T&T’s Uncertain Economic Recovery

Commentary

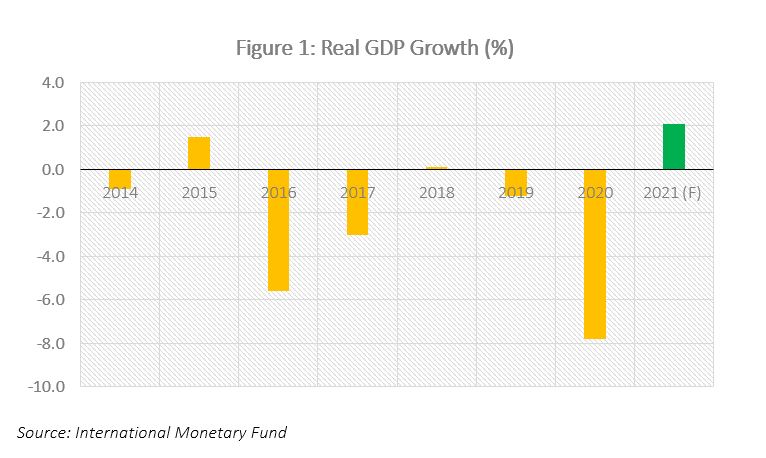

As the global pandemic rages on for almost two years now, the Trinidad and Tobago (T&T) economy, unsurprisingly continues to reel from the adverse effects that accompanied the public health restrictions and limited business activity. Prior to the COVID-19 pandemic, economic output was already stifled due to the bearish energy markets globally, which impacted the domestic energy sector with knock-on implications for the rest of the economy. Based on data from the International Monetary Fund (IMF), in 2020 the T&T economy recorded its largest contraction since the 1983 economic collapse when the economy shrank by over 10%. The most recent restriction measures, though necessary to preserve lives, will no doubt prolong T&T’s economic recovery, even if full commercial activity resumes in the second half of 2021.

The IMF estimates that the T&T economy contracted by 7.8% in 2020, steeper than the 4.3% average decline experienced in Caribbean and extending the 1.2% contraction registered in 2019. The Central Bank of Trinidad and Tobago (CBTT) estimates that economic activity shrank by 7.9% in 2020, based on its Quarterly Economic Activity Index. The decline in the energy sector weighed heavily with activity falling by approximately 14% during 2020, driven by plunging natural gas, LNG and petrochemical production during the year. The decline in the non-energy sector was around 6% with major sectors recording decreasing output. Activity was supported by a 5.7% increase in financial and insurance sector activities.

Expectedly, due to the pandemic, labour market conditions have deteriorated as non-essential business activity continues to be restricted and as companies prioritize expenditure amid dwindling revenue through temporary layoffs and/ or reduced working hours. In the absence of official labour market statistics from the Central Statistical Office for 2020, anecdotal evidence suggests that joblessness rose sharply, as retrenchment notices filed at the Ministry of Labour increased to 2,744 persons during 2020, significantly higher than the 1,528 persons retrenched during 2019. The CBTT has indicated that the hardest hit sectors by the pandemic in terms of employment have been energy, manufacturing, construction, transportation and other business services (hospitality, entertainment, and tourism).

