The Federal Funds Rate and its Importance to the Investment Landscape

Commentary

Benchmark Interest rates in the US

The Federal Reserve, commonly known as the Fed, serves as the central bank of the United States (US). Its primary objectives revolve around attaining the peak level of employment in the economy without inducing a significant increase in consumer prices (maximum employment) and ensuring a stable inflation rate (price stability).

One instrumental tool employed to achieve these objectives is the establishment of benchmark interest rates which are reference points for setting other interest rates. A key benchmark rate is the Federal Funds Rate which is the interest rate at which banks and other depository institutions lend money to each other on an overnight basis. The rate is set by the Federal Open Market Committee (FOMC) as a range, delineated by upper and lower limits, serving as a pivotal benchmark for short-term interest rates. The Fed strategically deploys the federal funds rate as a tool to implement monetary policy, exerting influence on economic conditions.

Historical Overview of the Federal Funds Rate

Since 1954, the fed funds rate has been dynamic, rising and falling as the Fed responds to changes in the economy. The rate has been set as high as 20% in the early 1980s in response to inflation and was slashed to a record-low target of 0% to 0.25% during the Great Recession that occurred in 2008 to encourage growth. In 2020, the rate was once again lowered to 0% to mitigate the economic impact of the Covid-19 crisis.

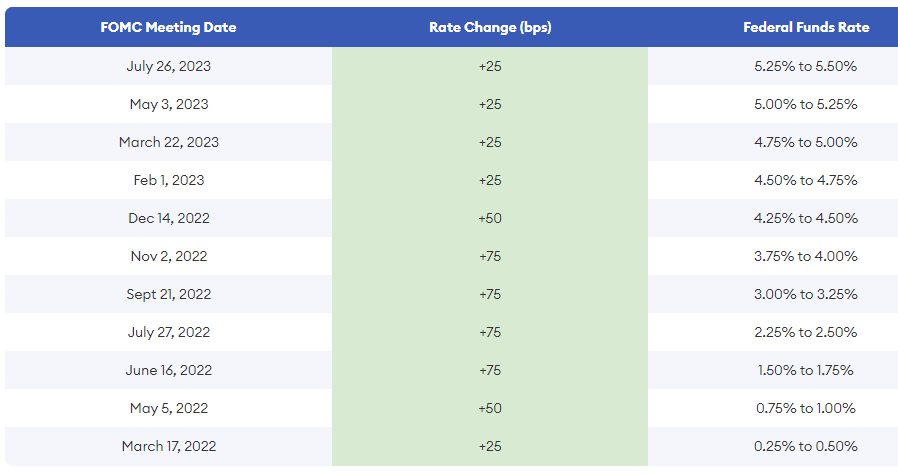

Since March 2022, the FOMC has been increasing rates in an attempt to tame inflation that has been increasing post the Covid-19 pandemic. The Fed has raised rates 11 times, from 0% to the current benchmark target range of 5.25%-5.50%.

Impact of the Federal Funds Rate

Consumers and Investors

The federal funds rate is a critical factor in shaping the economic environment and can have substantial implications for both consumers and investors. Due to its significance, it is important to understand the federal funds rate and monitor its movements.

The Federal funds rate has a direct impact on borrowing costs. When the federal funds rate increases, borrowing becomes more expensive for banks, leading them to potentially raise interest rates on loans to maintain profit margins. This, in turn, can have a dampening effect on economic growth and overall spending. Conversely, a decrease in the federal funds rate lowers the cost of borrowing among banks, encouraging them to lower interest rates, thereby fostering economic activity.

From March 2022 to September 2023, the federal funds rate experienced a 525 basis points increase. As one of the primary benchmark rates, this led to corresponding rises in mortgage interest rates, the bank prime rate, and credit card interest rates. Credit card interest rates surged by 663 basis points between February 2022 and August 2023, while the bank prime rate saw a 500 basis points increase. Similarly, interest rates on 30-year mortgages climbed by 264 basis points.

The drastic rise in interest rates directly increased the cost of borrowing money for both consumers and investors. This effect would be particularly significant for consumers with variable rate loan commitments, such as adjustable-rate mortgages and credit card debt, as their monthly interest payments would rise, consequently reducing their disposable income.

For investors, increased interest rates would raise the cost of borrowing on margin. Borrowing on margin is an investment approach that grants investors the flexibility to use their assets as collateral to obtain additional funds from a brokerage firm or bank. This enables investors to acquire more securities than they could with their initial capital, potentially enhancing their returns.

Increasing interest rates would diminish the attractiveness of margin borrowing as an investment strategy, consequently restricting the available funds for investment. With the elevated cost of borrowing, investment returns would likely fall, as the higher borrowing expenses can erode potential gains.

Table 1: Key Interest Rates

| Mar-22 | Sep-22 | Mar-23 | Sep-23 | |

| 30 Year Mortgage Interest Rates | 4.67 | 6.70 | 6.32 | 7.31 |

| Bank Prime Rate | 3.50 | 4.75 | 8.00 | 8.50 |

| Feb-22 | Aug-22 | Feb-23 | Aug-23 | |

| Interest Rates on Credit Cards | 14.56 | 16.27 | 20.09 | 21.19 |

Financial Markets

Fluctuations in the federal funds rate can impact asset prices. The cost of borrowing influences a company’s interest expense, which is the amount of interest paid on its debt obligations. Elevated borrowing costs result in increased interest expenses, potentially diminishing a company’s earnings, profitability, and dividend distributions. The heightened cost of borrowing may dissuade companies from pursuing new investments or expanding their operations, thereby hindering their growth potential. Moreover, a higher interest rate environment limits a company’s capacity to allocate resources to crucial growth initiatives and other strategic priorities. Faced with reduced earnings, profitability, and constrained investment and growth opportunities, a company’s long-term sustainability and competitiveness may suffer, consequently affecting its stock price.

Bonds and interest rates generally have an inverse relationship. Thus when interest rates rises, existing bond prices tend to fall and when interest rates falls, bond prices tend to rise. Depending on the movement in the federal funds rate, bond holders may experience capital losses or gains, impacting the overall value of their bond holdings.

Projected Movement in the Federal Funds Rate

During its meeting on October 31st -November 1st, 2023, the Federal Open Market Committee (FOMC) maintained the benchmark interest rate within a range of 5.25%-5.50%. This marked the second consecutive occasion where the Fed chose to keep rates steady. The FOMC meetings not only include rate decisions but also reveal the committee’s projections, offering insights into members’ expectations for the economy and the federal funds rate. These projections are critical indicators of the committee’s economic outlook and monetary policy stance and are closely observed by analysts and the investment community. According to the FOMC’s Summary of Economic Projections (SEP), they anticipate the benchmark rate to decrease to a median rate of 5.1% in 2024, 3.9% in 2025, and 2.9% in 2026.

Due to the extensive impact that the federal funds rate wields on the economy, financial markets, and the investment landscape, both consumers and investors should actively monitor the rate and try to predict the actions of the Federal Reserve. Anticipating potential changes in the federal funds rate enables consumers to effectively plan for potential shifts in borrowing costs, thereby influencing their monthly payments and overall financial stability. For investors, this foresight facilitates proactive strategic positioning and alignment of portfolios to capitalize on opportunities and mitigate risks associated with fluctuations in interest rates.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.