Risk Management and Black Swans – An Oxymoron

Commentary

The ongoing COVID-19 pandemic continues to dictate our lives since the first locally reported case on 12 March 2020 as Trinidad and Tobago suffers through its third and largest wave. We are currently experiencing the highest rates of infections and once again, we have reverted to lockdown measures in an effort to stave off spread. Globally, there are over 175 million cases of infection and 3.79 million deaths. On 10 June 2021 alone, there were 435,120 new cases and 11,498 deaths indicating the pandemic is still very much a going concern globally.

As expected, the economic fallout from this pandemic is significant. On 24 June 2020, the IMF projected a 4.9% contraction for the global economy for 2020, a downward revision from the -3% projected just two months earlier. More noteworthy was the market reaction to the pandemic in March 2020. The CBOE VIX Index, a measure of market volatility, spiked to 82.69 from 13.68 a month earlier; the DOW fell to 18,592 from 29,398 and the S&P fell to 2,237 from 3,370 a year earlier. Given this shock event, discussion has ensued on if this event should be considered a “Black Swan”.

Black Swan

In layman’s terms, a Black Swan is an unpredictable, unforeseen event with unknowable risks that can have significant losses. They can cause significant damage to the economy. In his book[1], Nassim Nicholas Taleb indicates three characteristics of a black swan[2]:

- Rarity: It is an outlier beyond the realm of our regular expectations.

- Extremeness: It is an event that carries an extreme impact

- Retrospective distortion (predictability): Assessing the event after the fact and deriving plausible explanations for the event.

One can agree that the impact of the global pandemic was extreme, noting the sharp increase in volatility and sharp drop in the Dow and S&P Indices initially. One may also argue that this event was indeed unpredictable.

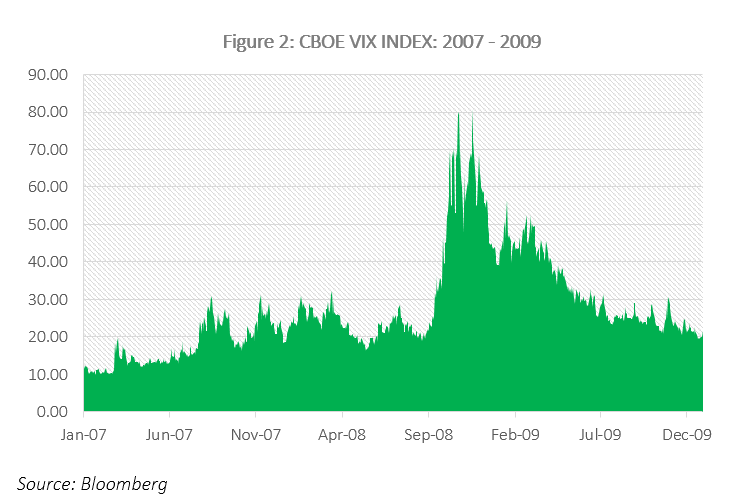

We take a moment to compare this current event to the 2008 financial crisis. In November 2008, the VIX index surged 32 points to 80.86 from a month earlier; S&P fell over 300 points to 676; and the Dow fell from 9,625 to 7,552. Movements were more significant over a wider time horizon, noting volatility, as measured by VIX, was under 10 prior to the start of the crisis. The 2008 financial crisis met all the requirements of a black swan. The economic impact was extreme, taking nearly a decade for the US Federal Reserve to withdraw monetary support and for economies to recover from the impact.

Prior to this, the more notable Black Swan event occurred on 19 October 1987, now referred to as Black Monday. In this event, the Dow Lost 25% (508 points) from 2,246 to 1,738 in a single day. US Stocks lost USD1 trillion in the two-month period from August 1987.

Despite these market reactions that may lend support that the COVID-19 pandemic was a Black Swan event, Taleb disagrees primarily on the premise that the pandemic was “wholly predictable” as key officials were aware of the spread of the virus prior to March 2020. He further indicated that the term Black Swan was initially coined for catastrophic events that highlighted a need for business reform, and not “a cliché for any bad thing that surprises us.”

Risk Management

Black Swans are not events that can be planned for as the coined term is defined by an event that is completely unforeseen, hard to predict initially, and whose risks are unknown. Quantitative models cannot capture the risk adequately to predict them as they are based on historical data and not current risks. According to Bogle[3], “the application of the laws of probability to our financial markets is badly misguided. If truth be told, the fact that an event has never before happened in the markets is no reason whatsoever that it cannot happen in the future.”

However, as Taleb indicated, Black Swan events highlight the need for business reform. According to Stamford Risk Analytics, the 2008 global financial crisis “revealed the need for a paradigm shift in risk management practices”[4].

Over the last decade, there has been significant developments in Enterprise Risk Management (ERM) which is focused on a consolidated management of financial risks like market, credit and liquidity as well as operational, among others. Companies with robust ERM frameworks may be able to better withstand the impact of Black Swan events. Through stress testing, the business can plan for an acceptable “worst case” outcomes and capitalize accordingly. They can manage concentration and diversification to reduce the impact of a specific event. Liquidity contingency planning, and business continuity planning manage losses and reduce interruption in the business’ operations. While these strategies may not wholly offset an event, they provide a buffer to the negative impact of the event.

Having a robust risk management framework is essential to companies, as well as flexibility to adapt strategy and operations to unforeseeable events. With these tools, many companies will be better able to survive Black Swan events.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are not a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have not acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do not have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.

[1] Taleb, Nassim Nicholas. 2007. The Black Swan: The Impact of the Highly Improbable. New York: Random House

[2] Bogle, J. C. “Black Monday and Black Swans.” Financial Analysts Journal 64, no. 2

(March/April 2008): 30–40

[3] Bogle, J. C. “Black Monday and Black Swans.” Financial Analysts Journal 64, no. 2

(March/April 2008): 30–40.

[4] Wladawsky, Irving. “Spotting Black Swans with Data Science,” Wall Street Journal, May 17, 2013.