Prolonging High Interest Rates – Impact on Small-Caps

Insights

At the most recent Federal Open Market Committee’s (FOMC) two-day meeting, which ended on 12 June 2024, the key short-term interest rate was left unchanged for the seventh consecutive time, at 5.25% – 5.5%. It was initially expected that the central bank would cut interest rates about three times in 2024, however, due to persistently elevated inflation in the US, chairman Jerome Powell signalled a single rate cut in 2024 and forecast more in 2025.

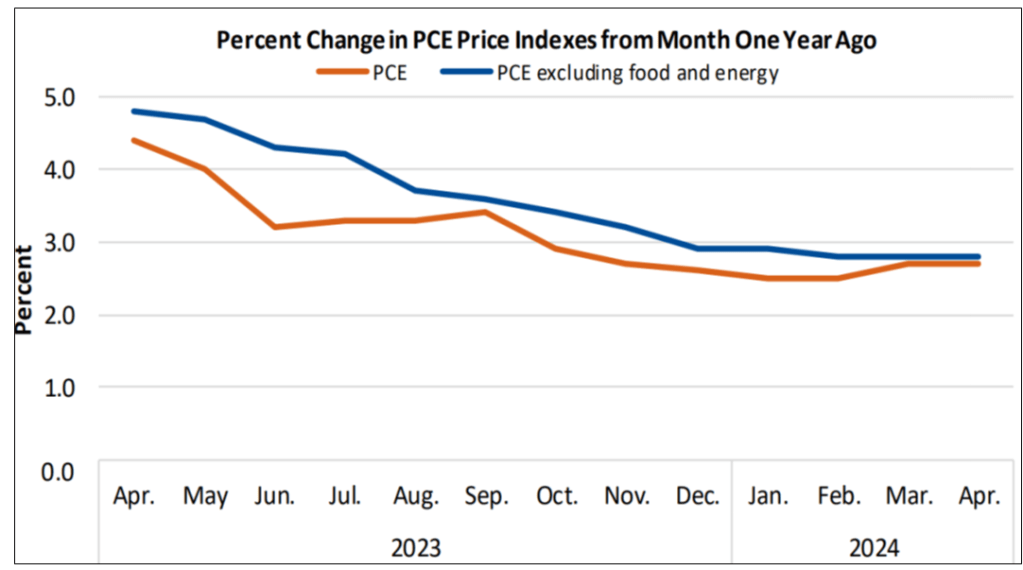

After peaking at 9.1% in mid-2022, annual US inflation as measured by the Consumer Price Index (CPI), trended downwards, moderating to a rate of 3.4% by the end of December 2023. Core CPI, which excludes the volatile food and energy items, stood at 3.9%. The Federal Reserve’s (Fed’s) preferred inflation gauge, Personal Consumption Expenditure Price Index (PCE), followed a similar path, and was slightly lower, at 2.6% by the end of 2023, while the core PCE measure, stood at 2.9%. Fast forward to the end of April 2024, and inflation remains well above the Fed’s target inflation of 2%, with the PCE at 2.7% and core PCE at 2.8%.

Figure 1: Percentage Change in PCE Price Indices

The disinflation witnessed in 2023 was attributed to the decrease in the price of goods such as used vehicles, household furnishings, and airline fares. Conversely, so far in 2024, the cost of services such as rent, car insurance and healthcare has continued to surge.

The resilient labor market continues to support retail spending, keeping prices elevated. Consequently, the Fed is not yet confident that inflation is moving sustainably towards their target, and thus, its rhetoric has shifted from cutting interest rates this year to possibly keeping rates higher for longer. The effects of this stretches across financial markets and can adversely affect consumers and businesses, keeping upward pressure on borrowing costs. As a result, in the equity market, there is a prolonged trend of small-cap stocks lagging their large-cap counterparts.

Large versus Small Cap Stocks

Market capitalization (‘cap’) is essentially the market’s estimate of the total dollar value of a company’s outstanding shares, calculated by multiplying these outstanding shares by the current share price.

Simply put, large-cap stocks are defined as shares of larger companies that have a market capitalization of USD10 billion or more. They are usually at the mature stage of the business life cycle and can also be referred to as blue-chip stocks, alluding to the companies’ dependable earnings, good reputations and strong financials. They also are generally less volatile in terms of price movement, and investors are rewarded with stable and healthy dividends. Some examples of large cap companies are Apple, Coca-Cola and Microsoft.

Alternatively, small-cap stocks are shares of smaller companies that have a market capitalization of USD250 million to USD2 billion. They are generally smaller than their larger counterparts in terms of scale, scope and influence. They tend to be more volatile, with generally less trading volume moving their share price. Some examples are Tenet Healthcare, Super Micro Computer and e.l.f. Beauty. While some small-caps are start-up companies, many are in fact similar to larger companies in terms of being well established with solid financials.

Higher for Longer Interest Rate Environment

Keeping interest rates higher for longer can have significant implications, particularly on small-cap stocks, with a number of possible negative effects, including:

- Increased borrowing costs

Higher interest rates equate to higher cost of borrowing for consumers and corporates, and even the government. Small-caps rely more heavily on debt to finance their operations and growth relative to large-caps. As the cost of servicing debt remains elevated, this can put a strain on the company’s financial health, potentially limiting their ability to maintain profitability and growth. Additionally, if a substantial portion of their debt is floating rate and matures in the near term, refinancing debt will be incurred at higher rates, worsening the financial burden.

