The Politics of International Trade

Commentary

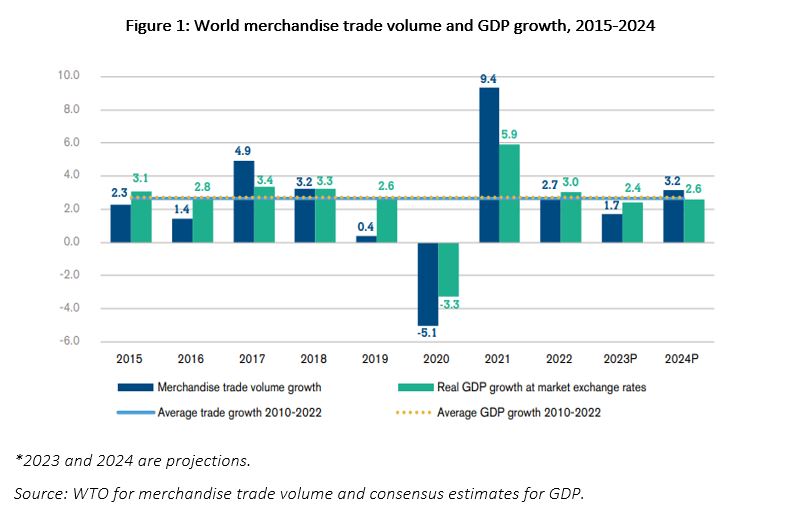

Subsequent to World War II, the concept of open markets and free trade became the prevailing philosophy for global exchange of goods and services among nations. During this period, there was a general agreement on the benefits of reducing trade barriers and promoting free trade, leading to the strengthening of the global trade system. However, in the last decade, there have been notable deviations from this trend, as geopolitical conflicts, shifting alliances, and changes in foreign investment flows have emerged as significant drivers in shaping trade patterns. Political and economic factors, including territorial disputes, resource disagreements, and ideological differences, have introduced uncertainties and risks that have impacted trading relationships and investment flows. The Ukraine-Russia war and the US-China trade war serve as prominent examples, highlighting the substantial influence of geopolitical tensions on trade flows. It is evident that these tensions will continue to affect international trade in various ways as the World Trade Organization forecasts modest growth of 1.7% in global merchandise trade volume in 2023, attributed to an improved global economic outlook. However, this growth rate remains below the average of 2.6% observed over the past 12 years.

Trade Barriers:

