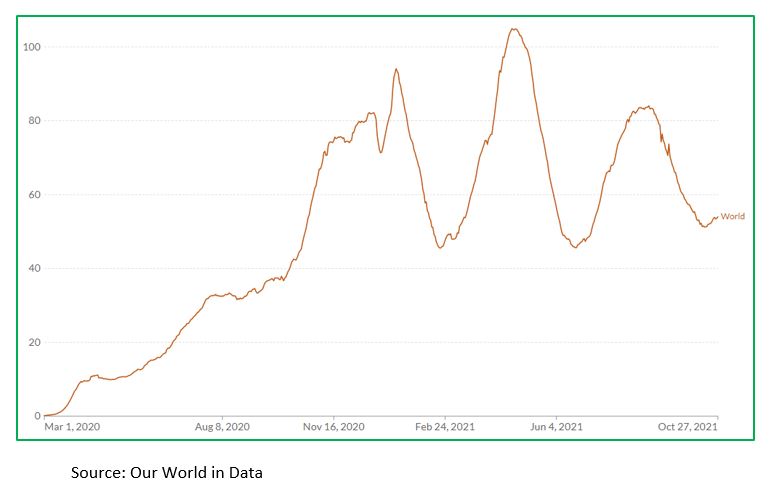

The momentum witnessed in the first half of the year, waned in the third quarter of 2021 as near-term outlooks dimmed due to rising coronavirus cases globally owing to the highly contagious COVID-19 delta variant and growing inflationary pressures. According to the World Health Organization (WHO), the delta variant is the most transmissible variant of the coronavirus and has been the cause for a renewed surge in infections worldwide as it peaked in early September 2021. Initially detected in India in October 2020, the variant has been found in more than 130 countries and is now the dominant strain in many countries.

Additionally, inflation spiked more than expected across the world due to supply chain bottlenecks, rising shipping and freight costs, dry weather conditions in key food exporting countries and surging commodity prices.

Chart 1: Daily new confirmed COVID-19 cases per million people

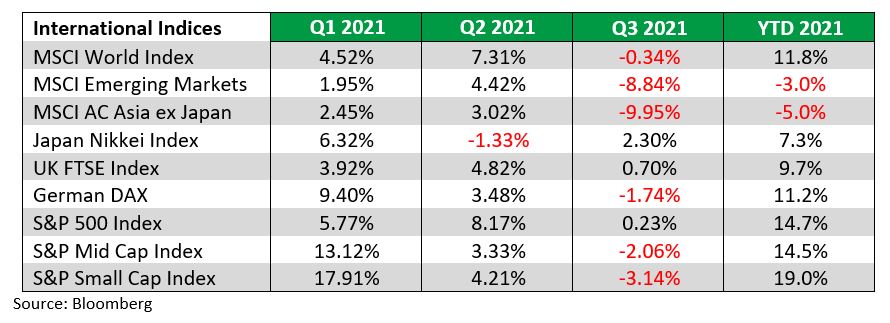

For Q3 2021, the MSCI World Index, a benchmark for global equities, declined by 0.34 percent after posting gains of 7.31 percent and 4.52 percent in the first and second quarter of the year respectively. The downward trend was driven by Asian and Emerging Market equities that registered losses of 9.95 percent and 8.84 percent respectively in Q3 2021.

In Asia, China was the worst-performing market as a sell-off in Chinese stocks occurred due to concern over continued supply chain disruptions and the ability of the country’s second largest property group – Evergrande, to service its debts. China was also plagued with power outages and the rationing of energy that dampened investor sentiment and the production of key commodities. This situation was further exacerbated with the re-imposition of activity restrictions following an outbreak of the Delta variant. Consequently, Q2 2021 GDP was disappointing as it rose 7.9% year on year, down significantly from 18.3% achieved in Q1 2021. Investors were also spooked by the regulatory measures adopted by the government during the quarter on internet-related companies and companies that do not operate in the society’s best interest. Such measures included probes, fines and mandates for organizational structural changes. Brazil was the weakest market in the Emerging markets owing to the steady rise in consumer prices above the targeted inflation rate.

In Europe, most large European countries have near fully vaccinated populations against COVID-19, so the threat of the Delta variant was not as significant. However, European markets faced lower investor confidence as worries emerged over inflation due to supply chain bottlenecks and rising energy prices. Consequently, the momentum seen in the prior quarter reversed considerably in the third quarter of 2021, with UK posting a marginal return of 0.70 percent and German stocks incurring a loss of 1.74 percent.

At the start of the third quarter, US stocks moved steadily higher, bolstered by the steady return to pre-pandemic levels of activity, solid corporate earnings and comfort by the US Federal Reserve that the economy and market would enjoy full Fed support until late 2021. Consequently, the S&P 500 reached a new all-time high on September 2nd 2021 at 4,537.

The tone and volatility of the market however changed by mid- September against the backdrop of profit warnings due to supply chain constraints and margin compression, lower than expected economic growth and news that the second-largest property developer in China – Evergrande was likely going to default on debt payments. Further compounding the volatility, was confirmation by the US Federal Reserve that it will begin to reduce Quantitative Easing before year end. US equities ended the quarter relatively flat, achieving a marginal return of 0.23 percent over the quarter, down sharply from 8.17 percent in Q2 2021

By market capitalization, Small and Medium cap stocks underperformed their large cap counterparts in Q3 2021, with losses of 3.14 percent and 2.06 percent respectively, down from positive returns in Q2 2021.

