- Annual Fee: TT$145

- Additional: $75.00

- Credit Line: TT$3,000 – TT$9,999.99

- Interest Rate: 2% per month

- Free access to our Online Banking service

Card at a glance

- Who it’s for: You want a basic credit card to build your credit

- Annual Fee: TT$145

- Additional: $75.00

- Credit Line: TT$3,000 – TT$9,999.99

- Interest Rate: 2% per month

- Free access to our Online Banking service

Features

Accepted internationally wherever you see the Visa symbol

Cash Back Rewards

- 24 x 7 Visa Consumer Benefits Services Centre: receive information and support on benefits offered and claims to be processed:

– visit the convenient online option www.visa.com/benefitsportal OR

– call in via telephone, 1-800-396-9665 when in the USA and Canada or +1 303 967 1098 from any other country, collect call plus

– Travel Assistance Services

- Emergency Card Replacement Service

- Emergency Cash Disbursement Service

- Price Protection – up to US$200 per account per 12 month period

Credit Card FAQs

General Credit Card FAQs

What are the requirements for a Credit Card?

Credit Card Application Checklist

Scan and upload the following documents via the Online Credit Card Application Portal

- Salary slip, not more than 1 month old

- Two (2) forms of valid identification

- Proof of Address not older than 3 months* (bank statements can be provided as a proof of address)

- Job Letter addressed to First Citizens not older than 3 months old

- Politically Exposed Persons (P.E.P) Declaration for Individual Form – This is your declaration on if you are a Politically Exposed Person (PEP), which the Bank needs to know, in line with the Proceeds of Crime Act 2000 (as amended) and the Financial Obligations (Amendment) Regulations 2014, Regulations 20(3). Definitions on who qualifies as a PEP is provided on the form

- Customer Declaration – This form provides the Bank with the customer’s declaration on if he/she has any tax obligations in any jurisdiction outside of Trinidad and Trinidad. This is in line with the Tax Information Exchange Agreements (United States of America) Act 2017

- Credit Card Standing Order Form – This form allows you to easily make arrangements so that your credit card payments are automatically kept up to date via standing order options which suits you.

- Note: *If the proof of address e.g. utility bill, is not in your name, a letter of authorization from the person in whose name the bill is in should be provided, along with a copy of a valid ID of the said individual.

- ** Co-applicants must be a minimum 16 years and one form of valid identification is required

For any questions, please contact us via any of the options below:

- Chat with us via WebChat

- Email us at: cardsales@firstcitizenstt.com

How can I obtain my Credit Card statement balance due?

You can obtain your Credit Card statement balance due via:

- Monthly Credit Card statement

- Online Banking

- Telebanking

- Mobile App

How can I obtain my real time Credit Card available balance?

You can obtain your real time available balance via Online Banking, the Mobile App or the ATM

What is my Credit Card statement date and when is my payment due?

Please refer to Table I below:

Table I

| Card Type | Statement Date | Payment Due Date | Minimum Balance Calculation |

| Visa Tertiary | 10th monthly | 30th of the same month | 1/24 of the outstanding balance as at the statement date |

| Visa Classic | 13th monthly | 2nd of the following month | 1/24 of the outstanding balance as at the statement date |

| Visa Purple | 13th monthly | 2nd of the following month | 1/24 of the outstanding balance as at the statement date |

| Visa 2 In 1 | 13th monthly | 2nd of the following month | Full Payment: total balance as at the statement date Minimum Payment: loan installment plus 1/24 of the outstanding balance as at the statement date |

| Vacation Lifestyle Mastercard | 13th monthly | 2nd of the following month | 1/25 of the outstanding balance as at the statement date |

| Vacation Lifestyle MasterCard Gold | 16th monthly | 5th of the following month | 1/30 of the outstanding balance as at the statement date |

| Visa Gold, Platinum Signature and Infinite | 16th monthly | 5th of the following month | 1/30 of the outstanding balance as at the statement date |

How can I make a Credit Card payment?