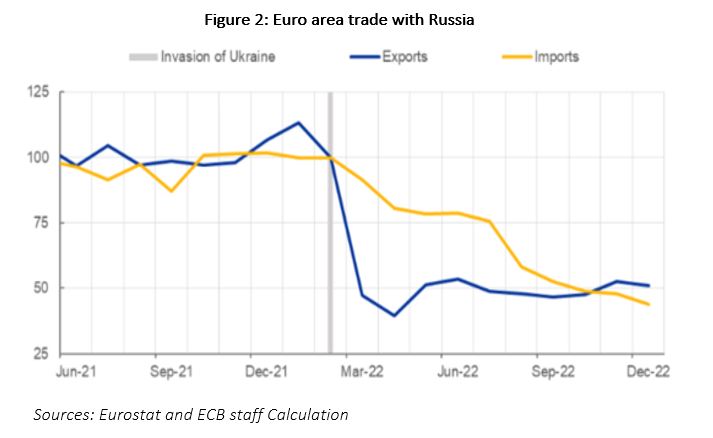

One of the most significant ways in which geopolitical tensions affect trading patterns is through the implementation of trade barriers such as tariffs and sanctions. Tariffs, which are taxes imposed on imported goods, increase the cost of foreign products and ultimately reduce demand among consumers. Similarly, sanctions restrict trade with specific countries or entities due to political or security concerns. These trade barriers can lead to a reduction in global trade as businesses and consumers seek alternative suppliers and markets. A notable example is the imposition of tariffs by the US on steel and aluminium imports from various countries, including China, in 2018. In response, China retaliated with tariffs on US goods, resulting in a decline in US exports to China and an overall decrease in global trade volume. This had a significant impact on economies reliant on exports. More recently, the conflict between Russia and Ukraine prompted the European Union (EU) and its allies to impose extensive sanctions on Russia. These measures included banning certain types of machinery and transport equipment and implementing price caps on seaborne imports of Russian oil. Consequently, Russia’s trade relations with the EU and the rest of the world continue to fundamentally change. Russia’s exports to the euro area, such as crude oil, coal, and natural gas, were significantly affected. The EU progressively banned the import of coal, crude oil, and refined oil products, leading to a shift in energy imports from other countries. The war also resulted in Russia reducing natural gas flows to Europe, leading to a 90% decrease in gas imports from Russia. Europe sought alternative sources, including pipeline gas from Norway, Algeria, and Azerbaijan, to replace the reduced supply from Russia.

The imposition of international sanctions on Russia has had a profound impact on its trade patterns. Because of the Ukrainian invasion, the value of Russia’s imports experienced a significant decline as all its trading partners, not just the countries imposing sanctions, reduced their exports to Russia. In response to the sanctions, Russia underwent a comprehensive restructuring of its trade patterns. It sought to reduce its dependence on a geographically diverse supply chain and instead focused on strengthening trade ties with specific countries. China, in particular, emerged as a key trading partner for Russia, accounting for almost half of its import of goods as of January 2023. Bilateral trade between China and Russia in 2022 rose by 34.3% year on year to a record high of 1.28 trillion yuan from 26.6% in 2021.This shift in trade dependencies reflects Russia’s efforts to adapt to the changing geopolitical landscape and mitigate the impact of international sanctions. By consolidating its trade relationships and diversifying its sources of imports, Russia aims to ensure a more stable and secure supply of goods. Geopolitical tensions, which lead to trade barriers such as tariffs and sanctions can disrupt global trade, alter trade relationships, and prompt countries to seek alternative suppliers and markets, leading to significant changes in the flow of goods and services.

Trade Wars:

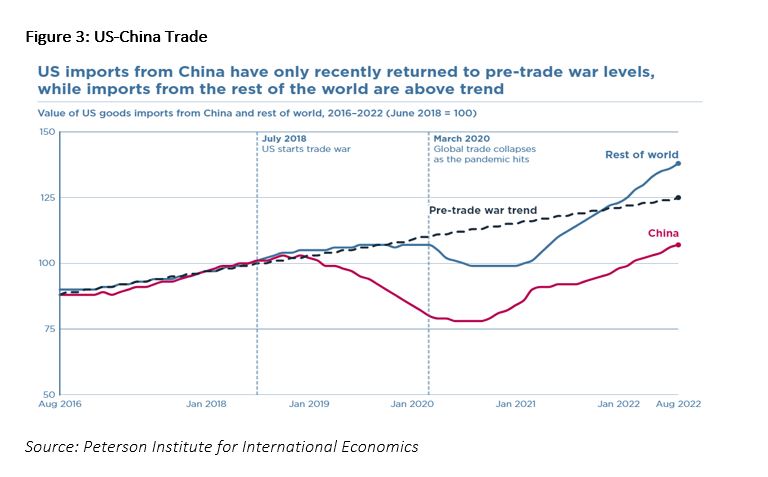

Supply chains are also affected by geopolitical tensions. One notable example is the US-China trade war, which prompted companies to relocate their manufacturing operations from China to other countries in Southeast Asia like Vietnam and Thailand. This shift in production was driven by companies seeking to avoid trade barriers and take advantage of more favourable economic conditions. As a result, these countries experienced an increase in exports to the US, while China’s share of total US imports declined. During the trade war, the US imposed tariffs on Chinese imports, leading to a reduction in US goods imports from China. The effects of this were amplified by the global trade collapse caused by the COVID-19 pandemic in early 2020. By October 2022, China’s share of total US imports had decreased to 18%, down from 22% before the trade war. Meanwhile, imports from the rest of the world increased by 38%, as they were not subject to US tariffs. These shifts in trade patterns reflect companies’ strategies to adapt to changing trade dynamics and mitigate the impact of trade barriers. They seek to diversify their supply chains and explore alternative sourcing options to maintain competitiveness in the face of geopolitical tensions.