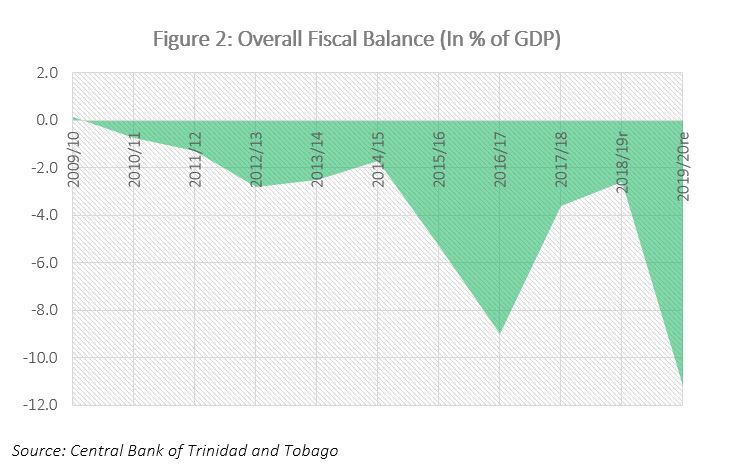

The squeeze on economic activity caused by the pandemic exacerbated the already weakened government fiscal accounts, which recorded the highest shortfall as a ratio of GDP in recent history in fiscal year (FY) 2019/ 2020. Revenue collection declined by close to 30% while the increase in total expenditure was contained to 0.11%. The overall fiscal deficit was registered at TTD16.8 billion, equivalent to 11.2% of GDP. The overall fiscal account has been in consecutive deficits since FY2010/2011. Consequently, the country’s debt levels have risen steadily in order to finance the successive fiscal shortfalls. The total net public sector debt (which excludes debt issued for sterilisation purposes) averaged just below 65% of GDP for the period September 2016 – September 2019. However, the ratio soared to 80.9% in FY 2020 due to the 17.5% increase in borrowing, coupled with the contraction in GDP.

T&T’s external accounts remain highly dependent on the energy sector, with energy exports accounting for an average of 81% of total exports since 2011 and more recently, for the nine-month period to September 2020, data shows that 75% of total export earnings came from the energy sector. During the same period, the external current account posted a smaller surplus equivalent to 2.3% of GDP, compared to an average surplus of around 4.5% of GDP over the preceding five years. The overall balance of payments turned positive during the period, supported by net inflows in the financial account. Accordingly, the balance of payments recorded an overall surplus of 2.3% of GDP, relative to an average deficit of 3.9% of GDP during the period 2015 – 2019.

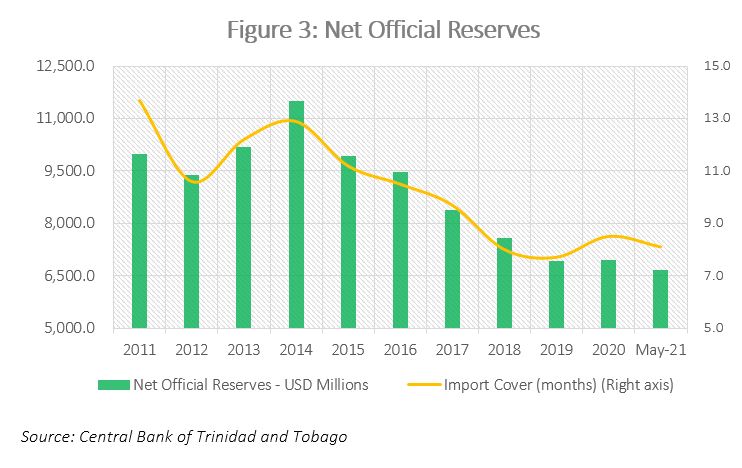

The country’s financial buffers have come under pressure since global oil prices plunged back in 2014. Accordingly, gross official reserves have steadily, but moderately declined. After peaking at USD11.5 billion in 2014, reserves have declined to just around USD7 billion at the end of 2020. Relative to 2019, 2020 experienced an increase of almost USD25 million, stemming the declining trend of the prior five years. According to the CBTT, the uptick in reserves during 2020 was supported by inflows from drawdowns from the Heritage and Stabilization Fund (which currently stands at USD5.7 billion) as well as proceeds from central government borrowings. Year to date (up to end May 2021), official reserves have declined further by 4% and is now equivalent to approximately 8.1 months of import cover, compared to 8.5 months at the end of 2020.

The IMF projects that the T&T economy will grow by 2.1% in 2021, while Fitch Solutions recently downgraded its growth forecast from 5.3% to 4.4%, largely due to nationwide lockdown which was implemented in May 2021. One of the key elements to a faster economic recovery is strengthening the vaccination drive as this will enable earlier reopening of the economy. While there are many headwinds associated with the outlook for the domestic economy, on the positive side, global oil prices have been ticking higher. Crude oil prices are up by close to 50% year to date (as at 7 July) and is currently trading around USD72.00 per barrel (WTI), the highest level since 2018 as fuel demand returns globally and OPEC+ production agreements keep supply subdued. Recent disagreements within OPEC+ member countries concerning the alliance’s output policy have also supported the higher crude oil prices in the past few days. Natural gas prices (as measured by Henry Hub) is also up by close to 40% year to date. Likewise, ammonia prices are currently at more than double their 2020 year-end levels.

Notwithstanding the more bullish outlook for oil and gas prices, the outlook for the T&T economy remains highly uncertain. Given the already constrained fiscal position, it may be difficult to implement additional fiscal stimulus without incurring significantly more debt, withdrawing from the HSF (once the legislation allows given recent oil price movements) or even divestments of government assets. Much depends on the evolution of the pandemic and how quickly the domestic economy can be fully reopened.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.