You can make a Credit Card payment via:

- Online Banking

- Telebanking

- Mobile Banking App

- ATM

- Fast Deposit Boxes located in any conveniently located First Citizens Branch

- A Standing Order from your First Citizens account or another Bank’s account

How soon do I have access to funds paid to my Credit Card?

You will have immediate access to funds on your Credit Card, once transferred from your First Citizens account to your Credit Card via First Citizens Online Banking, the Mobile App or Telebanking.

Please note:

- Payments made on Monday – Thursday by 3:00 pm or Friday by 4:15 pm are updated the same night

- Payments made on Fridays after 4:15 pm, will be credited to your Credit Card on Monday night

- Payments made on public holidays will be credited the night of the next business day

What Credit Card Reward programmes are offered?

There are two main Credit Card Reward programmes currently offered:

Is there insurance coverage with my Credit Card?

International Emergency Medical Services and World Wide Auto Rental Insurance are offered to Visa Platinum, Signature and Infinite Credit Cardholders.

Please click here for further information

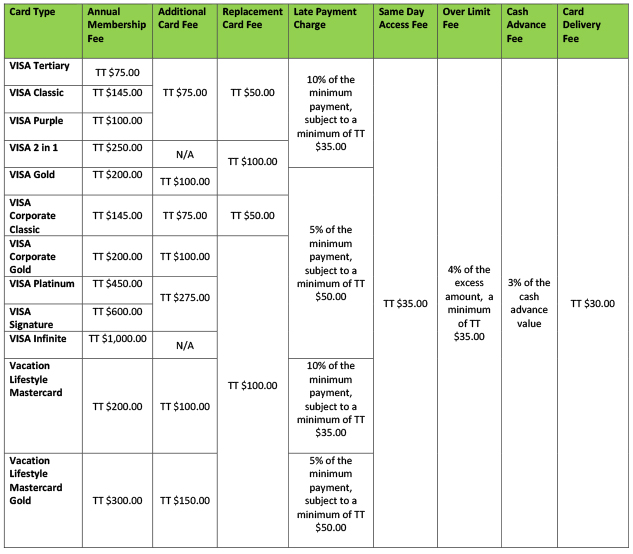

What are the fees and charges associated with my First Citizens Credit Card?

Please refer to Table II for the fees and charges associated with your First Citizens Credit Card:

Table II

When my Credit Card expires, how will I receive my renewed card?

Your renewed Credit Card will be directly delivered to you via TTPOST Couriers (TrackPak) to your mailing address currently on record at First Citizens. Please note, a delivery cost of TT $30.00 will be charged to your Credit Card.

What is the Foreign Currency Limit on my Credit Card?

The Foreign Limit varies for each card type, please refer to Table III for further information.

Table III

| Credit Card | USD Limit |

| Visa Tertiary | $2,000 |

| Visa 2 in 1 | $2,000 |

| Visa Purple | $2,000 |

| Visa Classic | $5,000 |

| Visa Business Classic | $5,000 |

| Vacation Lifestyle Mastercard | $6,000 |

| Vacation Lifestyle Mastercard Gold | $6,000 |

| Visa Business Gold | $6,000 |

| Visa Signature | $7,000 |

| Visa Gold | $7,500 |

| Visa Platinum | $7,500 |

| Visa Infinite | $8,000 |

How do I set a Standing Order payment to my Credit Card account?

You can log in to Online Banking:

- Click the “Payments” main tab and select “Standard Payee Payments” or

- Send a Secure Message by clicking the “My Messages” main tab and select “Send New Message” requesting a deduction of the minimum or full outstanding balance from your personal account on a specific date (the 28th is recommended).

You can also visit any conveniently located First Citizens Branch and a

Customer Service Representative will assist you.

How do I request a replacement card and/or PIN?

You can request a replacement card or PIN by logging in to Online Banking, click the “My Services” main tab, then select “Credit Card/ PIN Replacement”. Your card will be delivered within seven (7) business days and your PIN will be sent to a First Citizens Branch of your choice for collection. Please note, a delivery cost of TT $30.00 will be charged to your Credit Card.