Changes in Foreign Exchange Rates:

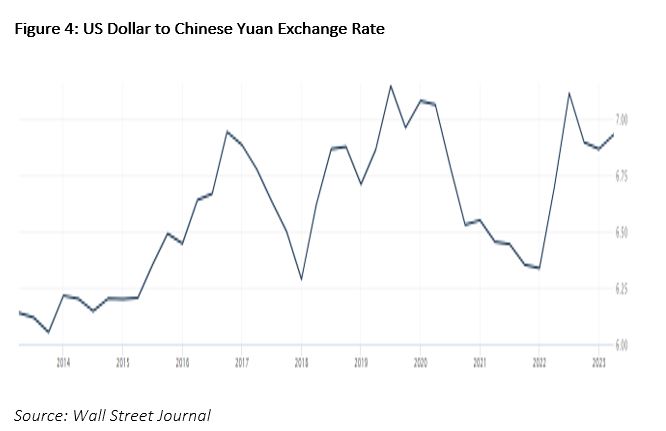

Geopolitical tensions can have a notable impact on trading patterns through changes in foreign exchange rates. During periods of tension, investors tend to seek safer currencies like the US dollar, causing it to appreciate in value. This appreciation makes US exports more expensive, leading to a decline in demand for them. On the other hand, currencies of countries affected by tensions may depreciate, making their exports cheaper and more competitive. For instance, during the US-China trade war in 2019, the Chinese yuan depreciated in value, which made Chinese exports more affordable and appealing to foreign buyers, resulting in an increase in Chinese exports to other countries. In more recent developments, both Russia and China have been actively working to reduce their reliance on the US dollar. Sanctions imposed on Russia and the US’s confrontational approach towards China have prompted these countries to accelerate their efforts to diversify away from the dollar. They are holding fewer dollar reserves, settling most of their trade in yuan, and exploring alternative international payment systems outside the dollar-dominated SWIFT system. Other countries, such as India, have also started settling oil purchases from Russia in non-dollar currencies.

Furthermore, the exploration of digital currencies by various nations offers another potential alternative to traditional currencies in international trade. As Russia and China create a more flexible trading relationship allowing countries to trade in local currency or alternatives to the US Dollar, US-exports to various countries throughout the world may decline.

Effects of Geopolitical Tensions on the Caribbean:

Geopolitical tensions in the Caribbean region, similar to global markets, have significant implications for trade. These tensions can affect trading patterns both directly and indirectly. Directly, if a major trading partner of Caribbean countries becomes involved in geopolitical conflicts, it can disrupt trade routes, cause shipment delays, and increase trade costs. While the Caribbean region was not directly involved in the Ukraine-Russia war, it still experienced the consequences in terms of trade. In 2020, the Russian Federation and Ukraine accounted for only a small percentage of the region’s total goods exports and imports, with Jamaica standing out as having higher proportions of exports to those markets. However, the conflict had a notable impact on the region, particularly in the prices of energy, mining outputs, food, and fertilizers. The global production and trade of these products, in which both Russia and Ukraine play significant roles, contributed to the price increases in the region since the region is heavily dependent on import of food and fuels.

Indirectly, global geopolitical tensions can affect investor confidence and overall economic stability. Uncertainty and instability in the global geopolitical landscape make investors cautious and hesitant to engage in cross-border trade and investment. This caution can lead to a slowdown in foreign direct investment (FDI), which is a critical source of foreign exchange inflows into the region, which in the latest available data accounted for USD8,957 Million, as well as a reduction in business activities, further influencing trading patterns in the Caribbean. The Caribbean, like other regions, must navigate the complexities and uncertainties arising from geopolitical tensions in order to mitigate potential negative effects on trade and maintain economic stability.

In conclusion, geopolitical tensions can have a significant impact on trade from tariffs, sanctions, trade wars and changes in currency exchange rate. Trade patterns are now more than ever being influenced by political affiliation rather that profitability.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.