- Reduced consumer spending

High borrowing costs for consumers can lead to a decline in consumer spending. This can directly impact company sales, and by extension, profitability.

- Increased market volatility

Small-cap stocks are known to be more volatile than large-cap stocks, and keeping interest rates higher for longer can increase uncertainty in the market, and the volatility that comes with it can disproportionately affect small-cap stocks relative to large-caps.

- Economic Slowdown

Sustained high interest rates can cause a slowdown in economic activity, and as small-cap companies tend to be more sensitive to economic cycles, in times of a downturn, these companies can be adversely affected.

- Shift to alternative investments

Relative to equity, fixed income and safe haven assets like gold can become more attractive to investors in a higher for longer interest rate environment, and as a result, shift demand away from small-cap stocks, which may be considered riskier at that time.

Large-cap versus Small-cap Performance

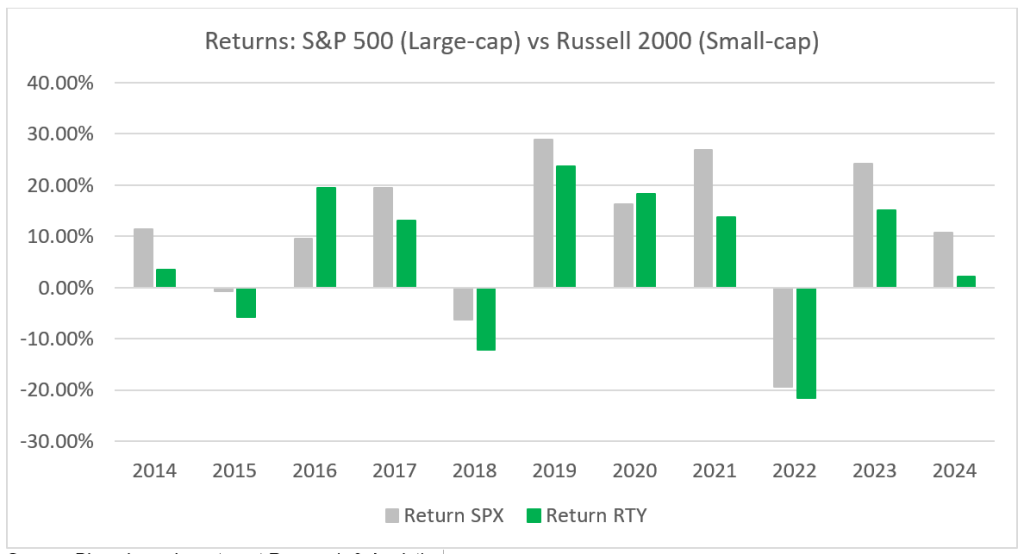

Figure 2: Returns – S&P 500 versus Russell 2000 Indices

Historically, through various economic, political/geo-political and technical ups and downs, large-cap stocks have broadly outperformed the small-cap market. Since the Fed first started to increase interest rates in March 2022 through to October 2023, the Russell 2000 Index (RTY) (small-cap index) has fallen by over 19%, compared to a 7% decline in the S&P 500 Index (SPX). Thereafter, the equity markets rebounded, however, year-to-date, the Russell 2000 is up by a meagre 1.1%, trailing the S&P 500, which is up by about 12%. Stubborn inflation has somewhat eroded prospects of rate cuts in 2024, causing small-caps to suffer.

Larger companies tend to be more profitable than small companies and these large companies can finance growth with retained earnings and therefore borrow less. When they do borrow, they can do so on better terms through bond markets, where they can attain longer-dated debt maturities, strengthening their ability to manage high borrowing costs.

According to S&P Global, small-cap companies have a greater dependency on shorter-term financing and they rely heavily on floating-rate debt, strengthening the immediate impact of any increases in interest rates on their profits.

While investors look to small-cap companies for their growth potential, the downside risks as a result of their higher sensitivity to changes in interest rates relative to larger companies, cannot be ignored.

Outlook for Small-Caps

High interest rates have made it challenging for small-cap companies, increasing the cost of servicing debt, thus weakening their balance sheets and squeezing profit margins. Additionally, corporate earnings are not anticipated to be significantly positive, giving investors little to no incentive to shift allocations within their portfolios from larger companies and other less risky investments, to small-caps.

However, not all small-cap stocks will be affected to the same degree. Companies with strong balance sheets, low leverage, and steady cash flows should be better positioned to withstand higher interest rates. Therefore, investors can invest in these higher-quality small-cap stocks. It is important to also note that large-cap stocks do not always mean bigger returns on your investment.

The current economic environment suggests small-cap stocks will likely continue facing headwinds for some time. Despite their lower share prices, small-caps have been unable to compete with market giants like Nvidia and Microsoft, who continue to deliver robust earnings growth even though they’re not trading at discounts.

A bright spot is that interest rates would not remain elevated indefinitely and would inevitably be cut with changing economic conditions. In this scenario, small-caps could see a recovery. Investors and analysts’ attention will remain on the health of the economy and the impending pivot, maybe igniting a catch-up rally for small-caps. Keep in mind, the most fundamental rule of thumb when investing would be to diversify, holding a mix of assets in your portfolio.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.