For customers residing abroad, you can request a replacement card and/or PIN to be delivered by FedEx via Online Banking.

What should I do if my Credit Card is lost or stolen?

You are required to immediately call 62-FIRST (623-4778) to make a report and a new Credit Card will be issued and delivered to your local mailing address. Our Contact Centre is available every day from 6am to 10pm.

If you are abroad, call:

- VISA at 1-800-396-9665 when in the U.S.A /Canada, or in other countries, call 1-303-967-1098

- Mastercard at 1-800-307-7309 when in U.S.A /Canada, or in other countries, call or 1-636-722-7111

Cash Back FAQS

How does Cash Back work?

You earn Cash Back for every purchase made with your Credit Card at a rate of 0.80% of the value of each transaction. In the case of corporate Credit Cards, with every international purchase, a rate of 0.40% is earned.

How often can I expect to receive my Cash Back?

Rewards are credited directly to your Credit Card every month based on your Credit Card statement date.

| Credit Card Type | Statement Date |

| VISA Tertiary | 10th of every month |

| VISA Classic VISA Purple VISA 2 in 1 VISA Business Classic | 13th of every month |

| VISA Gold VISA Platinum VISA Signature VISA Gold Business | 16th of every month |

How can I view my Cash Back earned?

You can view your Cash Back earned via your Credit Card statement.

How is Cash Back different from Bonus Points?

Cash Back is a direct credit to your Credit Card, whilst Bonus Points were issued in the form of a certificate and received via post.

Key differences

– Quicker access to your Rewards

– Paper-less and hassle-free

– The Cash Back credit reduces your outstanding balance

– You can shop at any merchant – locally or internationally

Contactless FAQs

What is Contactless technology?

This feature allows you to simply ‘tap-and-go! The terminal and card communicate using Near Field Communication (NFC) technology which allows you to tap your card over the merchant’s point-of-sale device to make a payment instead of inserting the card.

Why use Contactless technology?

Contactless technology brings you added convenience when making payments. With just a tap, you can make quick and secure payments.

How do I use the Contactless feature on my credit card?

Once the merchant point of sale device is enabled with Contactless technology, you can tap or wave your card 2 inches over the device to make a payment.

How can I determine whether I can use Contactless at a merchant?

The Contactless icon (see below) will be displayed on the merchant’s machine.

Will Contactless transactions require a Pin?

Each transaction is assessed “individually” and you will be prompted if you’re required to enter your Pin.

Is Contactless payment secure?

Contactless uses the same secure and robust technology as Chip & PIN.

When making a payment via Contactless, your personal card information is protected.

How can I be notified of a Contactless transaction?

First Citizens offers Email Alert Service which delivers convenient, fast and secure real-time notifications. Each notification will provide you with a brief transaction description that includes the merchant’s name, the transaction status (whether approved or declined), transaction value and your real-time available card balance.

Foreign Exchange Limit FAQs

What are the revised Foreign Currency limits on Credit Cards?

| CREDIT CARD | USD LIMIT |

|---|---|

| Visa Tertiary 2 in 1 Purple | $2,000 |

| Visa Classic | $5,000 |

| Visa Business Classic | $5,000 |

| Mastercard Gold / Lifestyle | $6,000 |

| Visa Gold Business | $6,000 |

| Visa Signature | $7,000 |

| Visa Gold / Platinum | $7,500 |

| Visa Infinite | $8,000 |

Why has First Citizens reduced Foreign Currency limits on Credit Cards?

The Bank continues to use its best efforts to address the foreign currency requirements of our customers and limits will be adjusted based on the availability of foreign currency. Your Credit Card continues to offer you the convenience of personal shopping both at home and abroad and access to online shopping and e-commerce. Your ability to conduct foreign currency transactions has always been and will continue to be, subject to the availability of foreign currency.

