Understanding Settlement Dates

Commentary

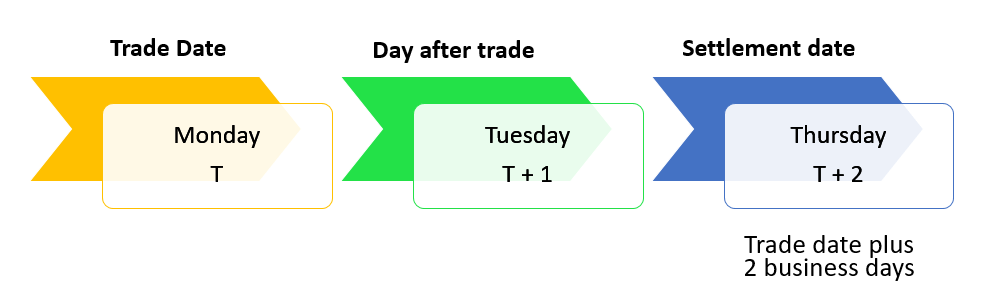

Settlement dates refer to the schedule for finalizing financial transactions, involving the legal exchange of securities and funds between buyers and sellers. Currently, the settlement date for most securities adheres to a T+2 timeline. Here, “T” represents the transaction date, and “+2” indicates that the settlement must be completed within two business days following the transaction.

Different types of securities have different settlement timelines. Treasury bills settle on the next business day (T+1), while stocks settle in two business days (T+2). Settlement dates exclude weekends and holidays, ensuring a smooth and regulated process for securities transactions.

The Importance of Settlement Dates

Settlement dates are essential for the smooth operation of financial markets, providing a standardized framework for completing transactions. Understanding the timeline for transferring funds and securities after a trade ensures timely transaction completion, thereby reducing counterparty risk. Counterparty risk, or default risk, is the possibility that one party in a financial transaction might not fulfil its contractual obligations. By following predetermined settlement timelines, parties can promptly exchange funds and securities, minimizing the risk of default or non-performance.

Clear deadlines for settlement help reduce or eliminate liquidity risk, which occurs when sellers are unable to deliver assets or buyers lack the necessary funds on the settlement date. Settlement dates offer investors a predictable timeline for receiving or disbursing funds after a transaction, enabling better cash flow planning. Investors can confidently know when they will receive proceeds from sales or need to make payments for purchases.

Timely settlement of transactions enhances overall market liquidity by ensuring efficient buying and selling of securities without unnecessary delays. When transactions settle promptly, investors have confidence in their ability to execute trades quickly and access liquidity as needed. This confidence fosters greater trading activity, narrows bid-ask spreads, and reduces price volatility, thereby improving market liquidity and efficiency.

Settlement Process

The settlement process involves several steps and includes:

- Trade Execution: Investors initiate buy or sell orders through their brokers.

- Transaction Date (T): This marks the initiation of the trade.

- Confirmation: Brokers confirm the trade details, including price and quantity.

- Clearing: The clearinghouse verifies the trade and ensures sufficient funds or securities for settlement.

- Settlement Date (T+3): Three business days after the transaction date, the actual transfer of funds and securities occurs.

- Completion: The transaction is officially settled, and ownership of securities is transferred.

Figure 1: Settlement Process

Changes to the settlement cycle

Before 2017, the settlement period for broker-dealer transactions was T+3, meaning three days after the trade. In September 2017, the United States Securities and Exchange Commission (SEC) amended a rule to shorten the settlement cycle to T+2. Following increased market volatility during the COVID-19 pandemic, the US Depository Trust and Clearing Corporation (DTCC) issued a white paper advocating for a change to a T+1 settlement cycle.

On February 15, 2023, the SEC officially amended Rule 15c6-1(a) under the Securities Exchange Act of 1934 to shorten the settlement cycle to T+1. On May 27, 2024, Canada and Mexico will implement the T+1 settlement cycle, with the United States transitioning to T+1 a day later on May 28, 2024. The United Kingdom (UK) and the European Union (EU) are in the initial stages of planning a future move to T+1, currently under evaluation by a technical group.

Recently, the Trinidad and Tobago Stock Exchange (TTSE) revised its rules to reduce the settlement period for local stocks and mutual funds from three business days (T+3) to two business days (T+2), starting from April 15, 2024. Although the TTSE is lagging behind its international counterparts, this rule amendment signifies a step in the right direction. It mirrors advancements in technology, rising trading volumes, and shifts in investment products and the trading environment.

Implications of changes to the settlement cycle to financial services industry

According to the Financial Industry Regulatory Authority (FINRA), starting May 28, 2024, stocks, bonds, exchange-traded funds (ETFs), certain mutual funds, municipal securities, Real Estate Investment Trusts (REITs), and master-limited partnerships (MLPs) traded on US exchanges will transition from a T+2 to a T+1 settlement cycle. This shift to T+1 will have various implications for investors, brokers/dealers, and the industry as a whole.

Investors purchasing securities will need to ensure their brokerage cash accounts are funded by the day after confirming a trade, rather than two days later. This means confirming that Automated Clearing House (ACH) transfers clear a day earlier than usual. Investors with physical, paper certificates will need to deliver them to their broker/dealer a day sooner. Broker/dealers must ensure accounts are funded in time for settlement and have efficient systems in place to handle the quicker turnaround.

There are several advantages to shortening the settlement cycle to T+1. It is expected to reduce credit and counterparty risk by shortening the time between trade execution and settlement. Liquidity risks will also likely decrease as investors can access the proceeds from securities transactions sooner. Overall, this will lower market risks associated with trade settlements. Additionally, investors may benefit from reduced fees, as clearing houses can lower the fees they charge broker/dealers for processing trades. Both investors and broker/dealers will benefit from needing less collateral in margin accounts, which are brokerage accounts that allow investors to borrow money from their broker to buy securities, thus freeing up resources for other uses.

Implementing T+1 presents several challenges for firms. Broker/dealers and clearinghouses will need to invest additional capital to update their systems and processes to accommodate T+1 settlement, potentially impacting short-term profitability. Additionally, while the US, Canada, and Mexico are moving to T+1, other major global financial centers will remain on the T+2 settlement cycle. This discrepancy will increase operational costs for multi-leg cross-border transactions.

The transition from T+3 to T+2 settlement dates marks a significant milestone in the evolution of financial markets. While the change introduces operational challenges and cost considerations, it ultimately enhances efficiency, reduces risk, and improves liquidity. Investors benefit from expedited settlement processes, while the financial industry adapts to meet regulatory requirements and technological advancements. As market participants navigate the transition, collaboration, innovation, and adherence to best practices are crucial for ensuring a seamless migration to T+2 settlement and fostering a resilient and dynamic financial ecosystem.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.