Sun, Sand, Sea and Fiscal Space…The Caribbean Economy

Commentary

The Caribbean region has long been trapped in a vicious cycle of low economic growth and onerous debt, exacerbated by its inherently small, narrow and highly open economies, which increase the region’s vulnerability to exogenous shocks. The pandemic has worsened the situation in many regards, and for countries which were able to begin the process of policy and structural reforms, have been greatly set back in meeting economic targets. As a result of the pandemic, tourism-dependent countries in the Caribbean contracted by an average of 9.8% in 2020, while the decline amongst commodity-exporters was less severe at 0.2%. Simultaneously, record countercyclical expansionary fiscal policy was deployed in an effort to shore up economic activity, to protect the socially vulnerable and to avoid a full-blown public health crisis. With many countries already reeling from several other adverse shocks (most notably weather-related), the ongoing economic fallout from COVID-19 is likely to extend into the medium term given the existing economic vulnerabilities.

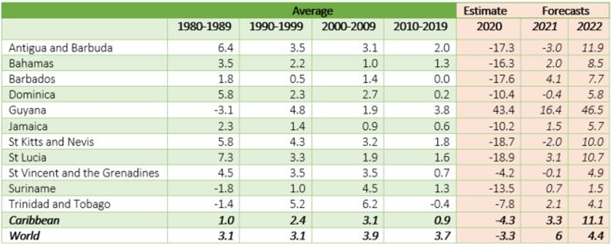

Table 1: Caribbean Historical GDP Growth and Outlook

Collectively, the Caribbean has moved from average economic growth of 1% in the 1980’s when primary production and commodities would have been the main drivers, to a peak average of 3.9% during the 2000’s when the global economy was booming and just before the global financial crisis of 2009. However, there is a clear divergence in performance among tourist-dependent economies and commodity exporters. For example, during the 2000’s while the tourism-dependent economies registered average growth of 2.2%, the commodity exporters recorded an average expansion of 4.2%, and looking ahead, the recovery seems to be much earlier and to some extent, stronger for the latter group of countries in the region.

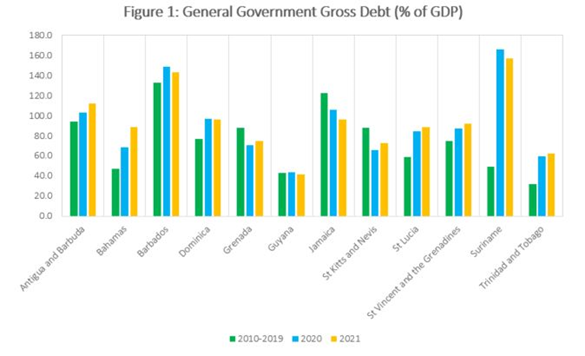

At the same time, the region is home to some of the highest indebted small and emerging nations of the world which severely constrains fiscal flexibility and limits room for maneuvering. For the period 2010 – 2019, the region’s debt to GDP ratio averaged 75.5%, rising substantially to 91.7% in 2020 due to a combined sharp contraction in GDP as well as widening financing requirements due to the pandemic. In 2020, it is estimated that Suriname was the most indebted with debt equivalent to 165.8% of GDP, followed by Barbados at 149% of GDP. Jamaica and Antigua and Barbuda are the other two Caribbean nations with a debt to GDP ratio above 100%. As a result of high and rising debt levels, policy is severely limited as, for many countries, debt servicing remains relatively high and subsumes a significant chunk of already narrow government revenue. The persistent fiscal deficits as well as pressure on the primary balance restrict government to effectively deploy countercyclical fiscal policies, which become necessary especially as the region is so prone to large natural disaster shocks. Consequently, many countries never get the chance to fully recover from these external shocks, resulting in large financing gaps and balance of payments challenges. Since 2000, many countries have resorted to debt restructuring exercises and have had to enter financing arrangements with the IMF.

Compounding the issue of high debt, sovereigns in the region are either rated as junk, (also called speculative grade) or not rated at all, with the exception of Trinidad and Tobago, which is rated at BBB-, at the cusp of investment grade by Standard and Poor’s. This poses another major challenge in terms of the cost of accessing the international capital markets to raise funds to fill the shortfalls in the fiscal accounts.

As many of the Caribbean operate within a fixed exchange framework, including the Eastern Caribbean Currency Union, Barbados and Bahamas, the ability to effectively implement monetary policy may also be relatively limited, as policy tends to move in tandem with the base country, in this case the US. Furthermore, policy must be centered around managing the peg, through maintenance of adequate foreign currency buffers to ensure exchange rate alignment.

As the Caribbean continues to grapple with the ongoing economic fallout and human crisis from the COVID-19 pandemic, policy formulation is important to break the cycle of low growth and high debt. It is likely that given the region’s high dependence on tourism as well as the limited fiscal space available to provide stimulus to spur private demand, recovery will take a while longer relative to other regions. The restrictions on certain business activities to help curb the spread of the virus, coupled with more stringent international travel requirements may have medium-to-long term implications, in terms of job losses, potential closure of tourism-related businesses and possible reduced airlift in the region as airlines restructure amid reduced profitability and/ or losses.

The IMF has outlined that protecting lives and livelihoods remain the priority, but has underscored the importance of tackling the region’s debt problems. According to the IMF, “restoring debt sustainability will require well-calibrated and appropriately balanced revenue and expenditure measures to reduce the primary deficits while minimizing the contractionary impact on growth, as well as greater efforts to mobilize concessional financing to help build resilience against future shocks. These efforts should be complemented with structural reforms to strengthen competitiveness and raise long-run growth.”

Notably, policymakers are operating in what can be considered uncharted territory in this pandemic and in an environment characterized by an unusually high level of uncertainty. There is no clear-cut path to recovery as there are multiple factors at play that will determine the speed and strength of the economic recovery.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.