Can I request access to additional foreign currency via my Credit Card after I have fully utilized my monthly threshold?

Yes, you may request, for consideration, the ability to make additional international purchases on your Credit Card. Please submit your request via your home Branch, Commercial Officer or Corporate Banking Officer or contact Contract Centre at 62-FIRST (623-4778) or email us at easybanking@firstcitizenstt.com. Your requests will be logged and the respective representative will contact you on the status of your request.

Can I utilise my Foreign Currency Limit for the billing cycle in one transaction?

Considerations on spend are provided on a case-by-case basis and will apply to urgent transactions, particularly related to medical and educational needs. You are required to notify the Credit Card Centre to facilitate this payment. You may also be required to provide supporting documentation such as invoices. Requests are to be submitted in-person to the Credit Card Centre or via email addressed to the Contact Centre at enquiries@firstcitizenstt.com.

Can I access my Foreign Currency limit via cash withdrawals/advances at the ATM while abroad?

Yes, for your safety and convenience, you can access up to $880 US for the day which will be reset every five (5) days until your Foreign Currency limit is exhausted.

Is the foreign currency limit based on my Credit Card Limit?

Your Credit Card limit remains fully accessible in TTD currency while the foreign currency limit is in accordance with the limits outlined in Table 1 above.

Is the revised foreign currency limit a temporary measure?

The Bank reviews the foreign currency limit periodically and customers will be advised in a timely manner of any adjustments.

When will the most recent change become effective?

This change will come into effect on September 10, 2021, in keeping with the September 2021 billing cycle.

Will the foreign currency limit be further reduced?

Periodically, the Bank reviews the foreign currency limits and this may, at times, result in adjustments to customer limits.

Credit Card Forms

To make your First Citizens credit card experience even easier, we provide a few forms, most used by our customers, in the management of their First Citizens credit card.

To find out more and download any of the forms listed below, you may click on any of the options below:

Additional Cardholder Form

This form allows you to add that person who is most important to you to your credit card account. Follow the simple steps below:

- Print form and provide requested information.

- Sign the form where indicated (both primary and additional cardholder/s).

- Visit any branch with the completed form along with original plus a copy of the following documents. One (1) ID for the primary and each additional cardholder e.g. electoral id, passport, drivers permit. The IDs are to be certified at the branch.

Increase in Credit Card Limit Form

This form allows you to start the application process to increase your credit card limit. Follow the simple steps below:

- Print, complete and sign form where indicated.

- Visit branch with form and original plus a copy of the following documents. The documents are to be certified at the branch. – (One (1) ID e.g. electoral id, passport, drivers permit along with a salary slip not more than one (1) month old.)

- Proof of address dated within three (3) months may be required if the increase in limit results in a change in the type of credit card.

- A Personal Financial Statement (PFS) may be required if the increase in limit results in a change in the type of credit card.

Card & PIN Replacement/ Name & Address Change/ Contact Information Change Form

This form allows you to provide the Bank with all the required information to do the most common amendments required for credit cards. You may follow the simple steps below:

- Print form and tick option applicable to you.

- Provide relevant requested information and documents as required.

- Sign the form where indicated.

Credit Cardholder Dispute Form

This form allows you, the cardholder to query the legitimacy of any unauthorized credit card transaction posted in your credit card history.

As this process is important, we urge you to take a few minutes to familiarise yourself with some further details on the dispute process. Please click here for further details.

- Print form and tick option applicable to you.

- Provide relevant requested information and documents as required.

- Sign the form where indicated.

- Scan your completed forms and documents to Credit.Card_Chargebacks@firstcitizenstt.com

- Upon receipt, you would be contacted by or advised further by one of our Chargeback Officers.

Credit Card Standing Order Payment Form

This form allows you to easily make arrangements so that your credit card payments are automatically kept up to date via standing order options that suit you. Follow these simple steps:

- Print form and tick option applicable to you.

- Provide relevant requested information and documents as required.

- Sign the form where indicated.

Payments

What are my options to pay my First Citizens Credit Card?