Table 1: International Equity Indices

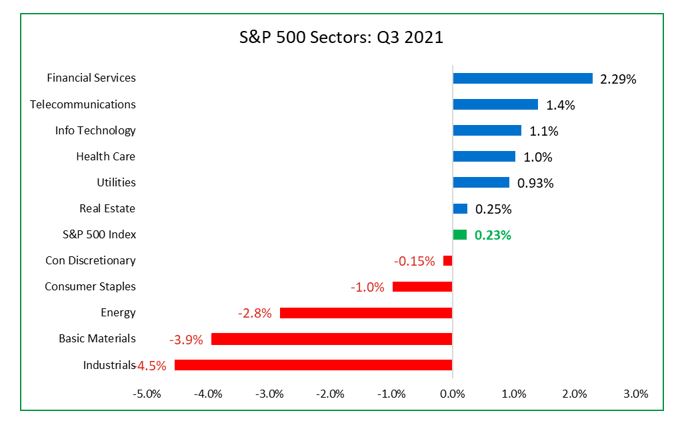

US Sector Performance

From a sector perspective, six out of eleven S&P sectors posted positive returns in Q3 2021, compared to nine out of the eleven sectors in Q2 2021. Financial Services (2.29 percent), Telecommunications (1.4 percent) and Information Technology (1.10 percent) were the top performing sectors in Q3 2021 and outperformed the S&P 500 index. The worst performing sectors that posted losses over the quarter were Industrials (4.5 percent), Basic Materials (3.9 percent) and Energy (2.8 percent).

Chart 2: US Sector Performance

Local Market Review

After accelerating in Q2 2021, the momentum in the local stock market cooled in Q3 2021, with the Composite Index posting a return of 2.01 percent, down from 4.40 percent in the prior quarter. The turnaround in the cross listed stocks was tempered by marginal returns by the local stocks. The Cross Listed Index returned to positive territory over the quarter with a return of 6.37 percent compared to a 4.03 percent loss in the prior quarter whilst the All T&T index that was relatively stagnant over the quarter, marginally up by 0.23 percent in Q3 2021 compared to 8.31 percent in Q2 2021.

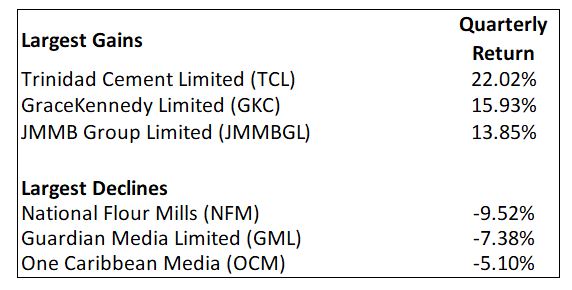

The stocks with the largest share price gains over the third quarter of 2021 were Trinidad Cement Limited (TCL), GraceKennedy Limited (GKC) and JMMB Group (JMMBGL) with returns of 28.5 percent, 25.8 percent and 17.6 percent respectively. Leading the declines were National Flour Mills (NFM), Guardian Media Limited (GML) and One Caribbean Media (OCM) with losses of 9.52 percent, 7.38 percent and 5.10 percent respectively.

Trinidad & Tobago Stock Exchange Largest Gains and Declines: 30 June 2021 to 30 September 2021

Equity Markets Outlook

Volatility in capital markets is expected to rise in the last quarter of the year. A key risk is inflation and the response of central banks around the world. If the inflation spike is deemed permanent, there may be a global response by monetary authorities to raise interest rates and / or reduce their Quantitative Easing measures. If the economic recovery is not entrenched, such action may be premature and thus may have a negative impact on the pace of the economic recovery.

Another potential risk to capital markets is the fiscal and tax policies proposed by the Biden Administration. The successful passing of the roughly US$3.5 trillion program for social infrastructure and taxes will prove crucial to the economic recovery amidst the potential withdrawal of the QE measures by the Federal Reserve. Uncertainty arises in the passing of the proposed policies given the narrow majorities in both the US Senate and the House. Delays and the failure to the passing of the bills may negatively impact investor sentiment and volatility.

An ongoing issue that has created some degree of instability in equity markets is the approaching deadline of the US Congress to address raising the US national debt ceiling by US$480 bn. On September 20 2021, a crisis was averted following the Senate approval to extend the debt limit until December 3rd after weeks of a partisan deadlock, allowing the US Treasury to pay its bills till until then. This reprieve is only temporary as the deadline for avoiding a government shutdown is less than two months away and is expected to destabilize equity markets as a US default would cause great harm to stocks and to the global economy.

Locally, economic activity is expected to pick up following the relaxation of restrictions against the backdrop of higher vaccination levels and the subsequent reopening of previously closed sectors. The rise in energy prices also augers well for the domestic economy. To ensure investment portfolios are resilient against volatility, it is important to diversify across asset classes, sectors and geographies.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.