Whether you are a student, a career builder, at the family stage or simply enjoying the finer things in life First Citizens has convenient and flexible credit card payment channels just for you.

Click on any one of the links below for further information on the payment options available to you.

Our Self Service options are:

First Citizens Online Banking

Welcome to First Citizens Online Banking.

- Manage your accounts, Pay your credit card

- Open accounts, Apply for loans and credit cards

- Pay bills and transfer funds to friends and family

Get started today sign up now…

First Citizens Online Banking

First Citizens Online Banking … enjoy the ease and accessibility of the simplest yet most powerful money management tool available to you.

This absolutely FREE service, allows you to do your routine banking and non-banking transactions at your whim and fancy!

Available 24/7, all you need to move to the ultimate in Self Service Banking is internet access. Further details on system requirements can be found at FAQs – Security.

No other service affords you the widest variety of transactions and benefits as the First Citizens Online Banking Service:

- View your First Citizens account and credit card balances and transaction history anytime. No need to wait on statements!

- Access a Secure and Convenient online channel to send your requests for service and assistance, through the Online Banking Secure Messaging Facility!

- Transfer funds quickly between your First Citizens accounts OR to anyone else at First Citizens or any other local bank!

- Pay your First Citizens and other banks’ credit card bills easily!

- Make payments to over 30 institutions, including other Banks, Financial Institutions and merchants! Save time!

- Open an account or apply for a loan online. So fast and easy!

- Stay informed. When you’re on the go, receive account alerts via e-mails.

- Online Wire Transfer Request Form

- Ability to pay multiple payees in a single transaction.

- Ability to re-order cheque books.

- Ability to download account information to Microsoft Excel, Quicken and Money formats.

- Transfers from your Abercrombie fund.

All these transactions are done in a highly secure environment that encrypts your information as you transact. In addition, you are well covered by a host of security measures such as secret questions and transaction pins. Click for more details.

Customer Support for Online Banking Customers is just as convenient as the service itself:

1. Call our Contact Centre at 62-FIRST Option 3 (623-4778 Option 3)

2. Log in to the Online Banking Service, once possible, and send a Secure Message OR

3. Send an email to channelsupport@firstcitizenstt.com OR

4. Our Web Chat option

Interested in Online Banking?

Do not hesitate….register or start using the service NOW to reap the fruits of more time and a more relaxed frame of mind.

If you like our Online Banking Service, we encourage you to also check out our: Mobile Banking and Telebanking Services too. These services offer many similar benefits and you never know when you may need them most!

First Citizens Telebanking

The First Citizens Telebanking Service brings convenience to your fingertips….saving you precious time and money.

This simple Self Service Telebanking service is available 24 / 7 to anyone with access to a landline or cellular phone and allows you to do your most routine banking transactions whenever you want to!

Take advantage of the many benefits you can easily access from this FREE service!:

- Access to information at your fingertips!

Listen to your First Citizens account/credit card balances and transaction history anytime! Obtain information on your savings, chequing, some investment, loan and credit card accounts!

- Flexibility when you need it most!

Transfer funds quickly between your First Citizens accounts! Authorise cheque stop payments!

- Manage your First Citizens credit cards!

Access your outstanding and available balances, your minimum or full payment amounts required plus pay your credit card when you want to, 24/7!

- Convenient payment method for your vital needs, 24/ 7!

Pay your WASA, TSTT, TTEC and your First Citizens credit card bills at your convenience!

So how do you access all these great benefits of the First Citizens Telebanking Service?

1. Register for the Service.

2. After registration, you can access the Service by calling 62-FIRST (623-4778) and selecting Option 1 for the Self Service Option

3. Enter your Customer Identification Number (CIF) and your Personal Identification Number (PIN), assigned during the registration process.

4. Proceed to select the transaction of your choice, as stated to you by the system.

What are the requirements and how do I register for the First Citizens Telebanking Service?

1. Firstly, you should own a First Citizens account, either a savings, chequing, investment, loan or

credit card account.

2. Then, you can visit any of our conveniently located branches throughout Trinidad and Tobago OR

3. You can begin the process by submitting your contact information and we can then assist with your branch appointment to complete the process.

How secure is this Service?

This is a PIN based service, which simply means that the only way information can be accessed is if someone knows your PIN. Your PIN is selected during the registration process but can also be changed anytime after registration through a secure process. As with any other PIN based service, you determine how secure it is by the safeguarding of your PIN; no one should know your PIN except you!

Tips for Using the First Citizens Telebanking Service:

1. Bill payments should be made at least five business days before the actual due date of the bill.

2. Monitor your accounts regularly by listening to recent transactions. Query suspicious activity as soon as you detect it.

3. Contact our Contact Centre Staff using 62-FIRST (623-4778) Option 3 if you have any queries.

Customer Support for TeleBanking Customers is just as convenient as the service itself:

1. Call our Contact Centre at 62-FIRST Option 3 (623-4778 Option 3)

2. Log in to the Online Banking Service, if registered for this service and send a Secure Message OR

3. Send an email to channelsupport@firstcitizenstt.com OR

4. CLICK TO CHAT our Web Chat Option

Interested in the First Citizens Telebanking Service? Do not hesitate….register or start using the service NOW to reap the fruits of more time and a more relaxed frame of mind.

If you like our Telebanking Service, we encourage you to also check out our: Mobile Banking and Online Banking Services too. These service offer many similar benefits and you never know when you may need it most!

First Citizens ATM network

Utilise our convenient network of 52 Onsite and 67 Offsite ATM Locations within Trinidad and Tobago.

Features :

- Withdraw cash from your First Citizens deposit accounts

- Make deposits to your First Citizens deposit accounts

- Transfer funds between your First Citizens deposit accounts

- Make balance inquiries of your First Citizens accounts

- Pay TSTT, T&TEC and WASA Bills

- Do Credit Card cash advances

- Register for UTU Mobile Top Up Service (at Branch ATMs)

- Accepts LINX debit cards

Tips for using ATMs

- Memorise your PIN, and never disclose it to anyone, including Bank Staff

- Change your PIN if you suspect it has been compromised

- While using the ATM, protect your privacy

- Stay alert, take stock of your surroundings while using ATMs

- Before leaving the ATM put away your card and cash properly

- If your card is lost or stolen report it immediately using 62-FIRST (623-4778)

- Report suspicious activity when detected

Emergency Card Replacement Service

Through the Visa Consumer Benefit Services Center, Visa provides emergency services 24 hours a day to Visa cardholders worldwide. Cardholders can call the network of collect-call telephone numbers and request emergency services related to their Visa cards.

The emergency card replacement service provides the cardholder with an emergency Visa card replacement while the cardholder is at their home country or traveling abroad.

Access full details on this benefit, as well as certificates and processing of claims at the Visa Benefits Portal at www.visa.com/benefitsportal.

The use of First Citizens Cards to conduct face to face or non-face to face transaction at the countries listed below is strictly prohibited. As such, these transactions would be declined.

The United States Office of Foreign Assets Control (OFAC) has put in place specific sanctions against the following countries:

| Afghanistan | Balkans* | Belarus | Burma (Myanmar) | Central African Republic | Cuba |

| Ethiopia | Hong Kong | Iraq | Lebanon | Libya | Mali |

| Nicaragua | Somalia | South Sudan | Sudan & Darfur | Syria | Ukraine |

| Venezuela | Yemen | Zimbabwe | Democratic Republic of Congo |

*OFAC sanctions are specific to the Western Balkans region which is comprised of the following countries:

| Albania | Bosnia and Herzegovina | Kosovo |

| Montenegro | Serbia | Former Yugoslav Republic of Macedonia |

Upgrade of 3D Secure Technology to 2.0

In 2014 we were the first to bring you 3D Secure Technology making online shopping safer so you are more comfortable shopping 24/7.

Now, we are upgrading the 3D Secure Technology making it simpler, faster, easier and even safer to shop online.

3D Secure 2.0 is an updated version of the original 3D Secure Technology designed to enhance customer experience and strengthen the security of online transactions.

With 3D Secure Technology 2.0 cardholders can look forward to an enhanced online shopping user experience as you will no longer be required to enrol for the service and have a password to shop online.

Cardholders are automatically enrolled and automatically authenticated when shopping online at 3D Secure Merchants.

3D Secure Technology Comparison

| 3D Secure (Old Version) | 3D Secure 2.0 (New Version) |

| 1. Cardholders must have three key pieces of information to register for the service. | 1. Enhanced customer experience as cardholders are automatically registered for the service. |

| 2. Cardholders must register for the service and create a Password and Personal Message to shop online at a 3D Secure Merchant. | 2. No password is required to shop online at a 3D Secure Merchant making the service simple, fast and easy. |

| 3. Cardholders must enter their password each time they shop online at a 3D Secure Merchant to authenticate the transaction. | 3. Cardholders are automatically authenticated when completing an online transaction through the capture of key information which is then utilized to analyse and trend customer behaviour. |

| 4. Transaction abandoned whenever cardholders are unable to remember their password. | 4. Seamless transaction as you are no longer required to remember and enter a password each time you shop online. |

| 5. Cardholders who forget their password must re-register for the service to set up a new password. | 5. No need to call the bank again for “forgotten passwords”, “incorrect password” or “account locked” messages. |

| 6. Cardholders are required to contact the bank in the event their account becomes locked after entering their password incorrectly after three times. | 6. No need to contact the bank. |

The technology is offered on First Citizens VISA and Mastercard credit cards, known as Verified by Visa and Mastercard SecureCode respectively. The service also applies to the First Citizens Prepaid Mastercard.

The Verified by Visa and Mastercard Secure Code services have been upgraded and all cardholders have been automatically enrolled for the service.

3D Secure stands for Three Domain Secure – a unique technology behind the global programs Verified by Visa and Mastercard®SecureCode™ designed to ensure safe online shopping by further authentication of the customer’s identity.

Verified by Visa and Mastercard SecureCode captures and trends key information about cardholders during your online shopping.

This information is analysed to further strengthen your online purchase with First Citizens credit cards.

First Citizens Visa and Mastercard credit and prepaid cardholders will no longer be prompted to register for either the Verified by Visa or Mastercard Secure Code Service prior to completing their purchase at online merchants who subscribe for either the Verified by Visa or Mastercard SecureCode service from their bank.

Visit our Frequently Asked Questions section for answers to all your questions.

- First Citizens VISA Customers – click here for Visa Secure FAQs

- First Citizens Mastercard Customers – click here for Mastercard ID Check FAQs

- One Time Passcode (OTP) Authentication – click here for One Time Passcode (OTP) FAQs

Choose to shop online with the added security and confidence that only Verified by Visa or Mastercard SecureCode from First Citizens can bring you!

Visa Secure FAQs

What is Visa Secure?

Visa Secure is a service offered by First Citizens to our Visa credit cardholders which strengthens the security of and confidence in online shopping with your First Citizens credit card.

How does Visa Secure work?

The Visa Secure service strengthens the security of your First Citizens online shopping experience by capturing key data elements during your online shopping. This information is then utilized to analyze and trend customer behaviour to authenticate your online purchase.

When you shop online at participating merchant sites you will see the Visa Secure badge.

Whether you’re using a desktop, mobile or other digital device, you may be guided through an additional check to verify your identity. This helps the bank know you’re really you, and it better protects you from fraud.

This service helps make shopping online more secure by protecting against unauthorized use of your Visa card.

What is the benefit of the Visa Secure service to me?

The Visa Secure service provides enhanced security and confidence for your online purchases.

Through this service, you have an added layer of protection that helps reduce the unauthorized use of your Visa card while shopping online. This service helps the bank know you’re really you and most importantly it helps to protect you from fraud.

No Hassle, No inconvenience. No Enrolment – No Confirmation – No Purchase. Only Peace of Mind. And it is FREE of charge.

Is there any direct impact of the Visa Secure service on me as a First Citizens Visa credit cardholder?

First Citizens Visa cardholders are automatically enrolled for the service when you complete an online transaction.

What happens when (i) my First Citizens credit card expires, or (ii) my credit card limit changes or (iii) I receive a new card after my last card was either lost, stolen or compromised?

- In situation (i) your transaction would be declined however,

- In situation (ii) and (iii) you would not be required to take any action. You can proceed with your online shopping.

Can I use both credit & debit cards?

Yes. This service was designed for both Visa credit and debit cards when shopping online. When you use your Visa debit card, your online transaction experience will be similar to a credit transaction.

How will I know if my online purchase has the added layer of protection?

This service automatically works at checkout with participating merchants. Remember, there is no need to download anything, install software or register your account to get this added layer of protection. When using this service, you may occasionally be prompted at checkout to verify your identity, but this is to ensure you are you and protect you from fraud.

What happens when I finish shopping?

As you complete the transaction, you may be prompted to verify your identity if additional authentication is required. It’s important to take special precautions when shopping online. This extra verification step helps ensure the person using your card is you.

If I do encounter this extra layer verification step, what will the extra check be?

You will receive a one-time passcode to your email on file. If you encounter this extra step, simply follow the instructions on your screen to verify your identity.

I used to see the Verified by Visa on your website. Is this service different?

No. Although the Verified by Visa name is no longer in use, the same technology is in place to help protect you. In fact, this service was enhanced to make transactions more secure and the user experience more seamless.

What is the cost for the Visa Secure service from First Citizens?

This service is free to all First Citizens Visa credit card customers.

Enrolling for Visa Secure/Security and Privacy

Why do I need to enrol for the Visa Secure service?

- All cardholders are automatically enrolled for the service upon completion of an online transaction. Enrollment into this service strengthens the security of your online transactions at 3D Secure Merchants.

- Enrollment is completed per card.

What and how many cards would be enrolled for the Visa Secure service?

All of your First Citizens Visa credit cards would be enrolled for this service. There is no limit.

How does Visa Secure protect me?

No enrollment, No Confirmation, No Purchase. You enjoy enhanced security and confidence in your online purchases.

Shopping with Visa Secure

Where can Visa Secure service be of benefit to me?

The Visa Secure service applies only to online merchants and therefore improves the security of your online shopping experience.

Do all online merchants use Visa Secure?

No. Only participating Visa Secure merchants will display (i) the Visa Secure logo.

NB. An online merchant can offer the Visa Secure service only if his/her bank offers the service to their merchants.

If the merchant does not use the Visa Secure service, then the Visa Secure logo will not be displayed.

Can I purchase online at merchants who do not participate in the Visa Secure service?

Yes, you can. If the online merchant does not use the Visa Secure service, then the purchase order will be authorized by the bank once you click the “Place Order” button.

There will be no display of the Visa Secure logo on the payment page.

Can I start shopping with my existing First Citizens Credit Card?

Yes. You can shop immediately as all existing cardholders are automatically enrolled for this service upon completion of an online transaction, no waiting period is necessary. If you just received a new credit card, the same applies.

What should I do if I am shopping online but a Transaction Denied window appears?

- Verify that the merchant is a participating Visa Secure merchant by looking for the Visa Secure logo on the payment page.

- If no logo appears, then it is ok; there should be no request for authentication, as the merchant is not registered for the service.

- Verify if you received the One Time Password OTP is you are prompted for a 6 digit code. The OTP will be sent to your email address on file.

- If the issue persists send us a secure message via your Online Banking or send an email to authorization@firstcitizenstt.com

What should I do if I still have questions regarding this service?

If you have questions or need assistance you can send us a secure message via your Online Banking or send an email to authorization@firstcitizenstt.com